Sugar #11 May’22

As we trade closer to the March’22 contract expiry in 7 sessions’ time the flat price continues to trade within the narrow band of 18-18.5c/lb that we have seen since the end of January. Perhaps not a huge surprise given that the net speculative position continues to diminish, currently standing at only 45k lots net long, the lowest it has been since June 2020.

It is getting harder to ignore the downtrend beginning to form in the nearby raw sugar contracts. An expiry into a backwardated May contract will further exacerbate the generic first contract trend, with the (currently) 55pt premium leaving us with a May contract trading at the mid 17c level.

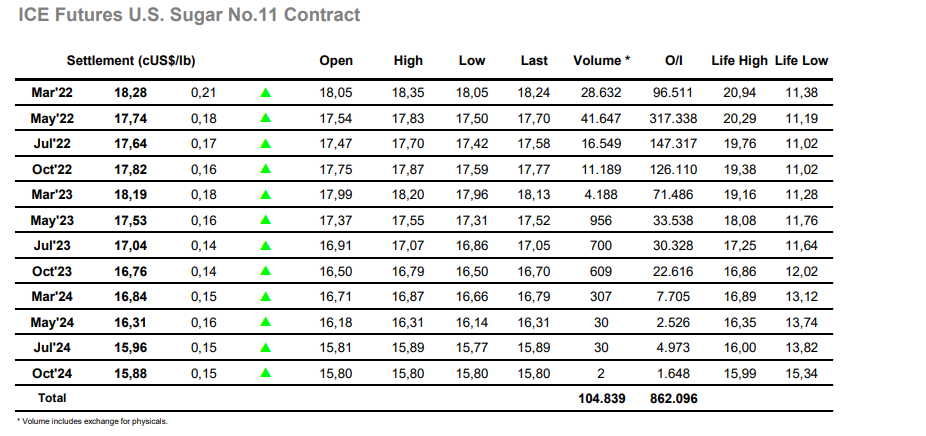

This lack of direction in the market has been coupled with a reduction in the traded volume, today seeing a lull in the market before picking up mid afternoon. This push to break higher eventually ran out of steam, and position taking at the close leaves the market to settle off the high of the day at 17.74. The May contract saw just over 41k lots traded today, a far cry from the 165k lots we saw on the 9th February. We continue to see adverse shifts in the calendar spreads with the Mar’22/May’22 ticking higher and settling at a 55pt premium. The May’22/Jul’22 spread has seen strong selling recently, the momentum in the nearby spread today only enough to lift the May’22/July’22 to a settlement level of 11pts, remaining close to the two year lows seen on Monday of 5pts.