Trend 1 – Free Market Deregulation

- The deregulation of the free market has been a reality in the electricity sector for many years.

- According to the official schedule of the Brazilian government, until 2024, there will no longer be consumers who are obliged to buy incentivized energy.

- By 2030, the market is expected to open completely, in which case, there will no longer be the limit that separates consumers from the free market and the regulated market.

- This means that in future all consumers of any size and location in the SIN (National Interconnected System) will be able to buy energy freely and negotiate prices directly with their supplier.

- Large companies in the sector are preparing to operate in the retail market and are investing heavily in technology projects to serve these consumers and offer new electricity products.

Trend 2 – Heated Incentive Energy Market

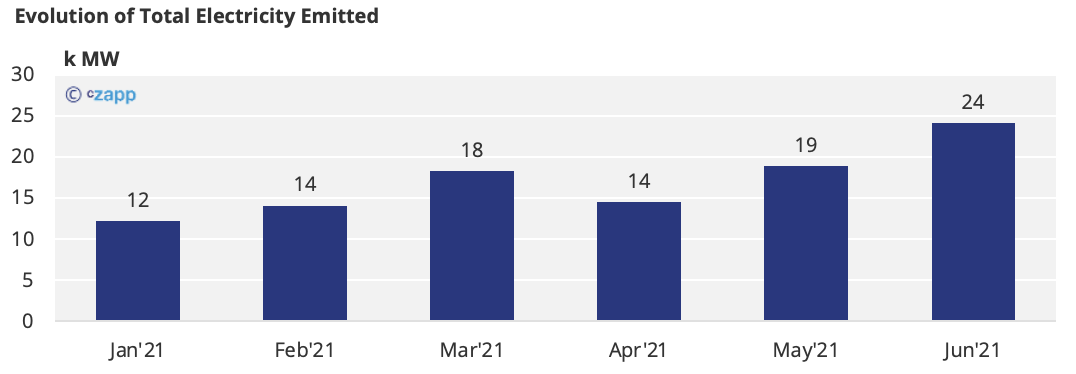

- Due to cost reduction, demand for incentivized energy by free market consumers is increasing prices for some time.

- Unlike conventional energy sold in the electricity sector, this type of energy is a little more expensive, but offers a discount on the consumer’s share of network costs (wire/connection).

- In addition, the government’s scheduled the end of this type of energy benefits (limit date is March 1, 2022).

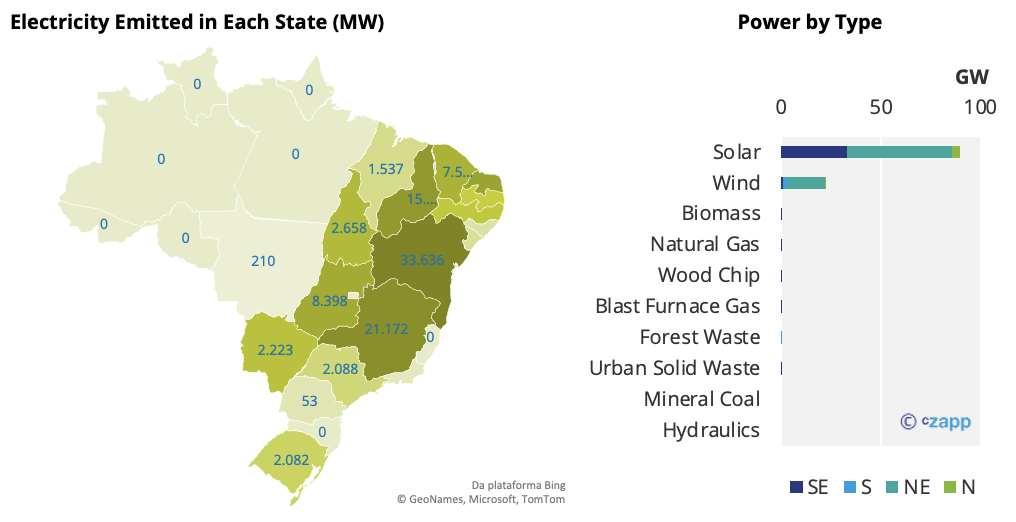

- To create new generation projects with ANEEL, many projects are being protocoled since the end of last year. Most of them are concentrated in the Southeast and Northeast regions of the country and predominantly from wind and solar sources.

Trend 3 – Growth of the Renewable Energy Certificates Market (REC)

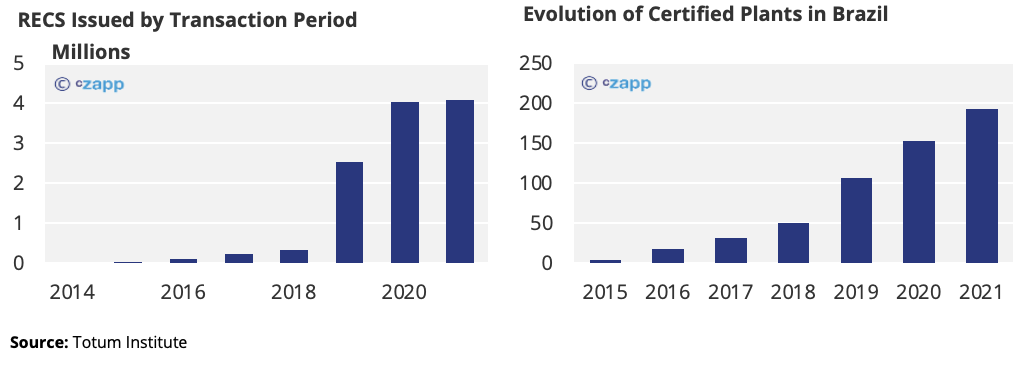

- According to the Totum Institute, a well-known certification house in the Electric Sector, national and multinational companies are seeking to acquire renewable energy certificates to reduce their carbon footprint.

- The demand for powerplant certification is also increasing.

- There is still a huge market to offer certificates with “more value” in terms of sustainability, as in many cases the RECs only meet environmental criteria (energy source) and not other important aspects present in ESG practices. This means that VIVE has great potential if well inserted in the electric sector.

Trend 4 – Hybridization of Electric Power Generation Sources

- The hybrid generation theme is being discussed not only in Brazil but in several other countries such as the United Kingdom, United States, China, India.

- There are several initiatives for the study and construction of hybrid plants involving wind and solar generation sources, but in Brazil, there is the possibility of testing hybrid plants with biomass and solar sources.

- In Brazil, the publication of a new regulation authorizing hybrid plants is expected by mid-2022.

Trend 5 – Deregulation of the Natural Gas Market

- This is a topic that has been discussed for some time in the legislative sphere and it has already started to show signs that is promising, but the deadline is still uncertain.

- The deregulation of the Natural Gas market will generate market competitiveness and cost reduction.

- This will also enable the promotion of other types of fuels such as biogas and biomethane, which are more sustainable and has enormous energy potential. It will be possible to generate carbon credits through programs such as VIVE in synergy with RenovaBio.

Other Insights That May Be of Interest…

Brazil’s Reservoir Levels Are Worryingly Low Ahead of La Niña

Why Do Electricity Prices Tend to Be High in Brazil?

What the Energy Crisis Means for Inflation & Commodities

Interactive Reports That May Be of Interest…