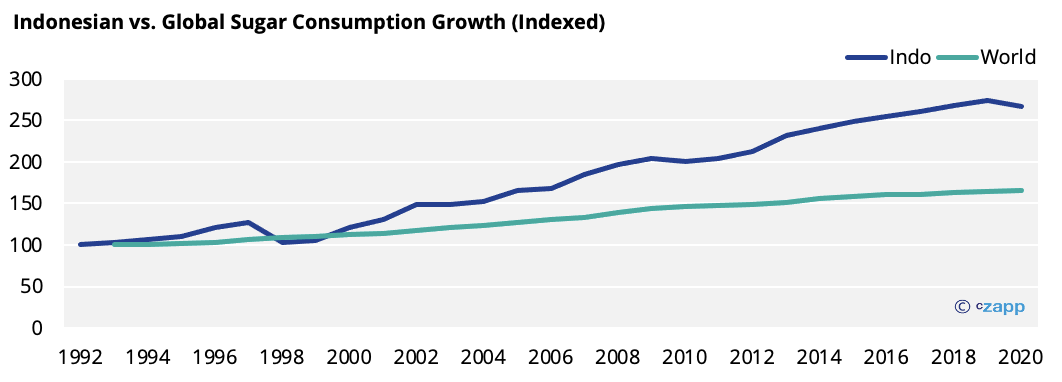

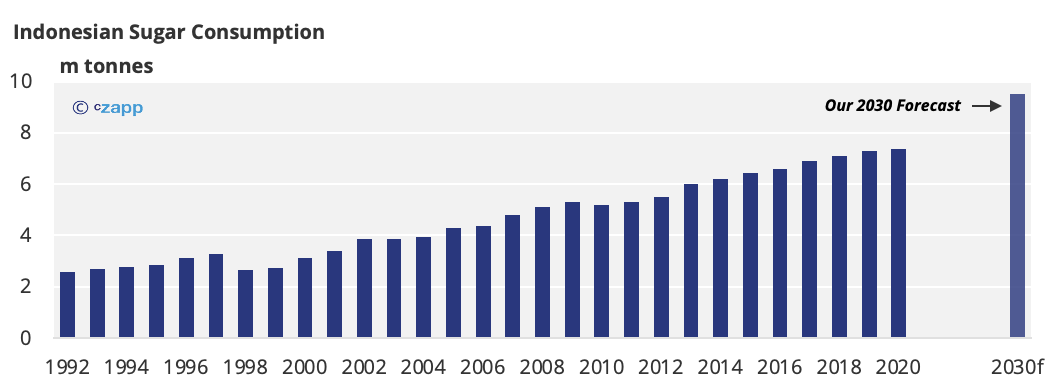

- Indonesia’s sugar consumption has grown by 40% across the last 10 years.

- The global average had been only 9% in this period.

- Many of the factors that have driven this growth could still do so, but how high can it go?

Indonesia’s Sugar Consumption Has Grown Rapidly Since 2010

Indonesia’s sugar consumption has grown by 40% across the last 10 years, up 31% from the global average. Other large consumers, such as India and China, saw just 7.8% and 6.8% growth in the same period.

