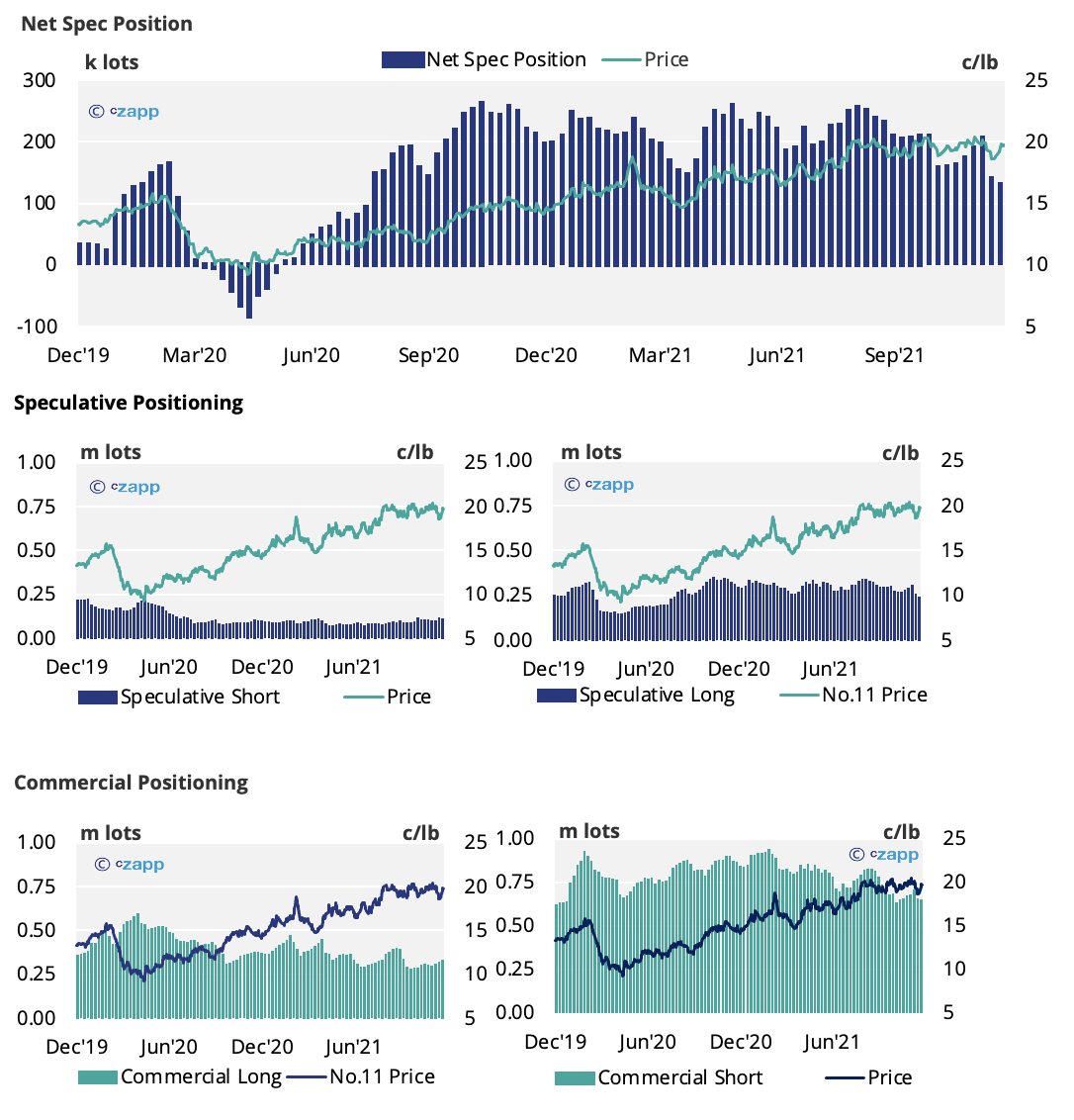

- The sugar futures markets have recovered after prices came under pressure due to Omicron concerns.

