Insight Focus

- Russia is normally self-sufficient in sugar.

- But more than 95% of its beet seeds are imported.

- Seed shortfalls could lead to stockouts, sugar imports.

Sugar Market Shrugs Off Russian Invasion

The sugar market hasn’t strengthened much since Russia’s invasion of Ukraine, making it an outlier.

Source: Refinitiv Eikon

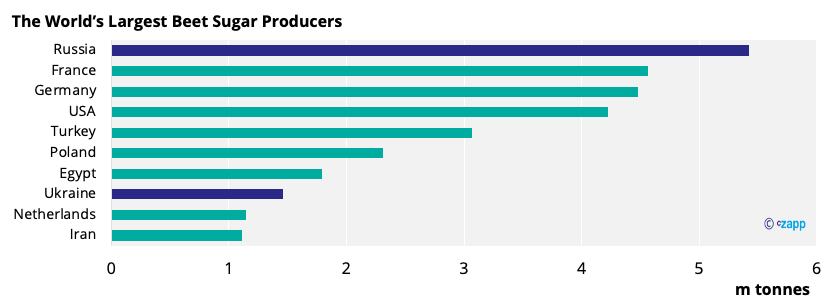

This could be because both Russia and Ukraine are often self-sufficient in sugar; both are major beet growers.

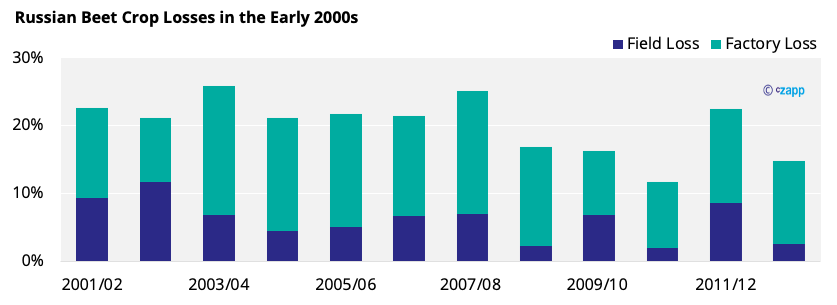

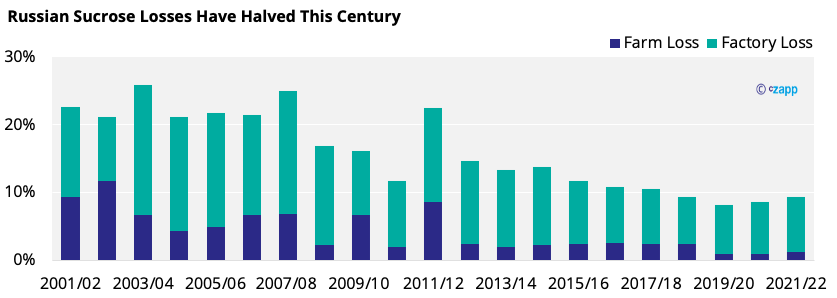

But it’s not always been this way. Twenty years ago, Russian beet farming and processing was inefficient. Beet yields were a third of those in Western Europe, and losses during harvesting, transport and processing frequently exceeded 20% of the crop.

