- The Omicron COVID variant has rattled the sugar market.

- Sugar’s 18-month uptrend has broken.

- We dig into the detail to understand what happens next.

Black Friday: The End of Sugar’s Uptrend?

Black Friday is the day after Thanksgiving and is marked by sales across the USA (and increasingly across the world). This year, those sales extended to the commodity markets, many of which dropped as news of a further COVID variant spread.

For raw sugar, Friday’s price drop means that it seems to have broken out of its post-COVID uptrend.

Source: Refinitiv Eikon

Sugar has been in a bull market for 18 months; it’s been one of the longest-running bull markets of recent decades.

Source: Refinitiv Eikon

Momentum has clearly been fading withing the recent uptrend. During 2020, sugar spent most of its time in the upper half of the trend channel. In 2021, it’s spent more time in the bottom half of the trend channel. The slowdown in momentum and the duration of the rally hinted that the uptrend was becoming stale. This was a problem because speculators were big buyers in the past 18 months, but often need momentum to continue to justify positions in markets.

For close observers of the sugar market, this staleness wasn’t a surprise. Although sugar has technically been in its uptrend for the last three months, it hasn’t felt like it. The market has traded sideways since mid-August, trapped between refinery buying below 19c and Indian selling at 20.50c. While the uptrend has broken, this sideways range is still intact.

Source: Refinitiv Eikon

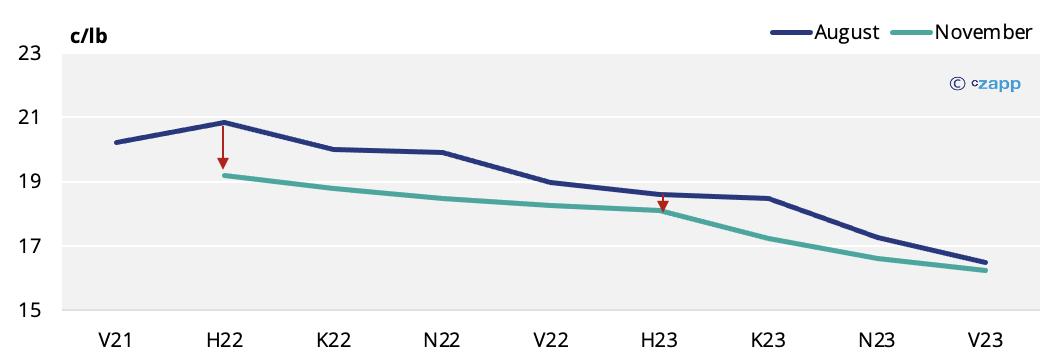

Although the sugar price has gone nowhere for three months, beneath the surface a lot has been happening. The sugar forward curve for 2022 has flattened, with the March/October 2022 spread falling from more than 300pts premium at its peak to below 50pts premium at the lows.

Source: Refinitiv Eikon

The stress seems to have come out of the sugar market because its structure is no longer incentivising producers to advance supply or buyers to defer demand as aggressively as it once was. This again is problematic because speculators seem to prefer markets with extreme backwardation or contango rather than those with flatter forward curves.

But while the market has de-risked, this only really applies to the 2022 positions. The 2023 curve is almost as backwardated as it was previously.

This means that, in the short term, the stress in the market has reduced, but in the longer term the risk of insufficient supply hasn’t gone away. The curve indicates that, in the short term, the market might struggle to continue to rally, but the bull market could remain intact in the longer term.

Sugar’s Recent Struggles: An Ag or Energy?

Let’s look again at sugar’s sideways drift since mid-August.

Source: Refinitiv Eikon

It’s been behaving like an agricultural product during this time, which is appropriate seeing as sugar is made from either cane or beet. Using Invesco’s DB Agriculture Fund as a proxy, we can see that ags have drifted since May, while Invesco’s DB Energy Fund has been strengthening.

Source: Refinitiv Eikon

But in recent weeks, ags have broken higher while energy has weakened. Sugar has failed to break higher, and so has been acting like an energy product, which again is appropriate seeing as sucrose can be used to make ethanol for road fuel and biomass can be used for electricity generation.