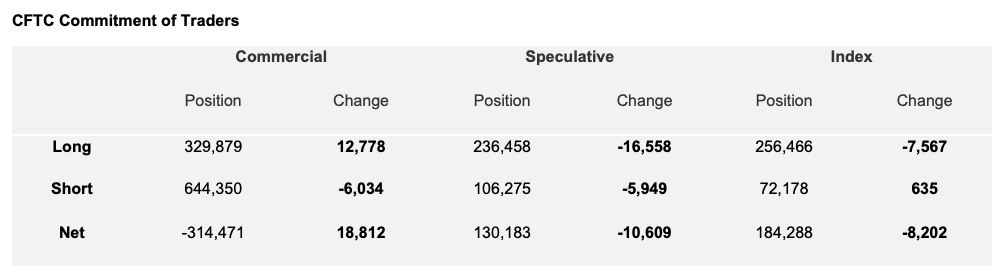

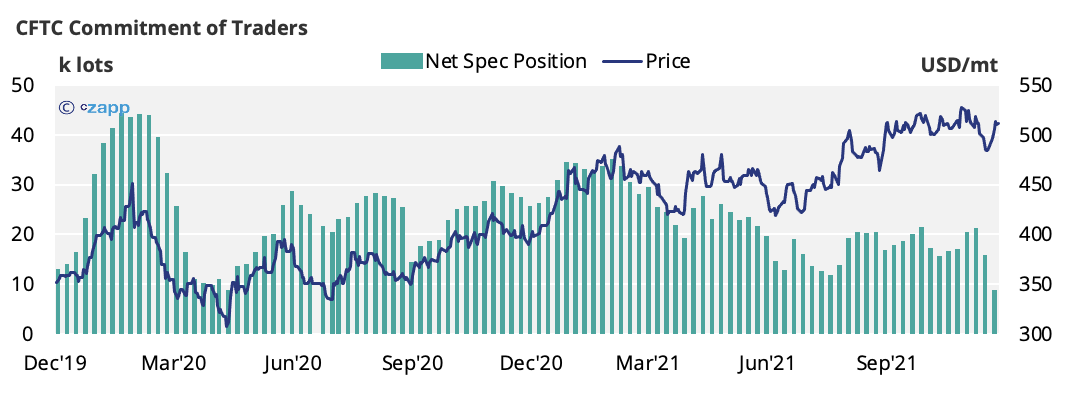

- The specs have significantly reduced their position in raw sugar.