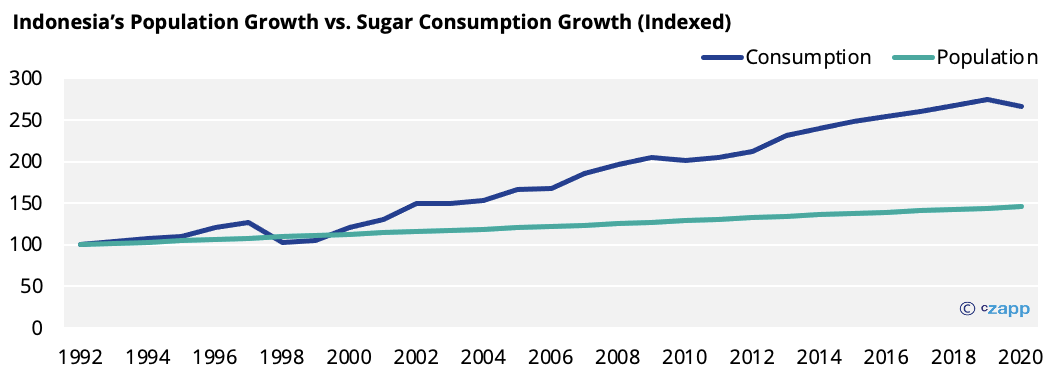

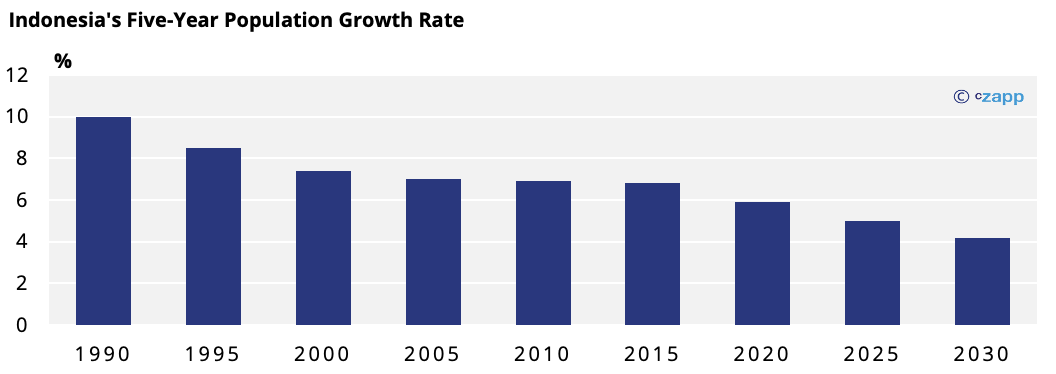

Several things have driven this growth. Firstly, Indonesia is now home to 264.65 million people, up 13% from 2010.

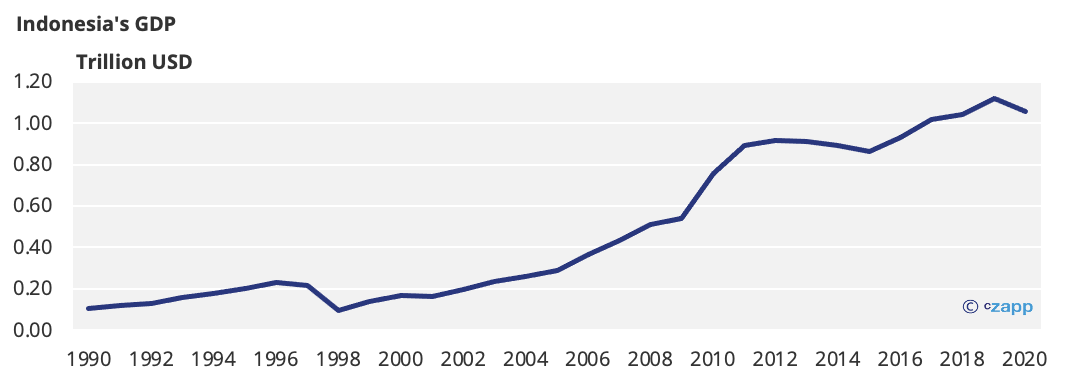

Sugar consumption often increases alongside population growth, but Indonesia’s economy also grew by over 40% during the same period.

This meant Indonesia’s GDP per capita drastically increased, leaving people with larger disposable incomes and flexibility when it comes to spending.

