- Ethanol and molasses prices can be closely correlated.

- This is because most of the world’s cane molasses are consumed by ethanol producers.

- Here, we illustrate how the two are related when it comes to price.

Molasses and Ethanol Prices Compared

One of the most frequent comparisons for molasses is the ethanol price.

Ethanol producers are the main consumer of molasses globally, with the majority of cane molasses consumed in the countries where ethanol is produced.

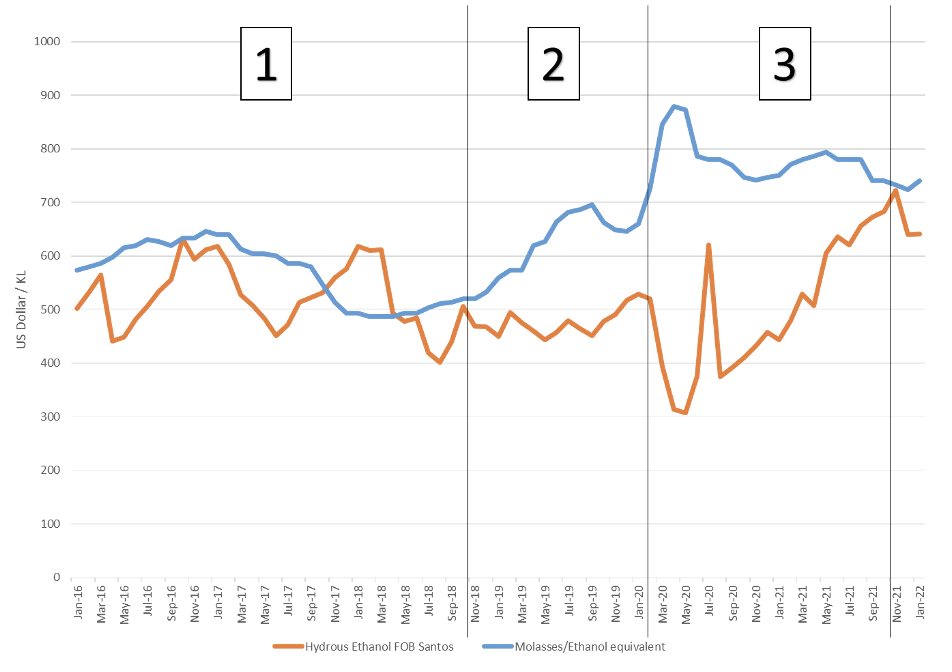

In an attempt to compare the products, a conversion factor can be made to give an “equivalence” between the products. For the stylised chart below, the following calculation is used:

Calculation for Molasses Equivalent Price = 4mt of Molasses per Kilolitre of Ethanol + $100 Conversion Costs

For example: Molasses FOB price $150 x 4 + $100 = $700 ethanol equivalent.

The molasses price is an average FOB price from the main exporting regions in US Dollars per metric tonne. The ethanol price is FOB Santos Brazil hydrous ethanol in USD/kl.

A description of the three main trends can be seen below.

Period 1: 2016 – 2018

Molasses and ethanol trended in a close range. Broadly, molasses offered a marginally higher return than the headline price of Brazilian ethanol implied. Between mid-2017 and 2018, ethanol offered a better return. This period coincided with cheaper molasses prices with good supply from Central America and Asia. We also saw an increase in EU sugar beet production after the removal of sugar production quotas in 2017.

Period 2: 2019 – March 2020

Molasses offered a better return in this period. The main driver was the increase in molasses prices due to a ban on cane molasses exports from Maharashtra. This removed up to 25% of molasses supply from the world market and saw molasses prices increase. This was also a period of relatively flat movements in oil and ethanol prices, with Brent within a range of 50-70 USD/barrel with an average of $64. Ethanol prices were steady in the range of 440-500 USD/kl.

Period 3: March 2019 – Present

This period is dominated by COVID. At the start of the pandemic in 2020, most commodity prices collapsed. We briefly saw negative oil prices in the US, and Brent fell to under 20 USD/barrel. Since then, we’ve seen oil and ethanol prices recover, which has brought molasses and ethanol prices back towards parity.

Explainers That May Interest You…

The Indian Ethanol Industry