Insight Focus

- Sanctions on Russia have disrupted global trade flows.

- China’s close economic ties with Russia provide an option for exports.

- China should increase its imports from Russia and become an intermediary for exports.

The sanctions imposed on Russia following its invasion of Ukraine will have massive repercussions for global trade. Russia is a major player in global commodity markets, exporting vast quantities of fertiliser and grains. China’s close economic relationship with Russia offers an opportunity to for it to engage with commodity markets in a new way.

Sanctions Choke Russian Trade Flows

Since Russia’s invasion of Ukraine, sanctions have been imposed on Russia by the US and its allies.

The most severe ones prevent the Russian Central Bank from accessing its forex reserves. Logistics companies are also refusing to provide services for Russian cargoes, and ports around world aren’t letting Russian-flagged ships dock.

These sanctions present Russia from moving agricultural goods in and out of the country, threatening its own supply and that of those reliant on it for supply.

Will the Market Find its Way to Russia?

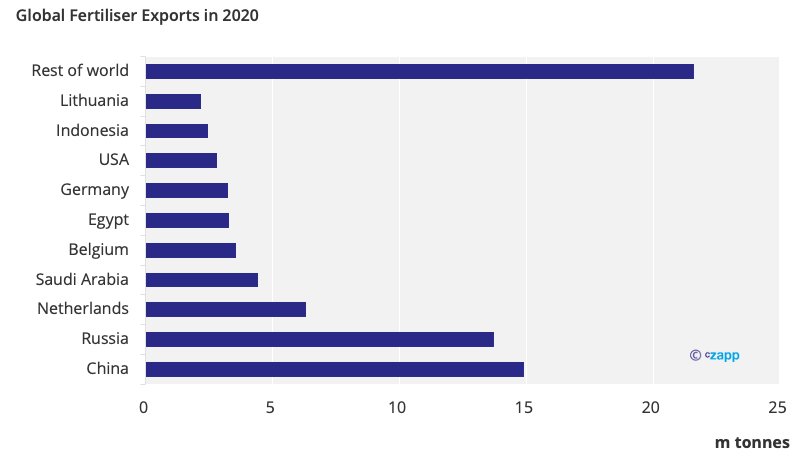

Russia is the fourth-largest fertiliser producer in the world. That said, it cut exports before it launched its invasion, with flows unlikely to resume any time soon now it’s invaded Ukraine.

Fertiliser shortages were hindering South American grains production prior to the invasion, so now, with 17% of world’s fertiliser out of reach, the FAO thinks global agricultural production will decrease.

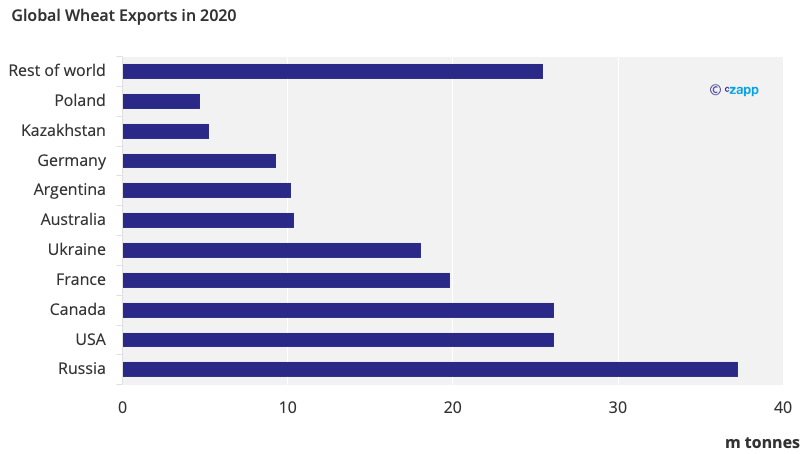

The disruption doesn’t stop here, though. Russia is also the world’s largest wheat supplier with its main buyers being populous countries in North Africa, Middle East, and Asia. Exports here are also being hindered by the sanctions.

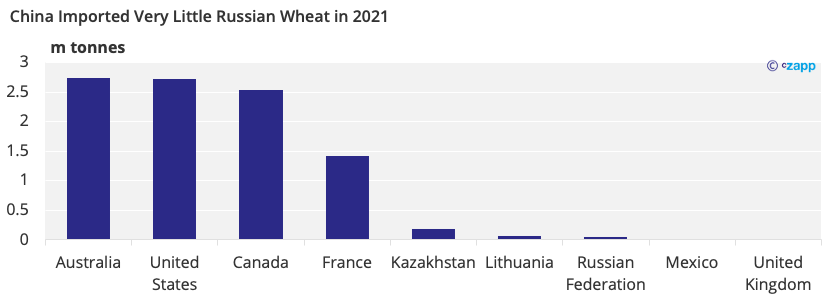

China has never been a big importer of Russian wheat; its main suppliers are Australia, the US and Canada.

