Insight Focus

- Japan’s sugar consumption is extremely low for such a developed country.

- Culinary traditions plus a health push are holding back growth for sugar and sweetener.

- Slowing urbanisation and population growth rates are also hindering increases.

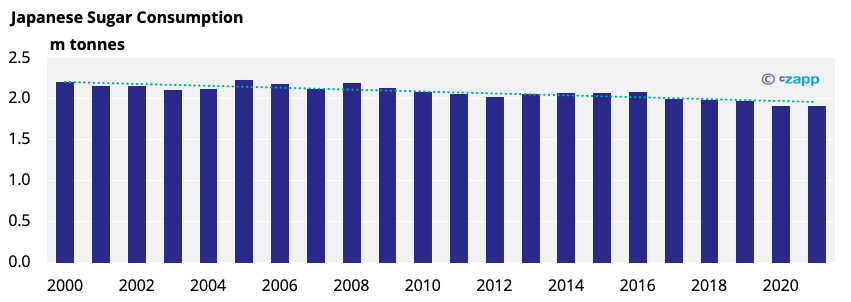

Japanese Sugar Consumption is Low for Such a Developed Country

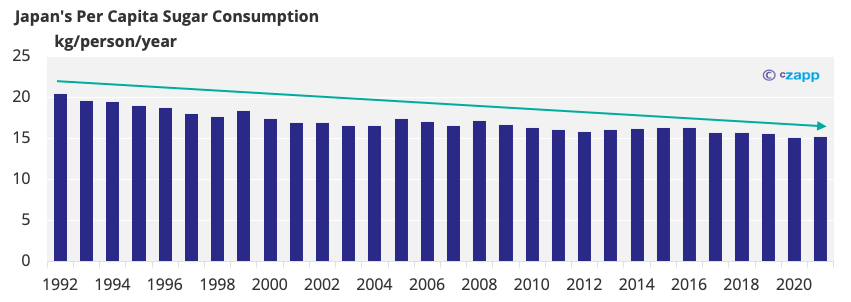

Japan is one of the world’s most developed countries, but its sugar consumption is low compared to similarly developed nations.

Its per capita sugar consumption is half that of the UK and Australia.

Traditional Diet and Alternatives Cap Sugar Consumption

This is likely because sugar has never played a huge role in the Japanese diet, even as processed foods have become more common. The country also has a mature non-sugar sweetener market, which means starch sweeteners, sugar alcohols and high-intensity sweeteners are often used in place of sugar.

We suspect Japan’s tendency to eat very little sugar has been amplified by the fact the Government’s recommended diet is low in sugar, and instead rich in grains, fruit, vegetables, fish, meat, and milk.

Such guidance can make consumers more health conscious, but even without this, the traditional Japanese diet comprises of few high sugar elements and is instead built around fermented and pickled foods, which, when paired with other rich foods, limit the need for the added flavouring both sugar and sweeteners offer.

Aside from its dietary guidance, though, the Government has done little to disincentivise sugar consumption. There’s no sugar tax in place, or even a recommended daily intake level for sugar, as people already pursue diets low in sugar without government intervention.

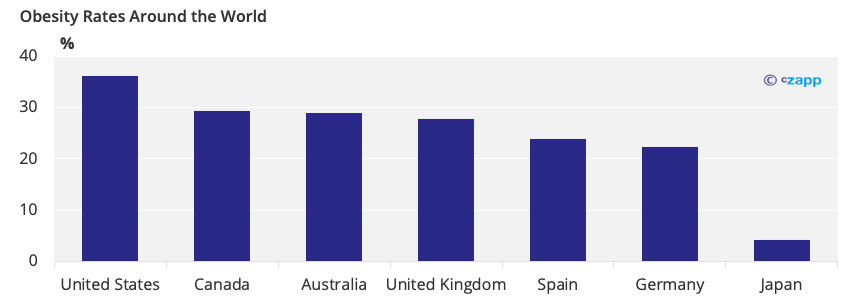

This is perhaps illustrated by the fact Japan has the seventh-lowest obesity rate in the world.

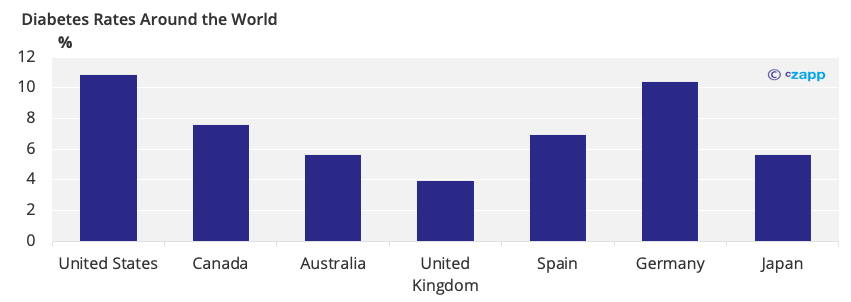

Its diabetes rate is low as well.