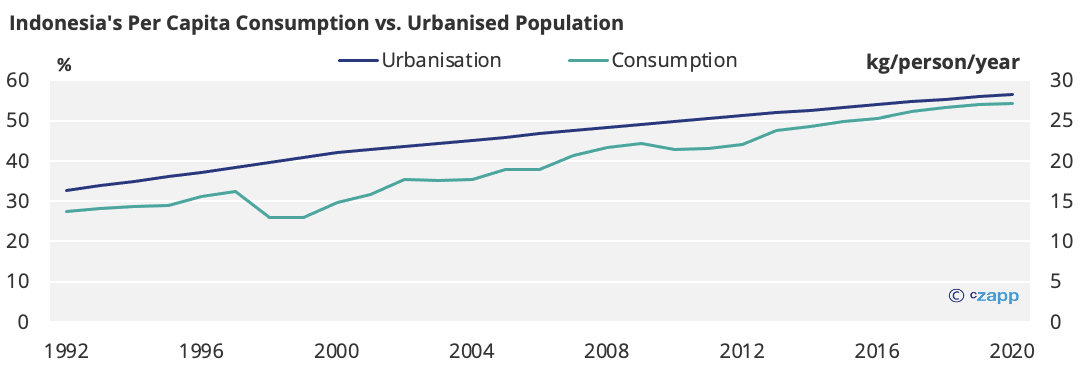

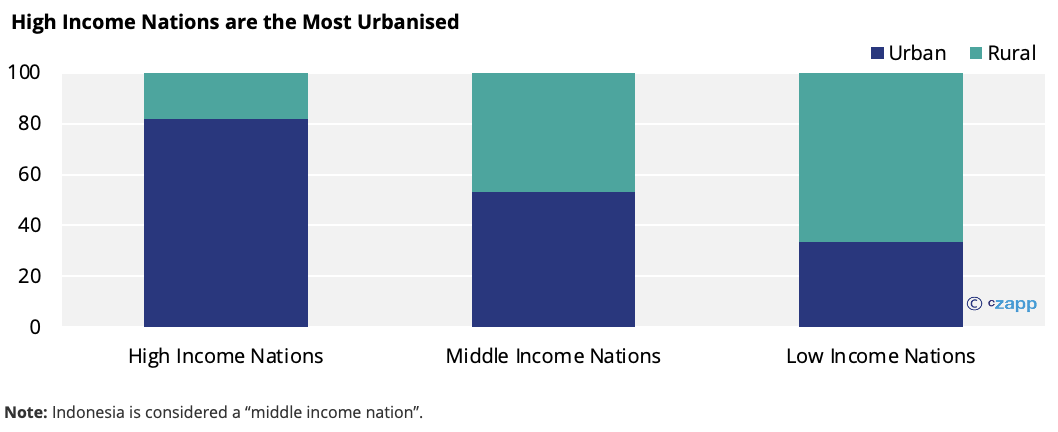

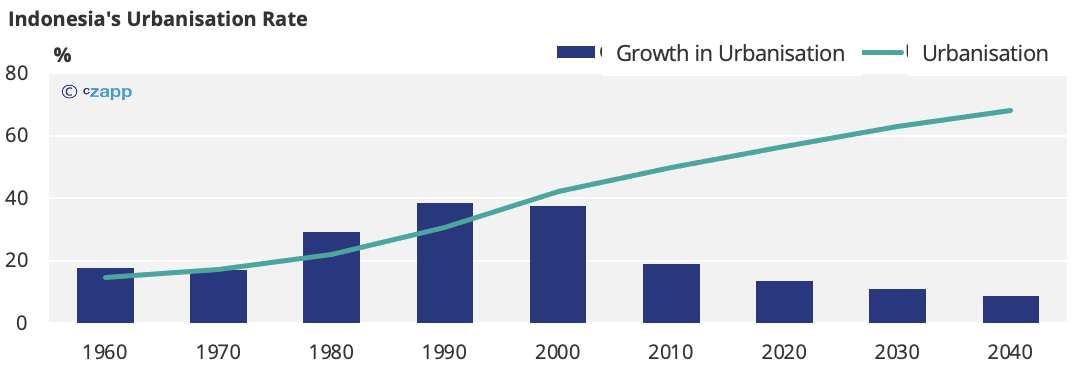

Economic development tends to correlate with increased urbanisation; as populations urbanise, sugar consumption increases.

This is because urban areas, namely cities, are often the financial hubs. It’s also because those living in urban areas have increased access to areas where sugar consumption is more common (e.g. bars, restaurants, theatres).

These trends were illustrated in a study of sugar consumption among adolescents, which was carried out by Taipei Medical University and the Indonesian Ministry of Health. The study found that those in urban areas had greater access to sugar sweetened soft drinks and snacks and concluded that adolescent boys and girls are 7% more likely to consume at least one sugar-sweetened drink per day than those that live in rural areas.

