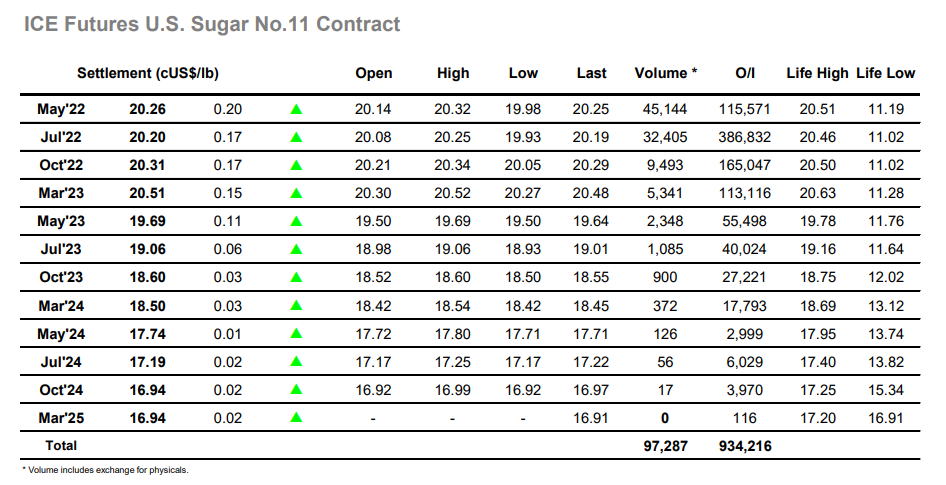

This Monday the #5 was closed, which contributed to a less liquid market on the #11. However, that doesn’t mean the day was dull: amongst a rolling of physical positions and spec repositioning, we saw quite a bit of volume coming from the very (late) beginning of the session. We started the day flat and traded within range for the first two hours, when a series of market orders took the market to the first high of 20.20, where some selling came through and brought the market back to the low 20s. After 12:00 BRT, we saw fresh rolling of the KN2 spread, and the steady pressure from buyers took the market again to the this time daily high of 20.32, and selling pressure appeared only at the closing hours when usually the algos exit their day trades. The K2 prompt closed at 20.25, with a 45k lot volume and an open interest of 115k, suggesting plenty of time for players to re-think their deliveries and a K2 tender which could be very low.

The BRL resumed its strength even though interest rates are suggested even higher in the G10 countries (perhaps foreign capital searching for answers on something we know very well: inflation). From the open we saw steady decline, with only a bump between 11:00 – 13:00 BRT, but the bulls resumed and brought the USDBRL pair to a 4.65 close.