Japan’s Population is Also Shrinking

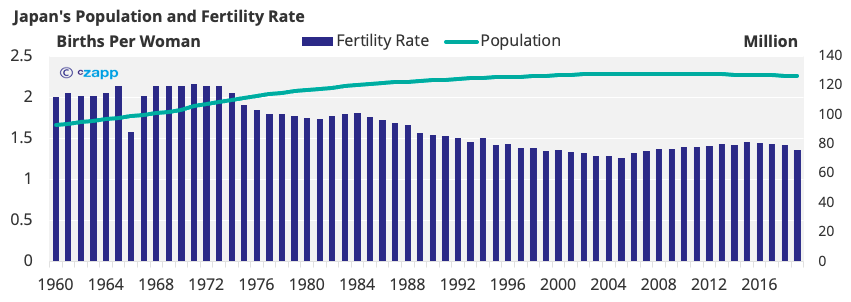

The Japanese population has been shrinking for over a decade, and this naturally correlates with reduced consumption.

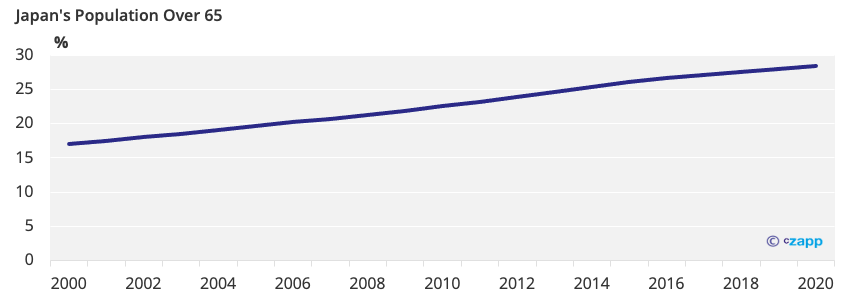

It’s made worse too by the fact that the country’s fertility rate is also dropping. As the country’s birth rate slows, its ageing population grows, and the elderly tend to consume less sugar.

Unless something changes, this issue should remain prominent for Japan, with its median age set to jump from 48.4 today to 52.1 by 2030.

Can Urbanisation Help Japan’s Consumption?

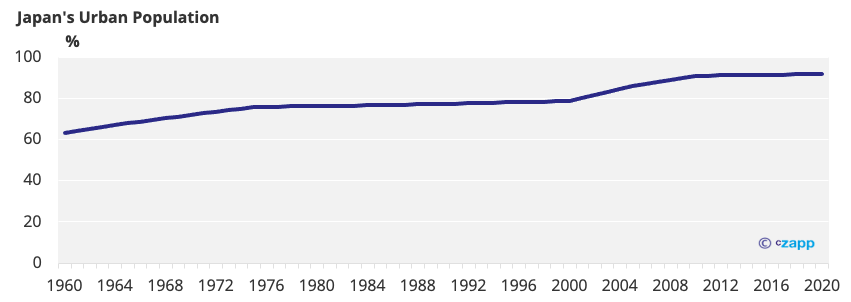

Urbanisation can help increase sugar consumption. However, Japan is an incredibly urban nation already, leaving little scope for increased urbanisation to drive growth.

Cities such as Tokyo and Osaka, where 45% of Japan’s population lives, don’t appear to be driving sugar consumption. This could link to the fact that Japan’s consumers are growing more health conscious.

How Does Sweetener Consumption Compare?