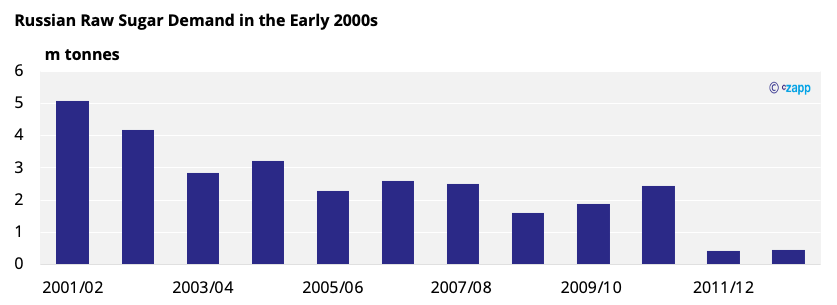

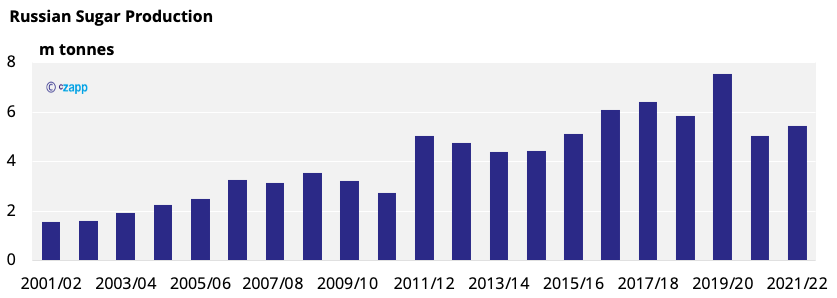

As a result, Russian sugar production rarely exceeded 2m tonnes, and with consumption close to 6m tonnes each year, the country was one of the largest sugar importers in the world.

Russia’s Beet Modernisation

To understand how Russia became self-sufficient, we need to go back to the last time it invaded Ukraine, in February 2014. The United States of America, European Union, Australia, Canada, and Japan all imposed sanctions on Russia, leading to a devaluation of the Ruble, which halved in six months, and high inflation.

Source: Refinitiv Eikon

In response, the Russian government turned inwards, aiming to increase self-sufficiency wherever possible. As well as building non-US Dollar denominated reserves and modernising its armed forces, this also meant accelerating investment in agriculture. We can see the effects of this investment in the beet sector.

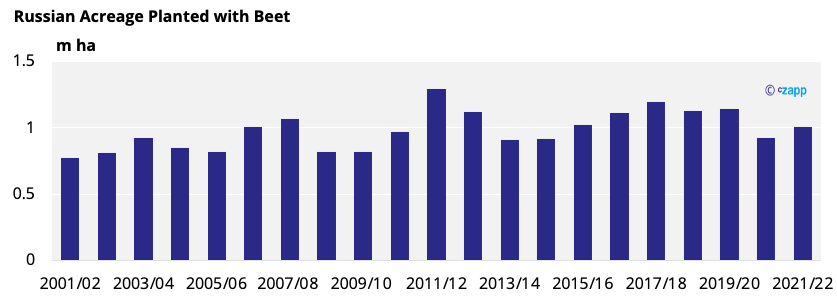

Russian beet acreage has grown little in the last twenty years and is just above 1m hectares today.

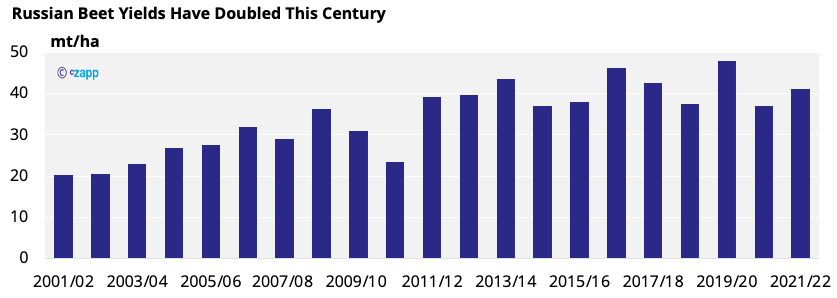

But beet yields have risen from 20 tonnes/ha to 40 tonnes/ha. This is still below the 70-100 tonnes/ha farmers in Western Europe achieve, but the doubling in such a short space of time shows the investment in farm equipment and technology.

Losses from beet harvesting, transportation and processing have also fallen dramatically.

As a result, Russia typically produces 6m tonnes of sugar a year, so has been self-sufficient since 2016. It’s no longer a major sugar importer, so sugar prices haven’t responded severely to the invasion yet.

Not So Fast….

