Insight Focus

- EU animal feed sector secures alternative oilseed supply as war in Ukraine continues.

- Farmers pass rallying animal feed costs onto consumers by raising meat prices.

- Feed manufacturers up amino acid content to offset soybean reduction.

Disruption to corn and rapeseed exports due to the war in Ukraine, has so far had little visible impact on the European animal feed sector, with compound feed manufacturers able to secure alternative supply in the short-term. Feed grain and oilseed prices are at multi-year highs and farmers are passing on rising animal feed costs to consumers by raising meat prices. Feed manufacturers are increasing amino acid volumes in their products to counter reducing soymeal content due to rising prices.

EU Feed Sector Sources Alternate Grain Supply to Plug Ukraine Gap

The European livestock sector is mitigating the short-term impact of the feed grain export disruption from Ukraine by sourcing alternative, more expensive supply to cover the shortfall, resulting in rising meat prices.

Russia and Ukraine are major grain producers. Following Russia’s invasion of Ukraine on the 24th February, Russian’s agricultural exports were largely halted by sanctions, while Ukraine was unable to send shipments with its Black Sea ports blockaded.

Both countries are key grain suppliers to Europe and the livestock sector is particularly dependent on Ukraine’s corn and rapeseed supply for animal feed.

According to the UN’s Food and Agriculture Organisation (FAO) data, the US was the largest corn exporter in the world in 2021 and Ukraine ranked third, shipping 24.7m tonnes last year. Ukraine was also the third-largest rapeseed exporter in 2021, shipping 2.66m tonnes, after Canada and Australia.

In 2020/21 (July-June), the EU imported 3.67m tonnes of corn (maize). Imports in 2022 should rise as the EU has already imported 3.8m tonnes of corn in the first seven months of 2021/22, European Commission data showed.

“Due to the loss of the Ukraine as an important supplier of ‘GMO-free’ raw materials, significant quantities of maize (corn) have to be secured as an alternative. Overall, demand can be covered by imports from North and South America, despite significantly increasing prices,” said trade body the German Association for Animal Nutrition (DVT) in early April.

Ukraine harvested a record volume of 42m tonnes of corn last year, but exports were halted when Russia invaded Ukraine. As a result, only 18m tonnes were exported before the war, said Ukrainian Agribusiness Club (UCAB).

As Europe imports most its soybean from the US and Brazil, supply of this oilseed has not been disrupted.

Despite the export disruption from Ukraine, an animal feed supplier in Europe said the impact is “not really visible at the moment” as manufacturers could continue to operate with alternative sources.

“The discussion is not about availability, it’s about who’s going to absorb the costs, it’s more relevant,” said the feed supplier.

EU Livestock and Feed

The EU has a substantial livestock population, with Spain, Germany and France rearing the highest number of farmed animals. According to the EU data, there were 143m pigs, 77m bovine cattle, 62m sheep and 12m goats as of December 2019. However, the number of livestock in the EU are likely to be lower in 2022 as meat consumption falls alongside stricter environmental regulation in the sector. These livestock are fed a mixture of farm origin roughage and compound feeds.

The bulk of compound feed consists of feed-grade cereals (barley, wheat, rye, triticale, corn), crude protein in the form of oilcakes or meals (soybean or rapeseed meal), and a small quantity of feed additives such as amino acids and vitamins. Soybeans and rapeseeds are crushed to extract oil and the meal is the by-product of the process.

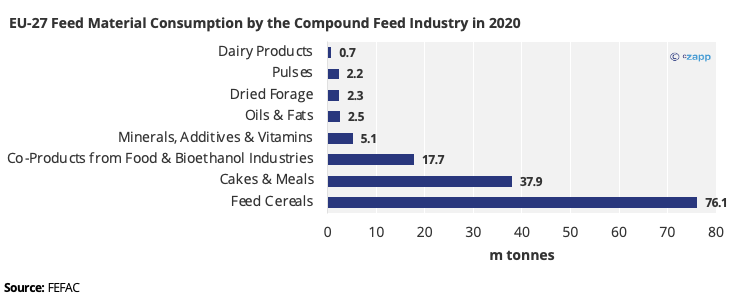

According to the European Feed Manufacturers’ Federation (FEFAC), the EU compound feed industry produced 150.2m tonnes of feed in 2020, and feed cereals account for half or 76m tonnes of the feed volume. One-quarter of the compound feed or 37.9m tonnes were made up of oil cakes and meals while feed additives only account for 3% of the feed volume or 5.1m tonnes.

Rising Feed Costs Push EU Meat Prices Higher

According to FEFAC, “animal feed is the most important livestock production cost factor and represented in 2020 up to 55% of the farm gate value of poultry, 32% of the farm gate value of pigs and 14% of the farm gate value of cattle.”

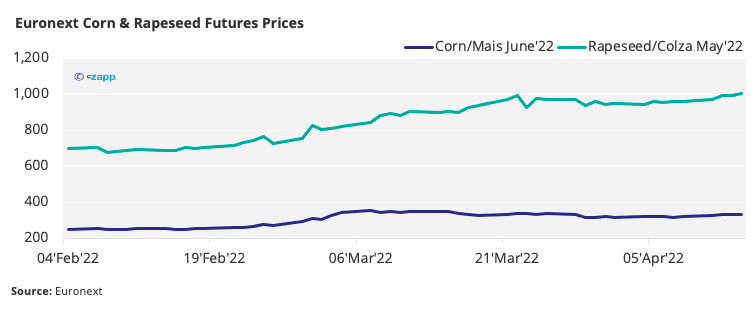

Corn and rapeseed prices were already at multiyear high prior to Russia’s invasion, and the export disruption in Ukraine has pushed prices further up. The corn futures traded on Euronext exchange surged as high as 351.50 EUR/tonne on the 7th March but has since fallen from the peak in March. The corn June 2022 contract last settled at 332.75 EUR/tonne on the 14th April, up 21% from the 24th February.

Rapeseed futures on Euronext surged to 1,004 EUR/tonne on the 14th April, up 31.5% from the 24th February.

The average soybean meal prices on a CIF Rotterdam basis also jumped over the past one and a half months, rising to 545.85 EUR/tonne in March, up 8.7% from February, data from Index Mundi showed.

The rising corn, rapeseed and soybean meal prices have pushed animal feed costs higher since Russia’s invasion of Ukraine, and farmers are passing these costs onto consumers, upping the EU’s average meat prices.

“Farmers are successful in transferring the price to the next part of the chain, it’s how much people can absorb. In the end, it will be absorbed somehow,” said the feed supplier.

According to the European food price monitoring tool, the average meat index across the 27 EU countries has been rising since Q4’21. In February, the meat index was 114.84, up 2.3% from September 2021.

High soybean and rapeseed meal prices mean compound feed manufacturers are looking to reduce the volume of these meals as the cost of single amino acids remains favourable. Amino acids are building blocks of protein and could be increased in feed to counter the lower content of crude protein.

Other Insights That May Be of Interest…

EU Ups Grains Production as Ukraine Outlook Worsens

Brazilian Soybean Plantings to Hold Firm Despite Fertiliser Limitations

Russian Invasion Deals Another Blow to Oilseed Supply

Explainers That May Be of Interest…