- Brazil’s decision of whether to maximise sugar or ethanol production has huge implications for global sugar supply.

- This decision is broadly based on the financial returns mills can achieve from selling each product.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

What Could Impact Brazil’s Sugar and Ethanol Production Mix for the Upcoming Crop?

The Brazilian mills’ decision of whether to maximise sugar or ethanol production has huge implications for global sugar supply. This decision is broadly based on the financial returns mills can achieve from selling each product.

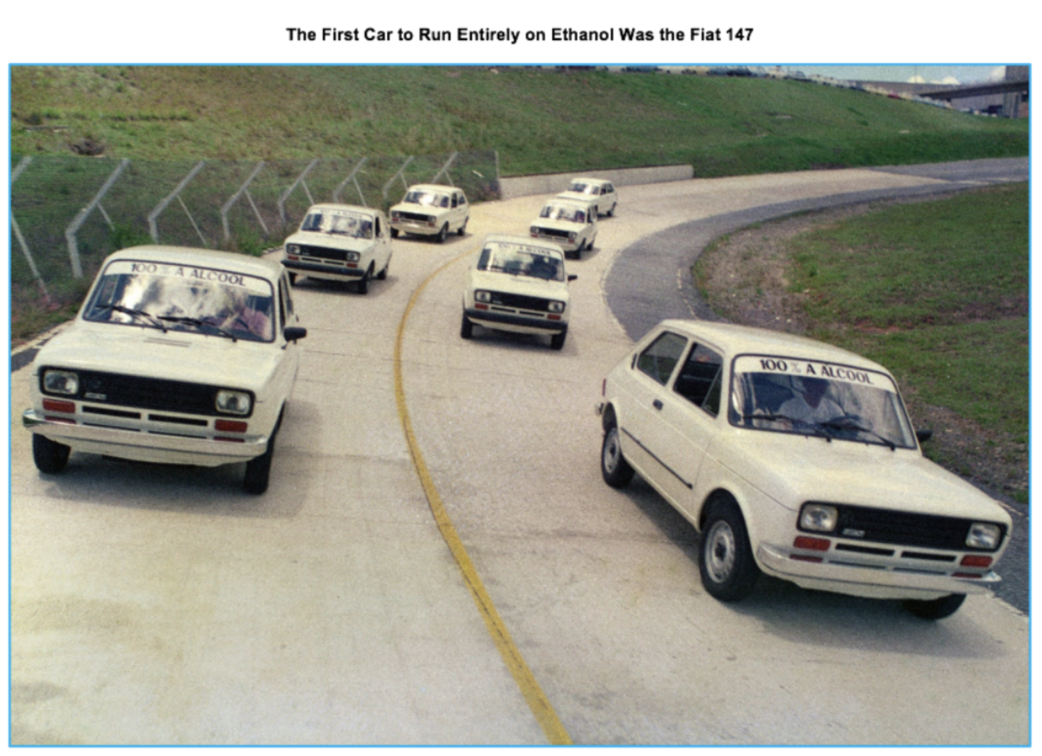

Most cars in Brazil are flex-fuel vehicles, which means they can run on ethanol (hydrous) or gasoline mixed with ethanol (anhydrous). This means drivers can choose which fuel they use depending on which is cheaper at the pumps.

Ethanol prices are therefore closely linked to the price of oil. Higher oil prices result in higher petrol prices which make filling up with ethanol more attractive to motorists, in turn potentially increasing demand (and prices) for ethanol. So, if the oil price is strong, this can lead to mills favouring ethanol production. Brent futures are just under 90 USD/bl at present, which is strong in relative terms. However, with the weak BRL and high No.11 seen in 2021, many Brazilian mills are expecting to maximise sugar production due to the strong returns offered in BRL.

We believe there will be a max sugar scenario, with 46% of cane allocated to sugar and 54% to ethanol for the 2022 crop. Brazil’s industrial capacity limits its ability to push sugar further. However, ethanol sales are made on a spot basis during the harvest and, if the oil price continues to rally, there will be pressure to increase ethanol allocation. Much of this sugar is hedged, though, so it incurs a cost to buy it back, which means ethanol would need to be paying considerably more than sugar for mills to consider it (we estimate +100pts on a No.11 basis). We therefore feel it’s likely that Brazil maximises sugar production.

The only other potential consideration is the upcoming Brazilian election in October this year. The pandemic has caused significant inflation in Brazil and fuel prices are now very high, which is politically difficult. There are talks of capping fuel prices, but this would ultimately support max sugar production as it would limit ethanol prices. Also, along with the lateness of the election during the season, it would make it likely inconsequential for 2022/23.

You can read more about the Brazilian ethanol industry in this Explainer. If you’d like to arrange a one-week trial of Czapp Premium, please contact jack@czapp.com.

Other Insights That May Be of Interest…

Market View: The Sugar Market Turns Positive

Explainers That May Be of Interest…