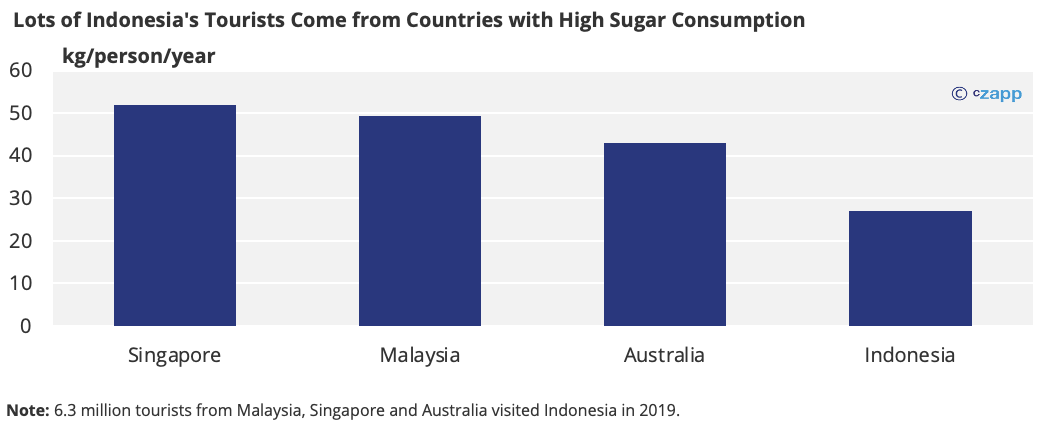

Tourism can also play a significant role in increasing sugar consumption as tourists tend to consume large amounts of sugar. In Indonesia, particularly, it’s likely that tourists will consume more on a per capita basis than the local population as a large number of the country’s tourists come from nations with higher per capita consumption.

Indonesia’s tourism industry has grown dramatically in the last 10 years, from 7.65 million visitors in 2011 to 16.11 million in 2019. With this, Indonesia has one of the fastest growing tourism industries in the world.

It’s worth noting, though, that this may be less of a driver for Indonesia, with 2019’s tourists equating to 5.7% of Indonesia’s population, compared to Thailand’s 57.1%.

That said, the tourists’ high per capita sugar consumption, paired with a rising number of visitors in years to come, will likely nudge Indonesian consumption up, even if it’s in a less noticeable way than in Thailand.

Can These Factors Still Drive Growth?

Between 2010 and 2020, Indonesia was urbanising at a rate of 1.27% per year. The United Nations thinks this rate will drop to 1.04% between 2020 and 2030. This rate of urbanisation, despite being slower, should continue to fuel sugar consumption growth.

Also, as Indonesia becomes more developed, we should see the gap between the urban and rural consumption narrow, with sugary products becoming more accessible in the rural areas. This is because, when considering a small settlement in a developed nation, we’d expect some form of restaurant and/or local shop offering processed food. We’d also expect infrastructure that means those in rural areas can easily access built-up areas with more shops. Inversely, developing nations’ rural communities may be more isolated and are less likely to have shops selling processed food and drink.

Turning our attention to population, Indonesia’s population grew by 13.1% between 2010 and 2020, but the United Nations thinks this growth rate will slow, with growth between 2020 and 2030 predicted at 9.38%.