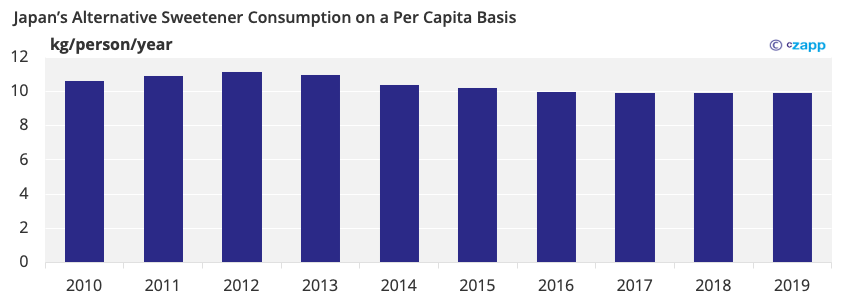

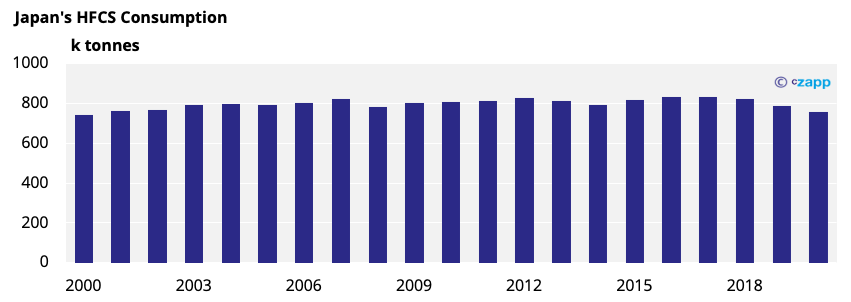

Unlike with sugar, Japan’s alternative sweetener consumption is relatively stable, with the High Fructose Corn Syrup (HFCS) the most common.

Japan’s HFCS demand first rose when the Government introduced a minimum cane price in 1965 to help the country’s cane farmers make more steady returns.

Sugar prices climbed in response, so Japanese refiners used imported corn to make starch before extracting the sweeteners that could replace sugar.

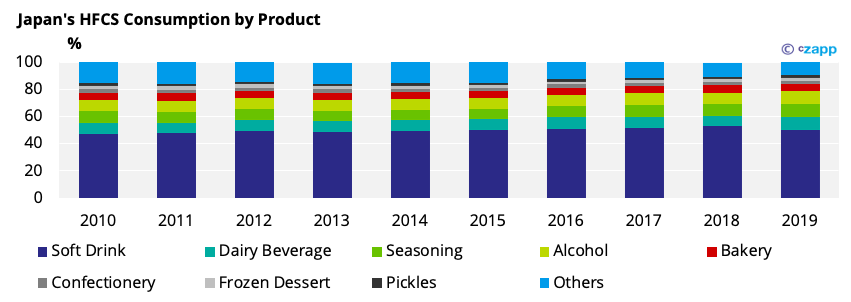

Today, at least 50% of Japan’s HFCS goes towards soft-drink production.

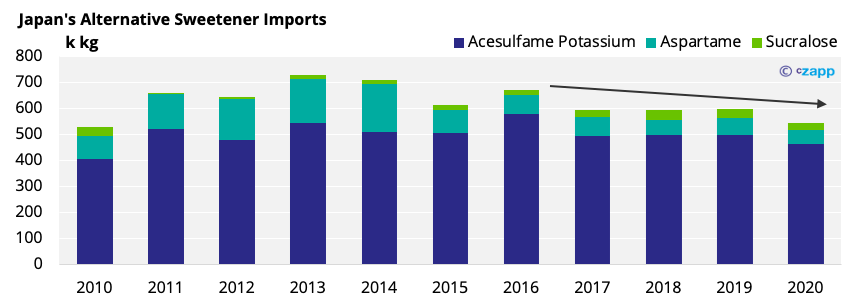

Limited data means it’s hard to paint a perfectly clear picture Japan’s alternative sweetener consumption, but several factors suggest that this too been declining since around 2016, with the country’s imports illustrating this drop.

It therefore seems that changing tastes and health pushes are driving Japan’s decline in sugar consumption, rather than switch to sweetener.

What Does the Future Hold for Japanese Sugar Consumption?

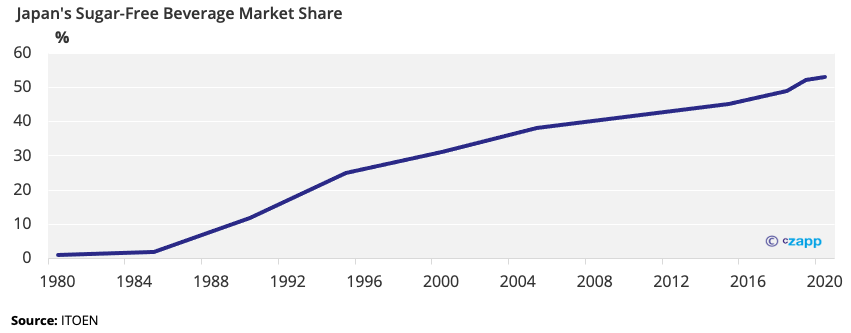

Japanese food is often low in sugar, with soft drinks one of the largest contributors to the country’s sugar consumption. However, sugar-free beverages now account for 53% of Japan’s total beverage consumption, up 23% increase from 2000.

This truly illustrates Japan’s growing interest in low sugar products, and it seems that this, along with the country’s traditional low sugar diet, will continue to what hold back growth in sugar consumption.

Slowing population growth and an urbanisation rate that seems to have peaked will also hinder growth.

It’s therefore likely the country’s per capita consumption has peaked at 15kg a year.

Other Insights That May Be of Interest…

Czapp’s Sugar Consumption Case Studies

Explainers That May Be of Interest…