Insight Focus

- Shipping accounts for 3% of global CO2 emissions but has been slow to adapt to climate targets.

- The industry faces challenges to de-carbonise as there are no perfect solutions currently.

- Shipping is having to find ways to adapt to ever more challenging climate targets

The corporate world has become increasingly aware of the need to show it is taking action to combat climate change, but the shipping industry has been behind the pack. However, as the regulatory framework shows signs of changing, more companies are looking towards innovation to provide a way forward. Changes also improve fuel security and provide financial benefits for companies, sweetening the move towards green solutions.

Around 80% of global trade is moved by the shipping industry, lending it a key role in the global economy. However, has struggled to change as over the last few years, as environmental targets have become increasingly important in government and corporate decision making. Although shipping now only accounts for 3% of global greenhouse gas (GHG) emissions this could rise to 17% by 2050 as other industries decarbonise and shipping grows, according to EU predictions. Since 1990 global emissions have grown by 53% but shipping’s have grown by over 70%, and this trend is set to continue.

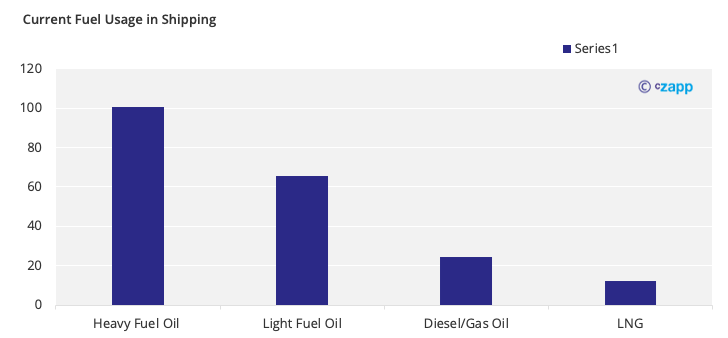

The slow adaptation is not without good reason. Shipping largely relies on fuel oil, heavy fuel oil especially, which is a particularly polluting fuel. Unlike other industries, shipping has no ready-to-go alternatives to fossil fuels. Cars can move to biofuels or hybrid and electric models, whilst power grids can move to wind and other renewables. For shipping, though, fossil fuels are the only widely used option.

Another complication is that ships often have up to 25-year cycles and, even when improvements are available, this means fleets change gradually.

These challenges mean little progress has been made, and shipping has even been excluded from many multi-national climate agreements due to the understanding that the industry will struggle to adapt.

When calls for change have grown, the industry has been unable to agree ways forward. An incredibly low tax of USD 2 per tonne of fuel (well under 1%) intended to fund research and development of improved shipping methods couldn’t even be agreed upon.

Calls Mount to Face Environmental Challenges

However, change is now coming. This is likely to be led by the EU. Due to the global nature of shipping and the fact that most shipping routes stop in multiple countries EU rules are likely to become global ones as large shipping companies will alter their whole fleets comply with EU standards.

The EU’s incoming regulations are currently being debated, but the proposals are already known, many of which should come to fruition. The regulation that garnered the most attention was that shipping is set to become included in the Emissions Trading System (ETS). Until now, shipping was not included under regulation that makes effectively financially punishes heavy emitters. However, starting with 20% in 2023 and gradually moving to 100% in 2026, emissions will begin to be included in the ETS.

Such a move would increase the financial incentive to reduce emissions dramatically. Replacing large shipping fleets is an expensive process, but that might be less of an issue if it were to be viewed as a lucrative, long-term investment.

FuelEU is another element of the EU plan to reduce shipping emissions. Starting with a 2% cut in GHG intensity in 2025 and moving up to 6% in 2030, the EU’s FuelEU program hopes to cut annual emissions by 75% in 2050.

The International Maritime Organisation (IMO) and other international bodies have also released some targets. The IMO is the UN’s maritime agency and as such has a great deal of influence on the shipping industry. The IMO’s main aim is to reduce the industry’s carbon emissions by 50% from 2008 levels by 2050.

However, the EU’s ambitions are the broadest, most binding, and quickest to come into effect. Shipping companies are reluctant to place new orders probably because they are waiting to see which EU proposals will become law. Once the EU seals its maritime deal there is likely to be a slew of orders for new ships that allow companies to future-proof their fleets.

Push from Consumers and Businesses

Calls for change are being driven, not only by governments, but by companies and consumers too. One of the main factors that’ll push the move to more eco-friendly shipping will be banking. Due to the focus that has been put on the environment, several financial institutions have promised to fund projects that help reduce greenhouse gas emissions.

Alongside this, many institutions are cautious funding any polluting projects. Shipping companies often borrow to fund fleet improvements so with the increased ease of borrowing to fun low emission ships companies are likely to favour those options.

Shipping companies are also coming under pressure from their clients. Most multi-national companies have made climate pledges, aimed at reducing their environmental impact – this often extends to their shipping.

Several companies have promised to commit to zero-carbon shipping by 2040 such as Amazon, Ikea and Unilever. Although the targets are 18 years off, the shipping industry is so far from achieving zero carbon that it’ll need to start making changes sooner rather than later.

Companies in the shipping industry, such as Maersk, are also pledging to reduce their own impacts faster and more broadly than legislation requires. Pledging to achieve net zero emissions by 2040, and 50% reduction on per container emissions by 2030. Maersk is also promising to move 25% of cargo using green fuels by 2030.

Maersk is not the only company promising these changes. Evergreen, CMA CGN and most industry leaders have set ambitious de-carbonisation targets. Evergreen and CMA CGN have both set targets to be carbon neutral by 2050, far more ambitious than IMO targets.