Potential rivalry between China and the US could mean China reconsiders its source, though, especially as sanctions have paralysed Russia’s Central Bank, making Russian wheat cheaper.

China’s Russian wheat imports look set to increase as, on the 23rd February, China changed its custom policy, giving the green light to all Russian wheat, which was formerly restricted due to disease.

Could Russia’s Transcontinental Rail Network Provide a Solution to Logistics?

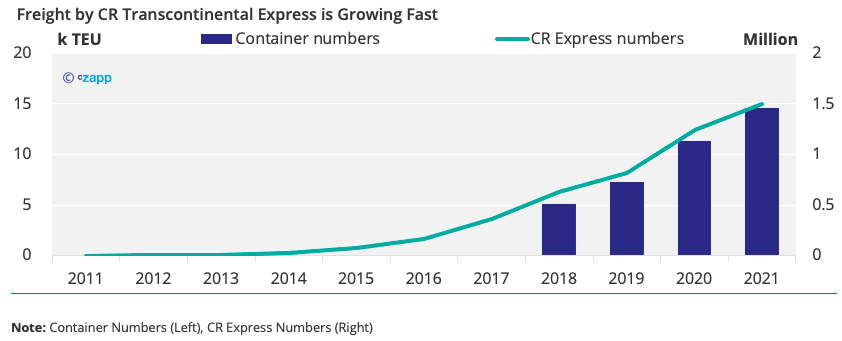

With logistics companies unwilling to operate near Russia, the rail network operated by state-owned companies in China and Russia is a good alternative.

The number of trains running from China to Europe has surged since 2011 but Russia’s invasion of Ukraine has disrupted the trade route, with Kyiv and Odessa two of the major interchanges for trains entering the EU.

Even so, the train takes 15 days to get to Germany, which is about a quarter of the time a ship needs. The capacity of the train will be the main bottleneck and transitioning from a Panamax to a 41-car train is not a simple task, especially when trying to transport large quantities of goods like grain and fertiliser.

Russia won’t be the first to make the transition, though. Ukrainian Railways has said it’s ready to organise agricultural exports by rail as a matter of urgency after closure of the country’s Black Sea ports.

The sudden opening of spare freight capacity caused by the drop in transit trains between China and Europe could create a partial solution to decreased freight capacity by ocean.

A Way Around SWIFT

Since Russia’s occupation of Crimea in 2014, it’s been searching for alternative systems to SWIFT to avoid sanctions. The Cross-Border Interbank Payment System (CIPS) created by China in 2015 is an option.

In 2021, 17% of bilateral trade agreement between Russia and China was settled in RMB, with the governments optimistic about RMB’s future role in economic ties before the war.

CIPS now has annual traffic of over 45.3 trillion RMB (7 trillion USD). However, the share of the RMB in international financial markets is less than 2% of global payments, compared with the 40% share the US Dollar holds. As a result, use of the CIPS payment system remains very small, about 0.3% the size of SWIFT.

With Russia now cut off from SWIFT, CIPS may be the only interbank payment system available, though. However, the transition, again, is not easy. Although CIPS is a system based on Renminbi, most of its foreign indirect participants rely on SWIFT for transactions with direct participants (i.e. Chinese banks).

China’s Future Role

Although the final impact of sanctions on Russia is unknown, we can make some assumptions on China’s future role:

- The CR Express could be a great logistical solution for Russian trade flows.

- China should buy more wheat from Russia, and less from other parts of the world.

- If Russia sends fertiliser to China, China’s exports could increase again, lowering domestic prices.

- China’s wheat reserves need a new source and Russian wheat blocked from global market seems like the perfect choice.

- CIPS is an alternative solution for Russian financial institutions but transitioning from one system to another is not a quick process.

- China may become an intermediary for Russian goods, including wheat and fertiliser.

Other Insights That May Be of Interest…

Black Sea Sugar Freight Suffers Little War Disruption

Is ‘Fortress Russia’ Self-Sufficient in Sugar?

Explainers That May Be of Interest…