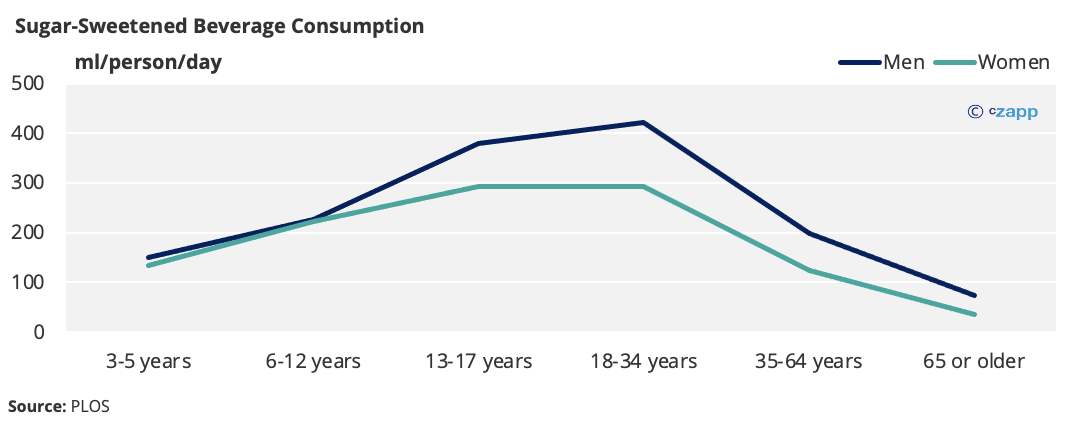

If this materialises, Indonesia’s population will be older on average; the World Bank thinks the percentage of Indonesia’s population aged 65 and above will increase by almost half by 2030. This poses a problem for sugar consumption, as it tends to decrease with age. In a global survey conducted by PLOS, both fruit juice and SSB consumption dropped globally with age, with the most substantial dip seen after the age of 40. When separated into regions, the trend held true across geographies.

So, as Indonesia’s urbanisation rate and population growth rate begin to slow, so could the growth in sugar consumption.

Declining growth in urbanization and population are not reflected in economic growth, however. The next few years will likely see accelerated economic growth in Indonesia, both nationally and on a per capita basis. The International Monterey Fund (IMF) highlights a strong response to COVID-19 and positive reforms aimed at increasing foreign investment in Indonesia as reasons why the country will likely see sustained economic growth.

Between 2010 and 2020, Indonesia’s economy grew by 40%. Between 2021 and 2026, the IMF predict growth of over 45%. The slow-down in population growth, paired with increased nation GDP growth, means per capita growth will be particularly pronounced, climbing almost 40% between 2021-2026, compared with 23% between 2010 and 2020. This economic growth, particularly on a per capita basis, suggests that there will be an increase in disposable incomes and, by extension, an increase in per capita sugar consumption.

Continued economic expansion paired with slowing, but still notable, urbanisation and population growth offer reason to believe these previous drivers of consumption growth can still drive growth going forward.

Threats to Indonesian Sugar Consumption

It’s not all clean sailing, though. As it stands, Indonesia doesn’t have any taxes aimed at reducing sugar consumption, but steps have been taken recently to lay the groundwork for such taxes.

Firstly, lawmakers have voted to investigate the idea of such taxes being introduced. Secondly, legal frameworks have been created that pave the way for taxes on sugar. Laws limiting the products that can be subject to excise tax have been altered and it seems likely that such a move was made with sugar in mind. As these laws are only in the early stages of exploration, it’s not yet clear what the laws would entail – whether they’re likely to be targeting sugar sweetened beverage taxes, or something else.

With growing awareness around sugar-related health issues, and a COVID-hit economy, it seems probable that some form of sugar tax will be introduced in Indonesia as way for the Government to increase tax revenue.

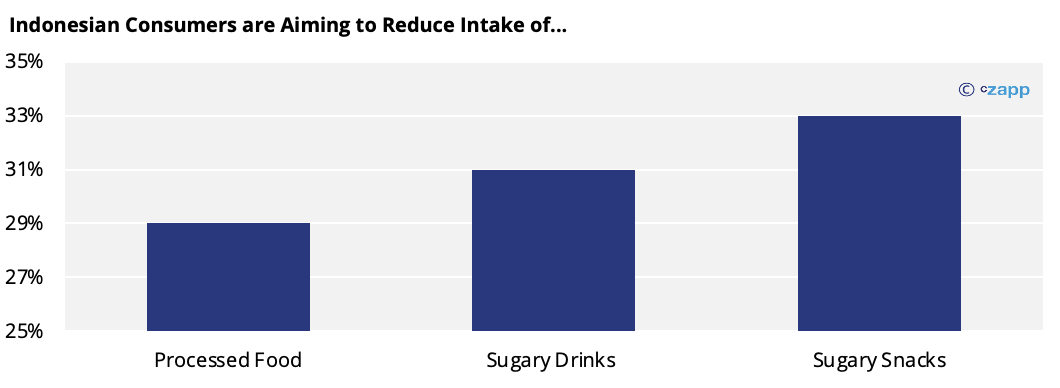

A report by Food Industry Asia (2019) highlighted that 99% of Indonesian consumers were trying to make their diet healthier, with 29%, 31%, and 33% of Indonesians looking to reduce consumption of processed food, sugary drinks, and sugary snacks respectively.