Source: Refinitiv Eikon

It’s a little concerning that sugar has been unable to catch a bid and has taken the bearish characteristics of each market in recent months.

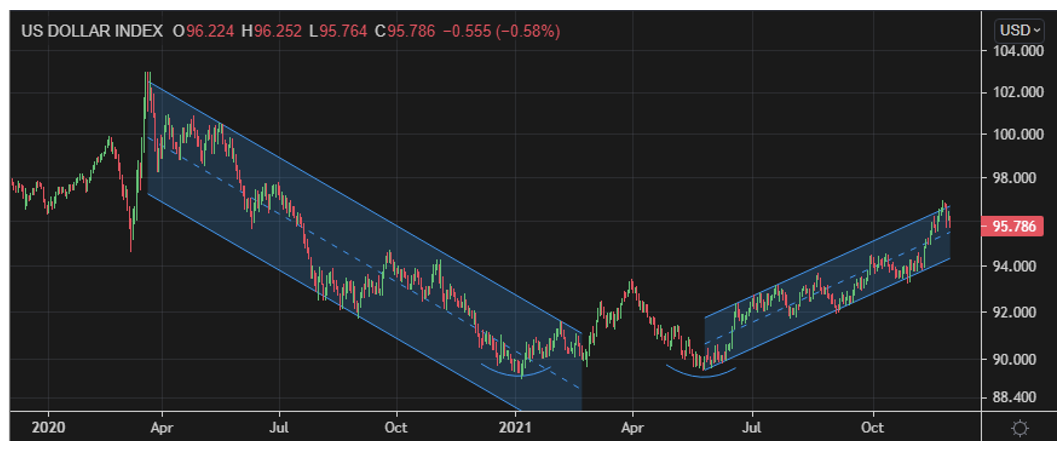

Sugar’s Recent Struggles: The US Dollar

In general, a weakening USD helps commodities strengthen, while a stronger USD makes it harder for commodities to strengthen. The USD weakened through 2020, which helped almost all commodities recover from March’s COVID shock.

Source: Refinitiv Eikon

But since the start of 2021, this process stopped, and the USD is now strengthening. This will make it harder for commodities to continue to strengthen. You can see this process by looking at the 20-day correlation between sugar and the US Dollar. From April 2020 to the end of the year, sugar was almost entirely negatively correlated to the USD.

Source: Refinitiv Eikon

In H1’21, the relationship was indeterminate as the USD was trading sideways while forming a base. In H2’21, the correlation has been mostly positive, which is unusual. It would make sense for the USD to pause its recent upward momentum following a strong month in November. But this is also a difficult environment for sugar to continue to strengthen.

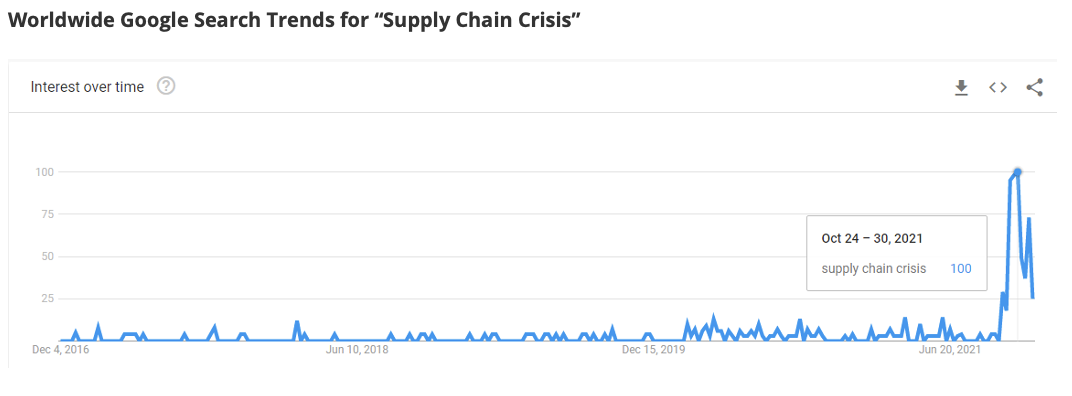

Sugar’s Recent Struggles: Disrupted Supply Chains

Another reason commodities have been elevated in recent months has been the extraordinary disruption to supply chains post-COVID shock. This has led to expensive freight rates for both bulk and container movements. Here’s a chart of the Baltic Exchange Drybulk Index for the past two years, showing the stress in the market, and how it’s now resolving.