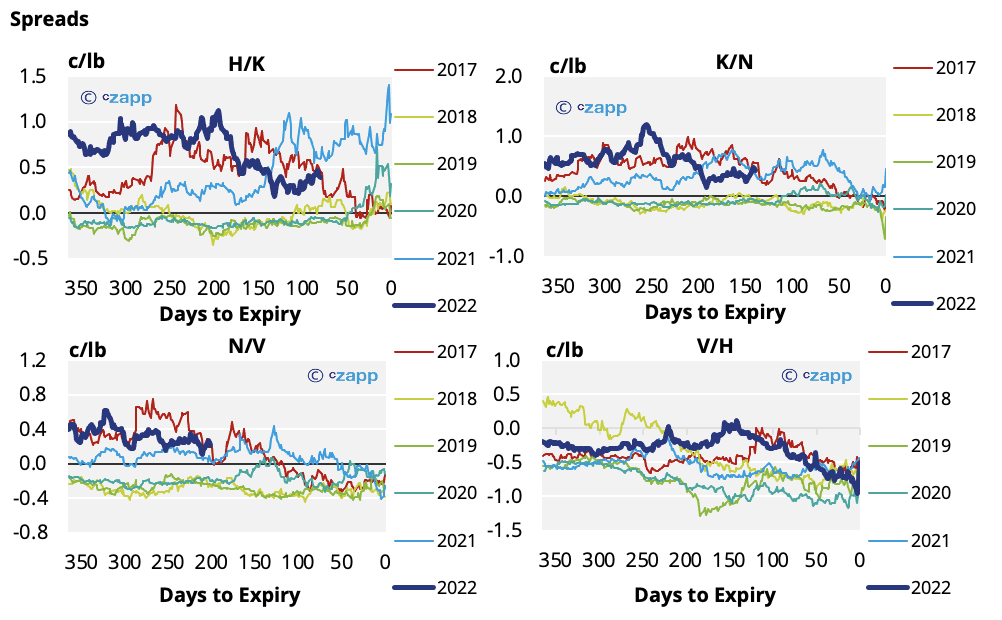

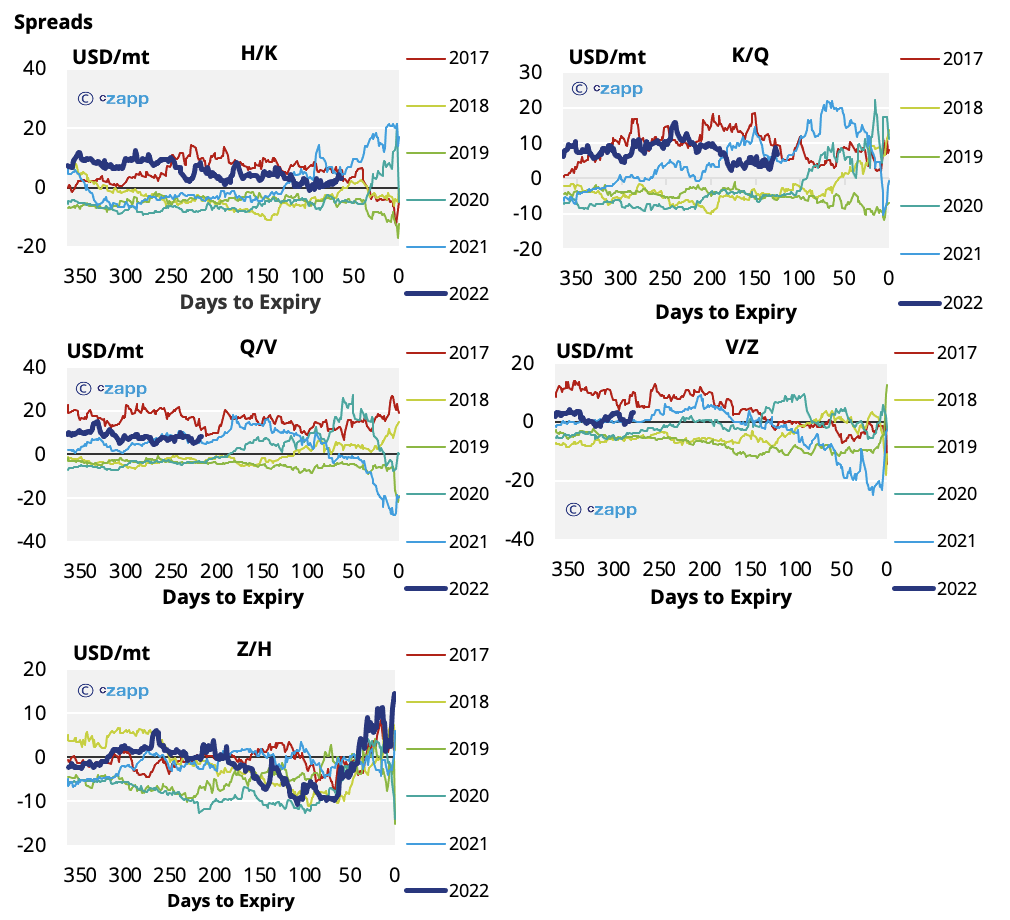

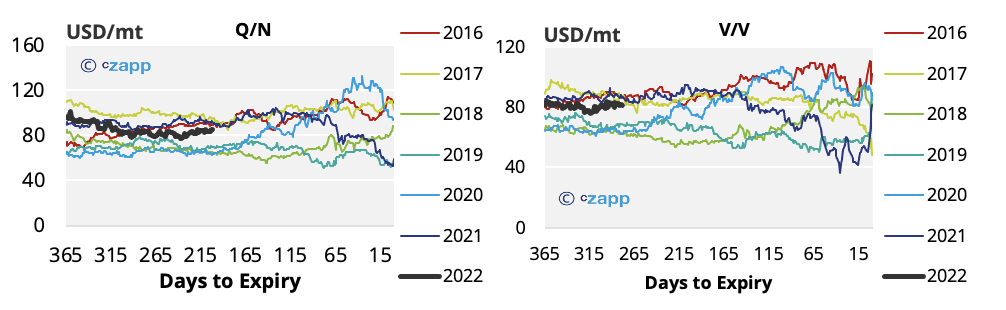

- Despite the large recent price movement, the spreads in raws and whites are largely unchanged.

New York No.11 (Raw Sugar)

- The No.11 weakened well below 19 c/lb after Omicron caused speculators to close positions.

- Since, however, there’s been a strong price recovery with the No.11 again pressuring 20 c/lb.

- This opportunity was taken by industrial consumers who have increased their long paper holding, though not by a massive amount.

- The spread structure has remained relatively steady, which will likely inhibit large forward buying from re-export refiners.The withdrawal of specs means there’s room for them to return to the market if the conditions become attractive to them once more.