It’s not only consumers who intend to reduce sugar usage, though. An industry wide survey, again conducted by Food Industry Asia, found that many manufacturers are reformulating their products to reduce their sugar content. 83% of companies have already started reformulating drinks to reduce sugar and a further 11% intend to do so soon. These changes will certainly impact consumption, but it’s worth noting that, even if consumers and producers intend to reduce consumption, it does not mean they will.

Another thing to be wary of when predicting sugar consumption growth is the increased use of alternative sweeteners we’re seeing around the world. In many countries, sugar consumption growth is being eaten up by HFCS. For example, in the early 2010s, Czarnikow and several other sources predicted that, by 2020, China would consume over 25m tonnes of sugar a year. However, China’s yearly consumption is yet to cross 16m tonnes. This is, in part, due to an increased use of HFCS in China, occupying roughly 20% of its sweetener demand.

As it stands, HFCS accounts for a very small percentage of sweetener use in Indonesia (1.35% in 2020). We suspect this is because there’s a high import duty on HFCS (over 20%), making sugar a cheaper option for consumers at present. We don’t think these duties will change as the Government wouldn’t wish to harm the local milling and refining industries.

Where Next for Indonesian Sugar Consumption?

When thinking about how Indonesian sugar consumption could develop going forward, it’s helpful to consider how other largescale consumers have developed.

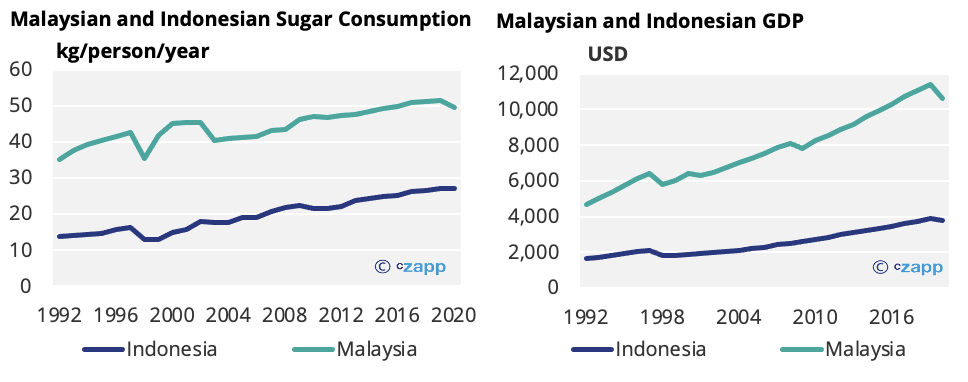

In this instance, Malaysia is a good bet.

Malaysia and Indonesia have a long-shared history of migration and cultural inter-influence and, whilst the nations have their differences, they are similar in a cultural and gastronomical sense. However, Malaysia is more developed than Indonesia, which means it offers a glimpse of what the future might hold for a wealthier Indonesia.

As it stands, Malaysia’s per capita sugar consumption is incredibly high at close to 50kg per capita. We think this is because Malaysia is incredibly urbanised, and its GDP is roughly three times that of Indonesia’s on a per capita basis.

There’s reason to assume that, as Indonesia becomes wealthier and more urbanised, it can approach a similar level of consumption. Even if consumption does not climb quite as high as 50kg per capita, Malaysia’s development, and the similarities between the two counties, indicates that Indonesian consumption could be similarly high in the future.

We’re not the only ones predicting this growth in Indonesian consumption, either. An Indonesian state plantation firm, PTPN, predicts growth of 21.7% between 2020 and 2025 and 40.6% between 2020 and 2030. Elsewhere, the Organisation for Economic Co-operation and Development (OECD) predicts that Indonesian consumption growth between 2020 and 2030 will be second only to India. The OECD also thinks Indonesia will soon be the biggest sugar importer globally and is likely to import 7.5m tonnes by 2030, up from 5m tonnes this year.

We think sugar consumption will reach 9.5m tonnes by 2030, up 28% from 2020.

This predicted growth is extremely significant if we consider the fact that domestic production has limitations in terms of scale and quality. Most industrial quality sugar is imported and, despite government efforts to increase production, even they acknowledge that self-reliance on industrial quality sugar is a long way off. It’s therefore likely we’ll see Indonesia maintain its position as one of the world’s largest importers.

Other Insights That May Be of Interest…

Czapp’s Sugar Consumption Case Studies

Explainers That May Be of Interest…