Insight Focus

- New Zealand milk production hit by drought.

- US cow herd stagnates in April.

- European dairy profitability hammered by soaring input costs.

New Zealand:

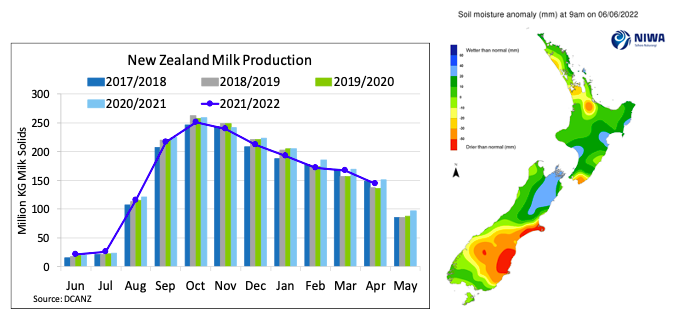

Last April, New Zealand milk production jumped 12% year on year, which made it difficult this season to see any gains at all. Instead, collections fell 5.2% on a milk-solids basis as the season draws to a close.

The soil deficit maps look favorable into the winter months given recent and much-needed rain, but many farmers experienced adverse pasture growth for so much of the season that feed imports have jumped. Palm kernel imports hit 17-month highs in April to compensate for weaker pasture growth and stock up on feed for the winter.

The Waikato and up into South Auckland experienced drought ahead of the recent rain and called for government support. Once again, the market is reminded that despite a record payout (that has come off in recent months) and increasing yields, there is only so much milk that can be produced if the weather does not cooperate. Into next season, NIWA is forecasting above average temperatures and normal-to-below average rainfall throughout winter so farmers will likely continue to build feed inventories, when possible, though costs are starting to bite and supplemental feed, as well as fertilizer, has become more difficult to procure.

Growth expectations for next season are muted, but weather swings can shift those forecasts 1-3% percentage points in just a few weeks. As of now, HighGround expects Q4 milk production to be flat, to slightly higher (0.7% year on year).

United States:

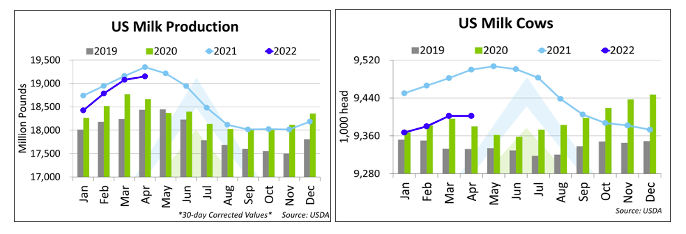

After two months of significant herd growth and what appeared to be momentum to return to parity with the previous year, US milk production suffered a setback in April and fell 1.0% from a year earlier, materially below HighGround’s estimate of a 0.3% fall. Production per cow was at parity with April 2021 after turning positive in February and extending those gains in March.

The US milking herd added 13,000 head in February from January (after a +10,000 head revision reported in the March report) and after a 7,000 head upward revision in March, added another 22,000 cows from February (the largest month-on-month increase since April 2002!), yet USDA reported no further build in April., which once again widened the gap to the previous year due to exceptional herd growth from mid-2020 that peaked in May 2021.

Due to significant reductions in the herd which started in June 2021, even if the US does not have any increases in milking cows from here, expectations are it will reach parity by September/October 2022. Tightness in replacement heifers and more challenging future margins due to increasing feed and other inputs must have been the cause for not adding more cows, even though the income-over-feed index in April suggested profitability was there for farmers to keep growing this spring.

In April, there did not appear to be any shortage of milk reported to milk processors, though the heavy discounting seen in previous years during the US’ seasonal peak was not reported.

EU27+UK:

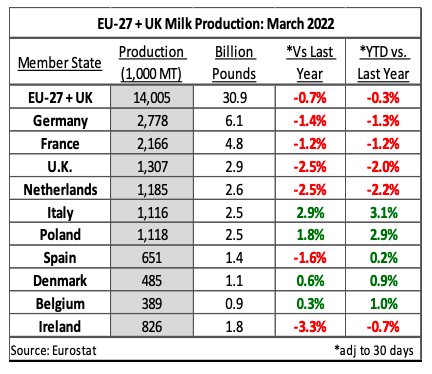

Germany, Spain and Belgium have finally reported March figures, bringing the total fall to 0.7% from a year earlier. Germany’s March production was the lowest for the month in five years and was the 10th consecutive month of year-on-year falls. For the Netherlands, this was the 16th consecutive month of lower milk production. France was not far behind with a 1.2% drop on the year. As we warned in the February report, France’s February milk production figures were indeed revised lower to showing 0.8% fall compared with the original 0.1%.

France is reporting year-on-year falls in every dairy product category, SMP (5.7%), butter (1.2%), WMP -9.9%) and cheese (0.9%). Ireland is reporting a year-on-year drop in butter and SMP production (12.1%). The Netherlands reported falls on the year in butter (14.2%), cheese (6.3%) and WMP (27.5%) but posted a very strong rise of 26.4% in SMP production.

The European Milk Board has warned that increased costs are threatening the survival of dairy farmers and milk production in Europe. Even though milk prices have been on a slight upward trend in recent months, these increases are not enough to compensate for the extreme rise in costs due to higher prices for inputs such as fertilizers, feed and energy. In Germany, the main dairies in North Rhine-Westphalia paid dairy farmers EUR 0.44/ kg (USD 471/tonne) of milk in February; while this was an increase in farm-gate price, it was far from enough to compensate for total production costs of EUR 0.53/kg milk.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial