Insight Focus

- High grain and low pork prices have made pig rearing a loss-making business.

- The Chinese pig herd is large, but farms are unwilling to maintain such a high population.

- China’s pork industry has a ripple effect globally because of high grain, oilseed imports.

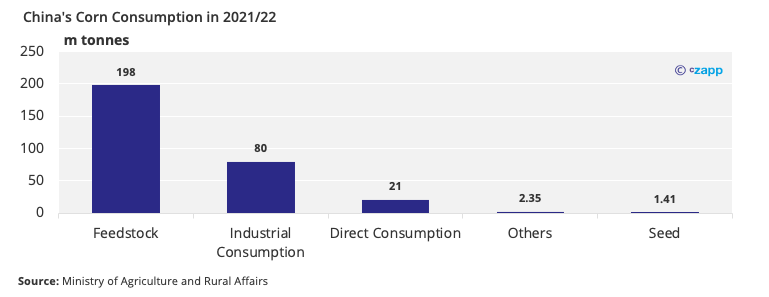

The latest pig cycle in China started in 2019 when African Swine Fever hit. The Chinese pig cycle usually lasts four years. The current cycle should finish at the end of 2022 with the new one starting in 2023, but strict COVID countermeasures and high grain prices could prolong the decline of pig population. China’s demand for corn and soymeal should fall over the next few years. This is because its pig herd will shrink with pig farming margins being squeezed by rising feed costs and government pricing policy.

African Swine Fever Has Little Impact on Pig Population

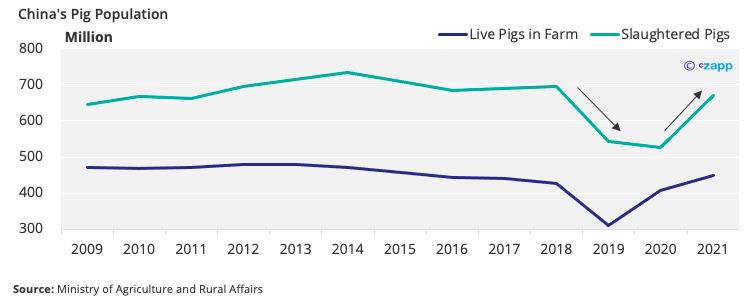

African Swine Fever severely hit China’s pig population in 2019 and 2020, but the herd recovered quickly in 2021.

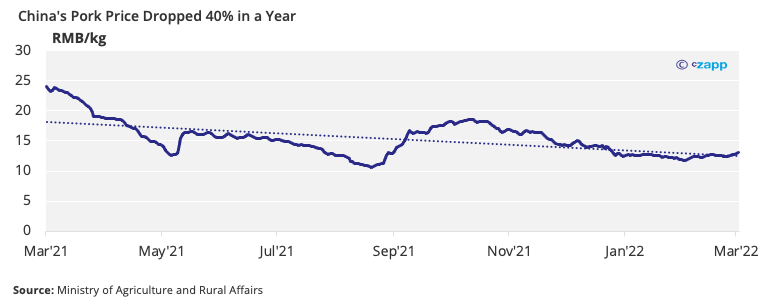

However, the population did not recover at the same rate as it fell, indicating weaker demand post COVID. The still quick recovery in the pig population and demand hit by repeated lockdowns meant the once high pork price plummeted 40% in one year.

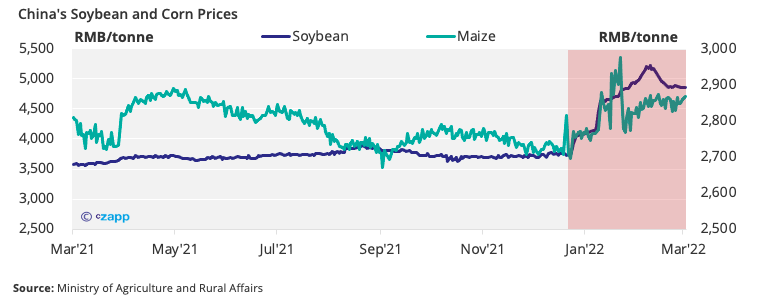

And prices of the two main feed crops (corn and soybean) have been rallying since January in China for various reasons. These include port congestion, high oil prices, the global fertiliser shortage, production cuts caused by unfavourable weather, and, of course, the Ukraine crisis.

But Raising Pigs is No Longer Profitable

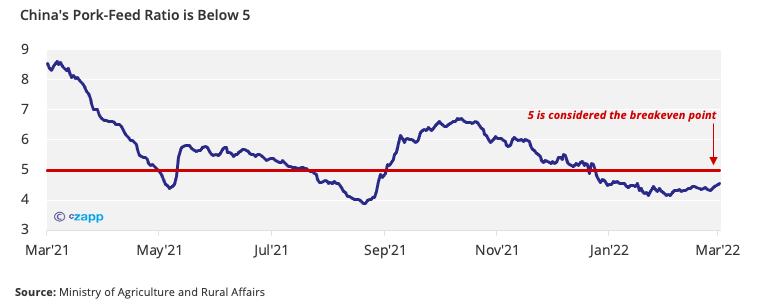

In China, a pork-corn Ratio is used to demonstrate the profitability of raising pigs. The ratio is calculated as pork price divided by corn price, both of which use kilogram as unit. The Ministry of Agriculture and Rural Affairs deems a ratio of 5 as the breakeven point as raising a pig in China demands a lot of corn, usually 5 times the weight of the pig. The current ratio is 4.54.

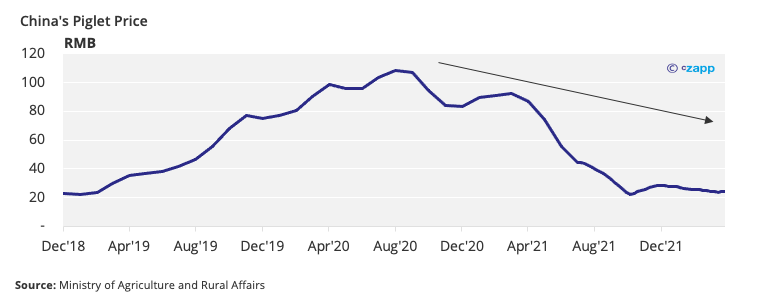

Another red flag is the piglet price, which has dropped nearly 80% from its peak in August 2020, implying weak demand for piglets in China.

China’s pig population should therefore decline in near future, which does not bode well for corn importers as most corn demand in China is for livestock feed corn.

There Will Be a Massive Adjustment in China’s Pig Industry

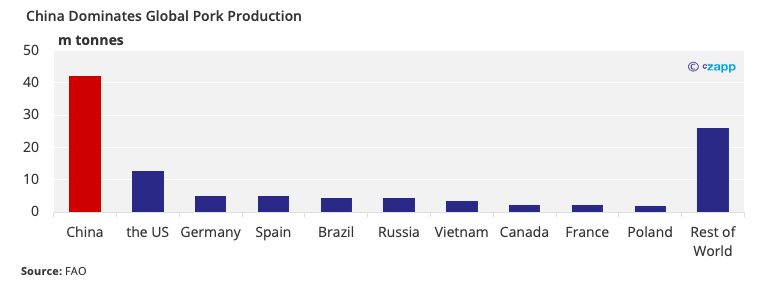

Pig farms are reluctant to purchase new piglets to preserve the herd. China is the world’s largest pork producer and pig rearer.

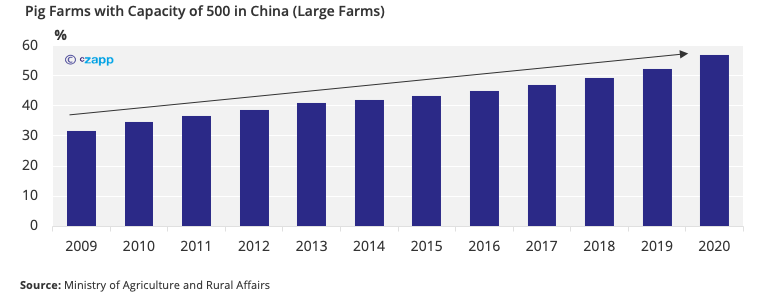

Before 2018, the majority of China’s pig farms were small, family-owned farms. However, after the swine fever outbreak and COVID-19, those small farms were squeezed out of the industry. The losses in pig rearing are stopping farms from expanding their herds. Pig farms are even considering reducing them before they run out of money.

Will the Chinese Government Step in?

The pork price is a very sensitive topic in China. It’s related to the country’s consumer price index. The government will try everything to keep it in check. However, as pork is the most important source of protein source for most Chinese, the government also has an incentive to keep the production and pig population at a comfortable level for food security reasons.

Since March, the Chinese government has announced a series of purchases for state pork reserves. The fifth and most recent purchase consisted of 4m tonnes. It shows the government’s resolve to stabilise the pork price and maintain the pig population, but so far, there’s been little market response.

Another obstacle is today’s high grain prices. China won’t slow the process of building up buffer stocks, but the price will force feedstock manufacturers to reformulate their products, so they use less corn and soybean meal; the government is encouraging this.

The Ministry of Agriculture and Rural Affairs has published guidelines on cutting corn usage in feedstock by 50% and soybean meal by 18%.

Regardless of what the government does, grain demand for animal feed in China should decrease. Once the impact of the war in Ukraine fades, dwindling demand for corn and soybean is unlikely to support high prices.

Other Insights That May Be of Interest…

Ukraine Crisis Adds Another Twist to Sudan’s Food Insecurity Spiral

Egypt to Boost Wheat Production with Black Sea Disruption

Explainers That May Be of Interest…