Insight Focus

- Brazilian May soybean exports fall 3.5m tonnes on the year on weaker Chinese demand.

- Soymeal and oil shipments are at re cord highs on wide crush margins, EU. Indian purchases

- An expected increase in Argentina’sbiodiesel mandate may fuel demand for Brazilian soybean oil

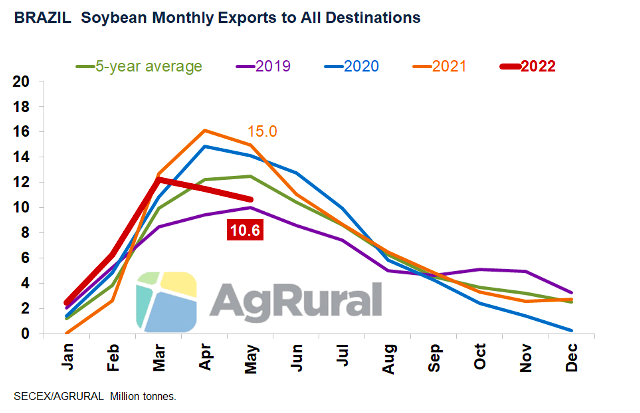

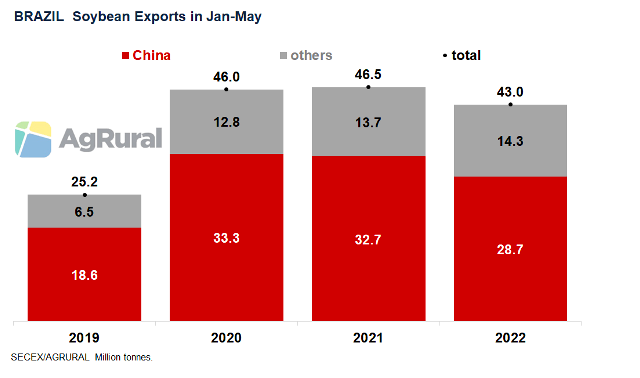

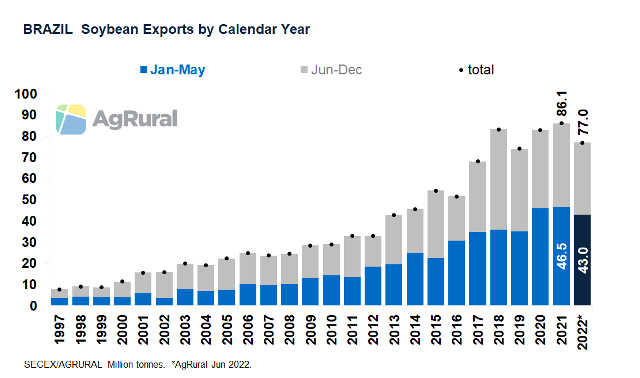

Brazilian soybean exports staged another weak performance in May. According to data released last week by the Ministry of Economy, the country shipped 10.6m tonnes of soybeans, 29% less than a year earlier and the smallest volume for May since 2019. As a result, January-May exports were 43m tonnes, down 7% from 46.5m tonnes a year earlier.

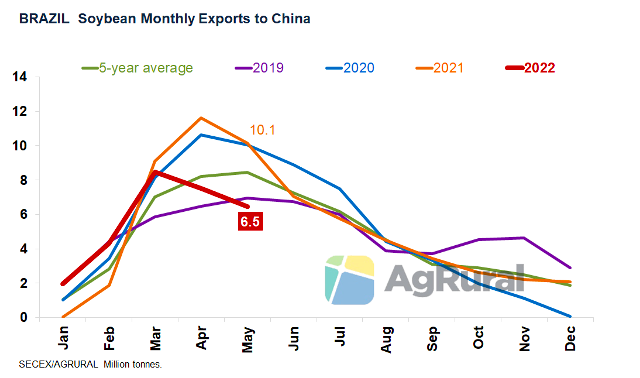

As in April, weaker demand from China was the main driver of Brazil’s below-average exports in May. Just 6.5m tonnes of soybeans went to China, 36% less than the 10.1m a year earlier. In January-May 2022, Brazil shipped 28.7m tonnes of soybeans to China, down from 32.7m a year earlier and from 33.3m tonnes in the first five months of 2020.

Other Destinations Take More

Although other destinations don’t fully offset the drop in shipments to China, they have continued to increase their soybean purchases from Brazil. So far in 2022, other importers accounted for 14.3m tonnes of Brazil’s soybean shipments, up from 13.7m a year earlier and 12.8m tonnes in the same period of 2020. Compared with the first five months of 2021, the destinations that increased their purchases from Brazil most were Iran (shipments from January to May 2022 were 870k tonnes, 337k more than a year earlier), Vietnam (up 146k at 608k tonnes) and Egypt (up 131k at 223k tonnes). The EU, the main destination for Brazilian soybeans after China, imported 4.612m tonnes, up 85k on the year.

Farmer Selling Finally Picks Up

Over June 1-10, preliminary numbers released by the Ministry of Economy show that Brazil shipped 3.1m tonnes of soybeans, with a daily average of 383k tonnes, well below the 527k average in June 2021, when exports for the whole month were 11.1m tonnes, of which 7.1m went to China. AgRural is forecasting June exports of 9m-9.5m tonnes.

For July, no significant drop is expected from the 8.7m tonnes shipped in July 2021 as a recent rise in Chinese crush margins and a weaker Brazilian real against the dollar have unlocked farmer selling – more than welcome in a year when producers have been very reluctant to sell.