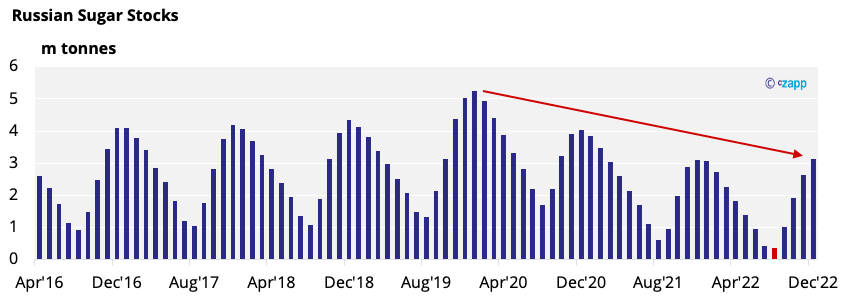

However, the last few years haven’t been typical. The last two beet harvests in 2020/21 and 2021/22 have been below average and Russia has run down sugar stocks.

In August 2022, we think stocks could fall to less than 10% of annual consumption. The government has imposed price controls and sought to import sugar. We examine the effect of the Russian invasion of Ukraine on sugar shipping here.

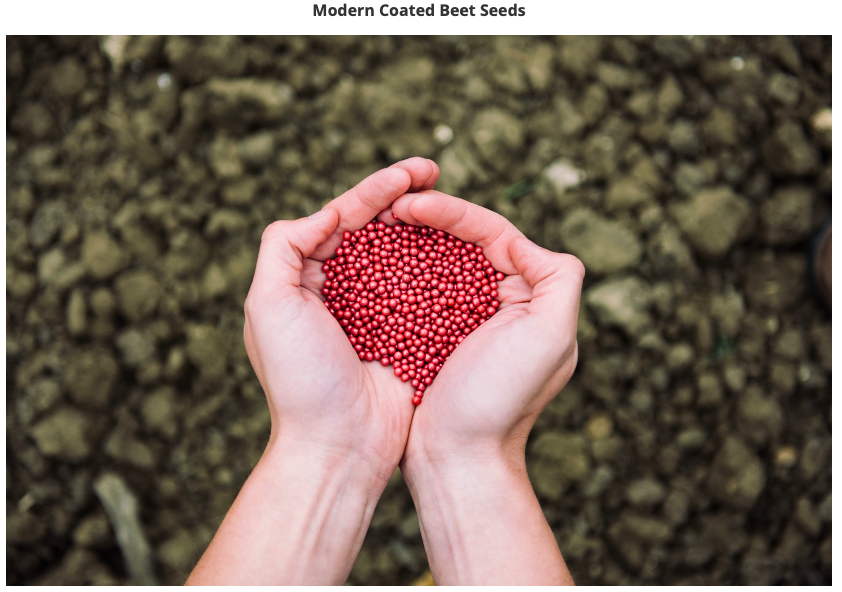

There’s one other flaw in Russia’s plan to become self-sufficient in sugar, though: it currently imports more than 95% of its beet seeds.

We believe that seeds for 2022 sowings have already been procured but securing modern coated beet seeds under the current sanctions regime for 2023 and beyond will be difficult. Could the Russian seed industry create their own varieties in time…?

Beyond this, it’s inevitable that costs will increase. Russian farmers will need to pay more for diesel, fertiliser, machinery, and spare parts. The Russian government is offering preferential loans at 5% interest to help, but the scale of the problem could be greater than the scale of the loans. This could threaten the viability of Russian beet farming in the medium term.

With this, we think there’s a risk Russia increasingly needs sugar imports to meet domestic consumption. If the government continues to fix sugar prices at low levels, localised shortages are possible.

Other Insights That May Be of Interest…

Market View: Why Isn’t the Sugar Market Stronger?

Fertiliser Importers Caught in Russia-Ukraine Crossfire

Ukraine & Grains: Who is Most at Risk?

Russia & Ukraine Grain Flows Likely to Be Disrupted into H2’22

Explainers That May Be of Interest…