No.5 London (White Sugar)

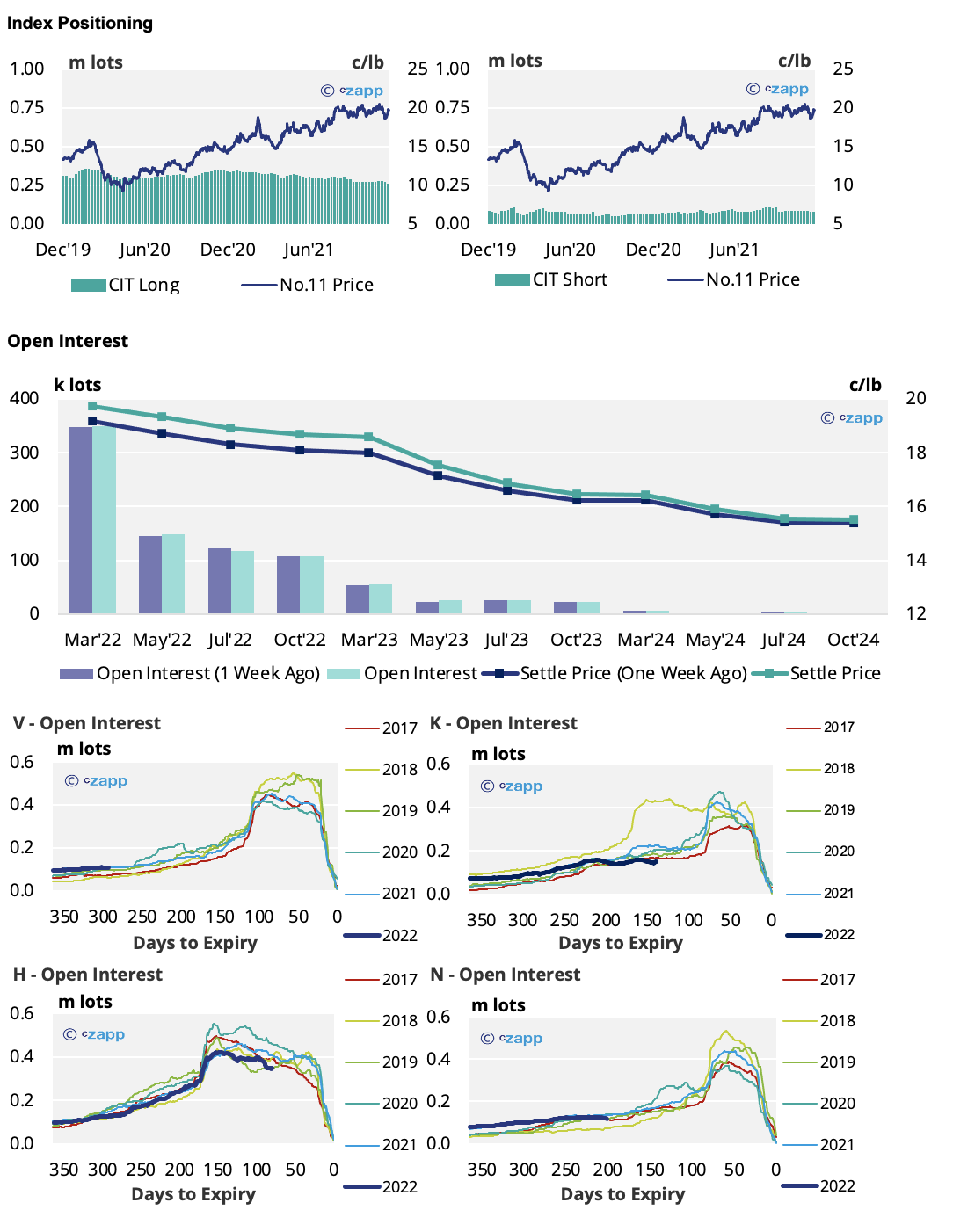

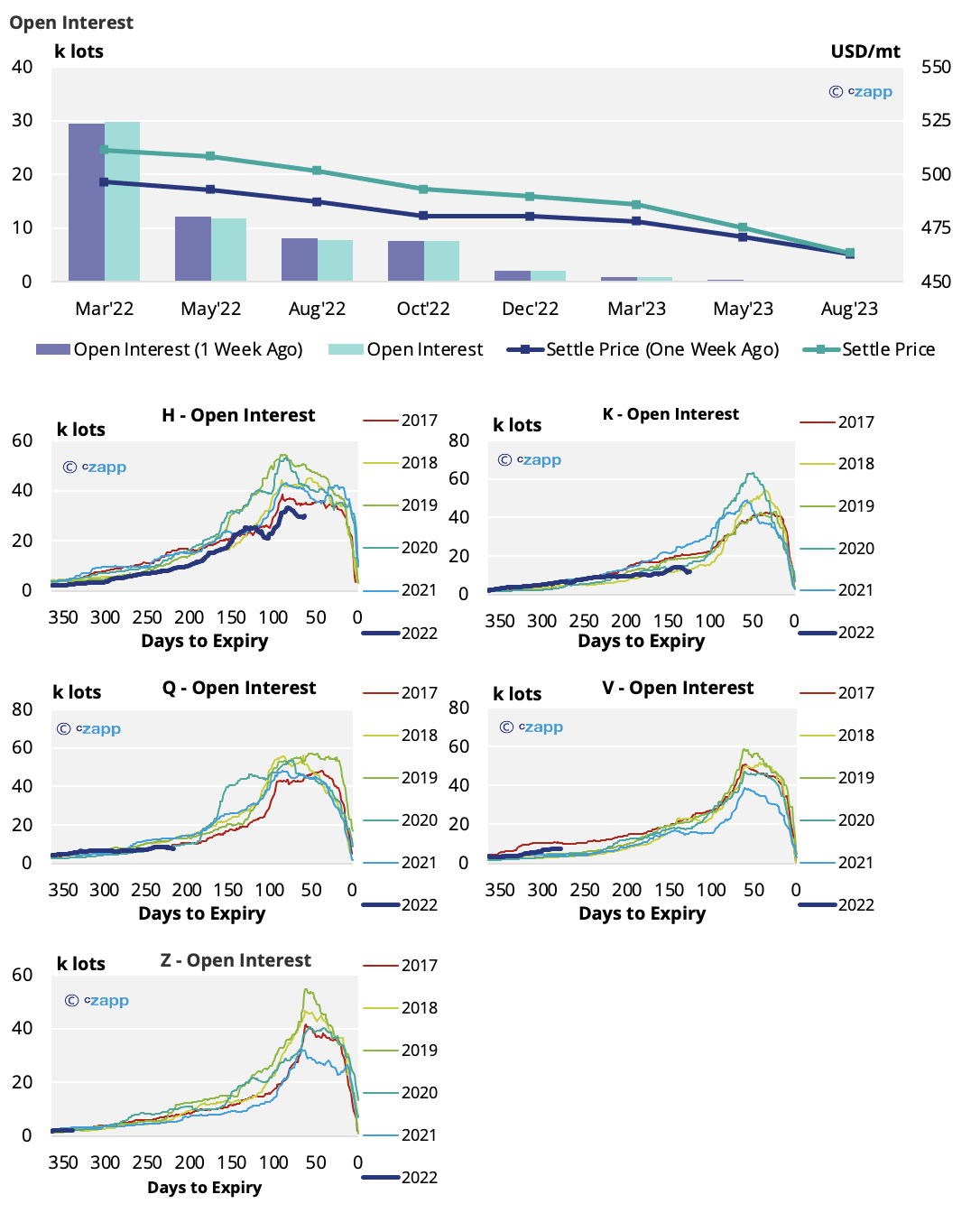

- The No.5 market has rebounded, after the pressure created by the spec exit.

- The H’22 contract is still below historical levels, which could be bearish for physical demand in the short term.

White Premium (Arbitrage)

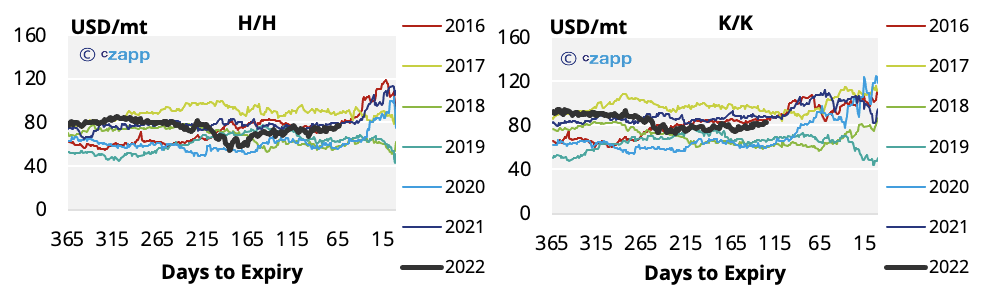

- The 2022 white premiums have continued to slowly strengthen.

- However, the level remains lower than the margin needed by the refineries, especially considering how high freight rates have impacted refiner costs.

- This level is making it difficult for re-export refineries to operate at present.

Other Insights That May Be of Interest…