Innovations Making Changes Possible

The pushes to change shipping have cast a spotlight on the innovations that’ll allow shipping to become less carbon intensive.

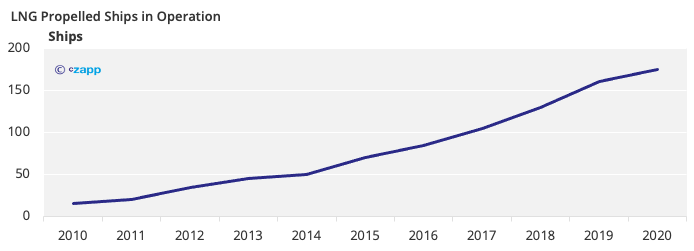

One focus is often on the use of liquified natural gas (LNG). LNG is notably less carbon intensive than current fuels, emitting roughly 21% less on average per voyage. Orders for LNG ships have been growing as companies look to them as an option to decarbonise. LNG has also received a boost from IMO 2020 targets aimed at desulfurizing fuel.

In 2021 a record 240 LNG ships were ordered – more than were operational by 2020 — and 30% of all orders for new shipping vessels were LNG-powered. Technology that allows ships to be dual-fuel or designed so they can be converted to LNG has meant a gradual transition is possible using LNG. CMA CGN has seen the opportunities LNG presents and ordered 12 new LNG ships as part of its strategy to reduce carbon emissions.

LNG faces issues though. Firstly, it’s seen as a ‘transitionary’ fuel – a stopgap until a longer-term solution is found. Companies are therefore reluctant to back wholeheartedly it in case it needs to be replaced in the near future. This is an acute issue considering the infrastructure that would also be needed. Despite this, EU reports have highlighted LNG as positive alternative to heavy fuel oil.

Maersk has launched its own solution to carbon emissions from shipping alongside Hyundai by ordering eight ‘zero-emission’ ships. These ships use methanol, which is being touted along with ethanol and other biofuels as a long-term replacement to fossil fuels.

The ships also provide a compromise as they’re dual-fuel ships and can use more conventional fuel too. Such a design will ease transition. It too, however, faces issues. Green fuels aren’t easy to find and Maersk has struggled to source them. In fact, Maersk has had to heavily invest infrastructure to create the fuels.

Some shipping companies are investigating using wind energy, not as a sole means of transport, but as a supplementary power source. These come in several forms. Michelin is developing a wing-like sail that can be inflated, Cargill is planning to instal large sails to some of their fleet, and Maersk has already experimented with Rotor sails.

Sails may seem like an antiquated decision to make, by tests by Maersk show benefits of around 8% in terms of fuel use. Cargill believes it can save up to 30% of fuel on certain routes. These savings spread across large sections of shipping companies could have a major impact on their carbon footprints.

Some other more long-term options are also being touted, namely hydrogen fuel and even electric and hybrid ships, which have proved capable of shorter trips. However, such innovations are unlikely to flavour the shipping industry anytime soon. Any moves to hydrogen would need drastic investment in infrastructure – hydrogen is also not exclusively ‘green’ and it too faces question about its environmental impact. LNG, biofuels and other innovations do, however, provide some scope to reduce emissions in the immediate term.

Incentives Beyond Environment Boost Focus

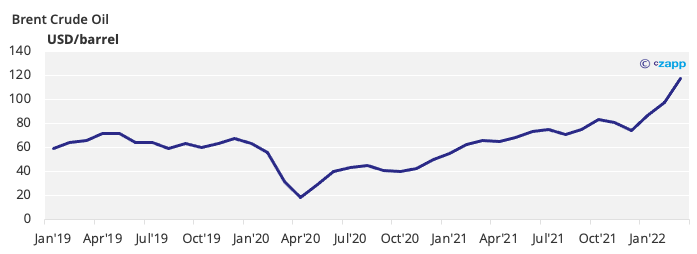

Changes are being led by a focus on climate change. However, other factors are making changing the shipping industry seem like a smart move. The price of crude oil is one of these additional factors making shipping look at its practices. Oil prices are currently both high and volatile this means the 8% and 30% savings that Maersk and Cargill believe they can achieve using wind technology could be hugely economically rewarding spread across entire global fleets.

The decaying relationship between Russia and virtually all Western nations also provides a pushing factor for the shipping industry. The fuel oil that shipping uses is often reliant on Russian fossil fuels. Although oil from Russia is not explicitly sanctioned uncertainty and boycotts mean this sourcing may be challenged going forward.

Global uncertainty is also important because, as the world becomes more unstable, nations are looking to diversify supply lines and localise production where possible. It’s not possible to drill for fossil fuels in nations that don’t have the natural resources but making bio-methanol or ethanol can be done domestically. Brazil’s push for improved fuel self-sufficiency by using ethanol highlights the benefits of such a plan. Having a diverse fleet of ships that can run on LNG, biofuels and traditional oil therefore provides more stability to a shipping company and investment in such changes would probably be pushed by this factor.

Concluding Thoughts

- The shipping industry is behind the curve on de-carbonisation and is predicted to, within the next decades, account for 10% of global emissions.

- EU and UN regulatory changes could shape the future of green shipping by financially incentivising the green transition.

- Private companies, consumer attitudes, and financial institutions are also pushing the shipping industry to reduce its footprint

- Maersk, CGA CGN, Cargill and slew of other companies are moving their businesses towards a greener future.

- Biofuels, LNG, and even sails provide shipping companies with routes to reduce their emissions.

Other Insights That May Be of Interest…

Czapp’s Sugar Consumption Case Studies

Explainers That May Be of Interest…