AgRural forecasts Brazil’s 2022 soybean exports will be 76m-78m tonnes, below last year’s record 86.1m tonnes, but still a substantial volume, given that the 2021-22 soybean crop lost about 20m tonnes to drought, the loss of appetite from China and the strong pace of Brazilian soybean meal and oil exports.

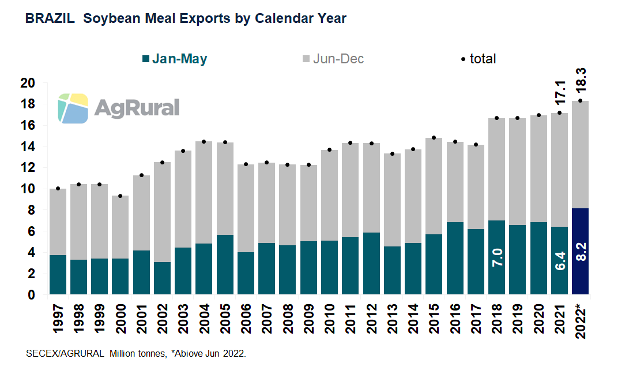

New Record for Soybean Meal Exports

With another strong result in May, driven by strong international demand and high crushing margins, Brazilian soybean meal exports totaled 8.2m tonnes in January-May, 28% higher on the year and a new record for the period.

Shipments were led by the EU, on 3.766m tonnes (742k more than a year earlier), Indonesia, which bought 1.334m tonnes (494k more) and Thailand, on 1.162m tonnes (188k more). But the country that most increased its imports from Brazil, after the EU, was Vietnam, whose imports rose by 450k tonnes compared with the first five months of 2021, to 872k.

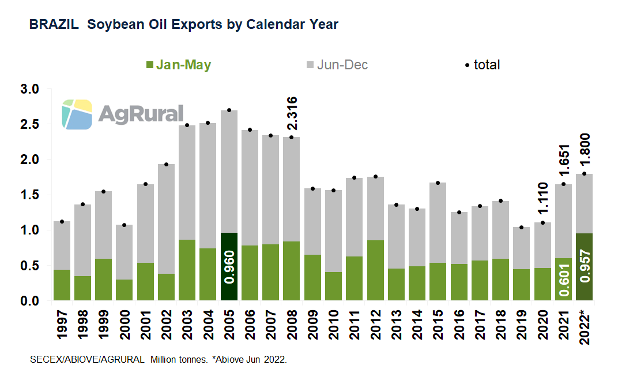

India Leads Soybean Oil Strong Results

Brazilian January-May soybean oil exports totaled 957k tonnes, very close to the record high of 960k established in 2005. The strong performance is due to a cut in the Brazilian biodiesel mandate and an increase in Indian demand, which has used Brazilian soybean oil to offset some of the drop in purchases of vegetable oils from other countries, such as Indonesia, Ukraine and Argentina. In January-May, India was the destination for 640k tonnes of Brazilian soybean oil, four times more than a year earlier.

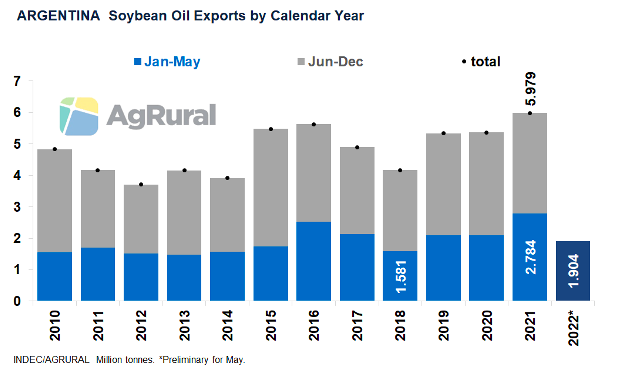

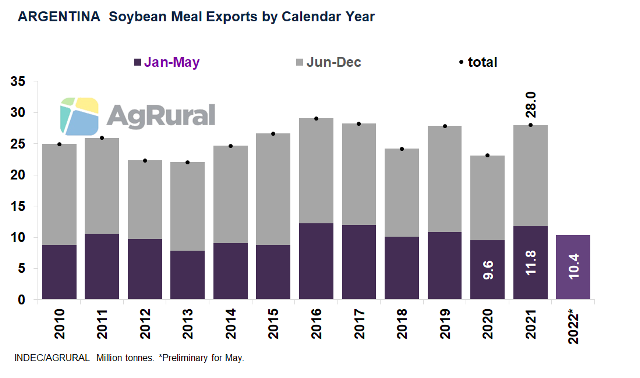

Filling the Gap Left by Argentina

Argentina’s soybean oil exports, totaled just 1.904m tonnes in January-May, according to preliminary government data, and that helped spur Brazilian exports. The volume is 32% lower than in the same period last year and the lowest since 2018. Argentinean soybean meal shipments also fell in May to 10.4m tonnes, 12% lower on the year.

More Biodiesel

After reducing its soybean crush in the first months of the year due to a spike in export taxes and the 2021-22 crop failure in Paraguay (an important origin of soybeans for the Argentine crushing industry), Argentina’s soybean meal and oil exports are expected to increase over the next few months, especially now that the completion of the 2021-22 harvest has shown that production turned out to be larger than expected. Narrowing crushing margins in Brazil are also likely to help Argentine exports. On the other hand, an announced increase in the Argentine biodiesel mandate to 12.5% from 5% for 60 days, an attempt to tackle the fuel crisis, could still give Brazilian soybean oil exports further room to grow.