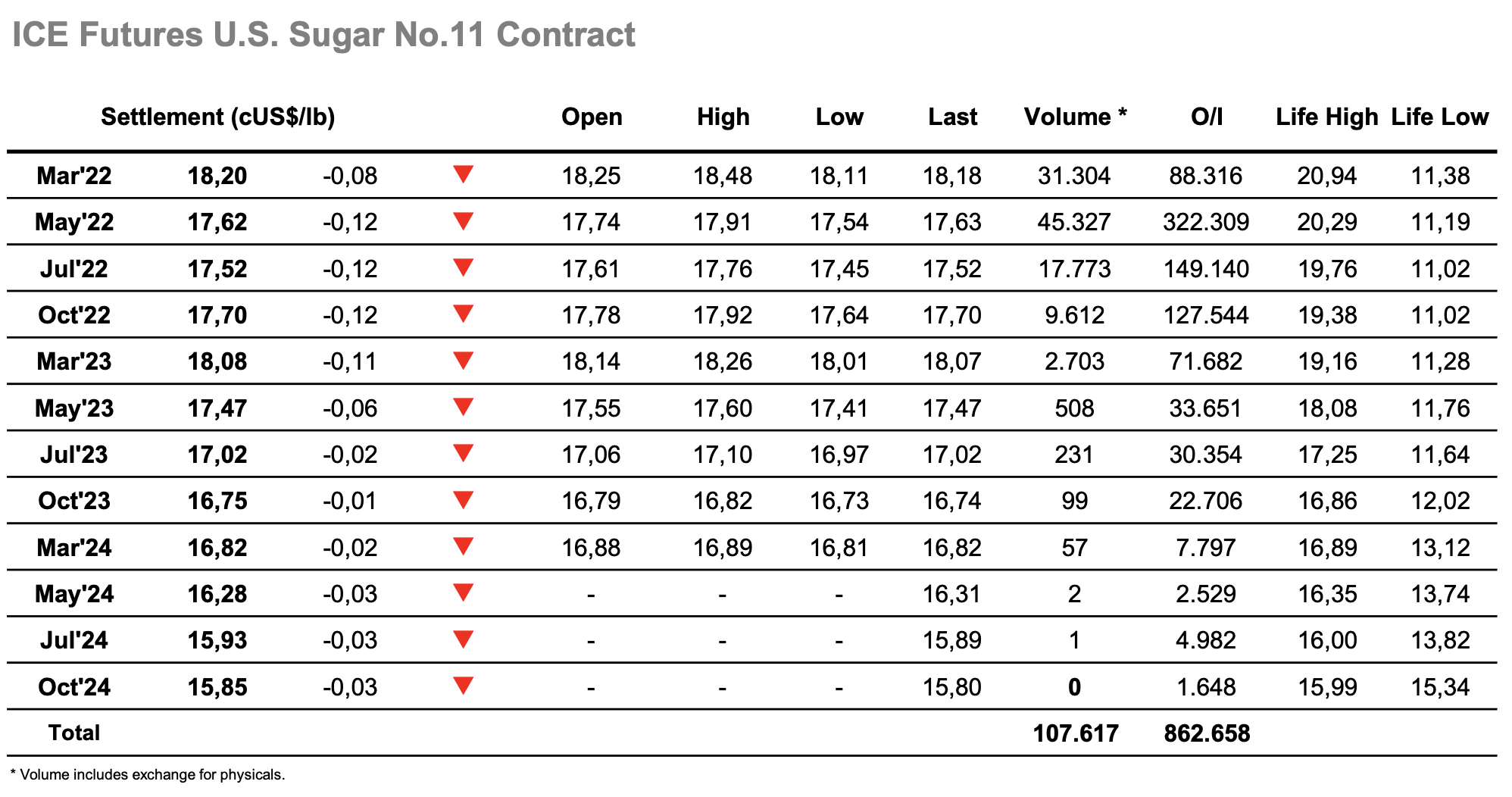

Sugar #11 May’22

Following yesterday’s failure to break convincingly through 17.8c in the May’22 raw sugar contract it was almost a certainty that we would see another attempt to trade higher today. A very quiet opening was interrupted by a push through to 17.9c, with the 18c level clearly a target for the (now dwindling – https://www.czapp.com/auth/interactive-reports/96) number of long speculators hoping for some upward momentum in the market. A breach of 18c was not to be with the market running out of momentum and returning to flat against the open. This technical weakness was capitalized on, and a comparatively exciting 5 minutes of trading brought us swiftly down from 17.7c to 17.57c. This set the tone for the remainder of the session and leaves us to settle at 17.62c for the weekend, the market downtrend still intact. Perhaps unsurprising considering the relentless strength in the BRL, which has traded from over 5.7 to 5.1 since the start of the year.

In the spreads we saw the Mar’22/May’22 continue its steady push higher, now approaching the 60pt premium we saw all too briefly during the squeeze last week. The May’22/Jul’22 thought about following suit, however after touching 15pts saw good selling (in line with the flat price chart) and returns to a premium of only 9pts. The 126pt premium seen in this spread only six months ago remains a very distant memory.