Source: Refinitiv Eikon

This is plotted on a log scale. The index increased by more than ten times in the 18 months and has just halved in the last six weeks. While the huge rally may have made life difficult for commodity traders, the wider public simply didn’t notice until October, when the supply chain crisis suddenly became front-page news. By this stage, though, the worst was already over, and the market was starting to weaken.

If supply chains continue to normalise, this will take some of the bullish pressure out of the commodity markets, allowing them to weaken. It’ll also ultimately give buyers a bit more confidence to step back into the physical markets again.

Sugar’s Recent Struggles: Inflation Expectations

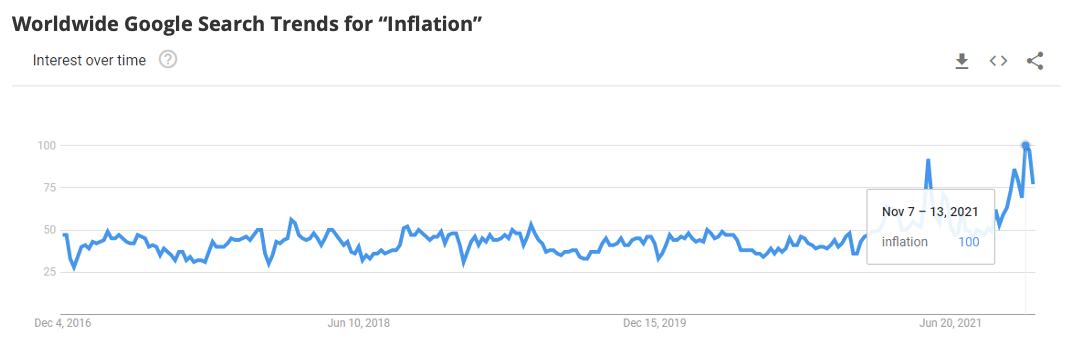

Might a similar thing be happening with wider inflation expectations? Awareness of increased inflation has been rumbling all year, but wider interest peaked in November 2021. The world now seems obsessed with the notion inflation is coming and this will be positive for commodity prices. In the long term, this view might be correct, but today’s consensus makes us nervous; we might be due a nasty shakeout first.

Sugar’s Recent Struggles: Excess Supply

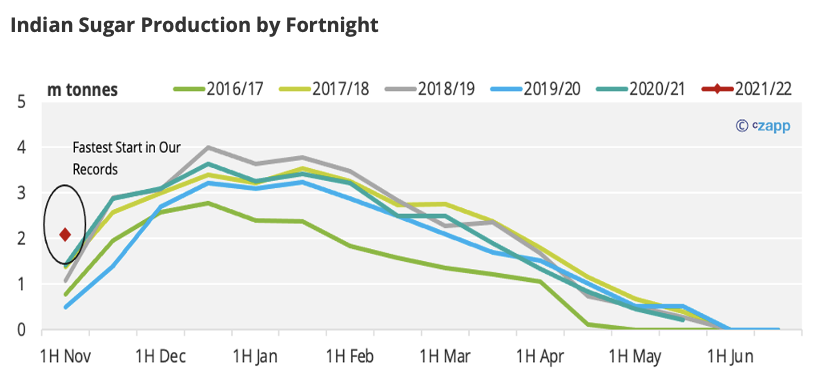

The sugarcane harvest in India has started at a rapid pace. Sugar from this cane will be available for export imminently. Indian mills and traders have sold more than 3m tonnes for export this season already; a further 1m tonnes is probably available if raw sugar prices trade back above 20 c/lb. 2m tonnes more might then be available from Northern India if required.

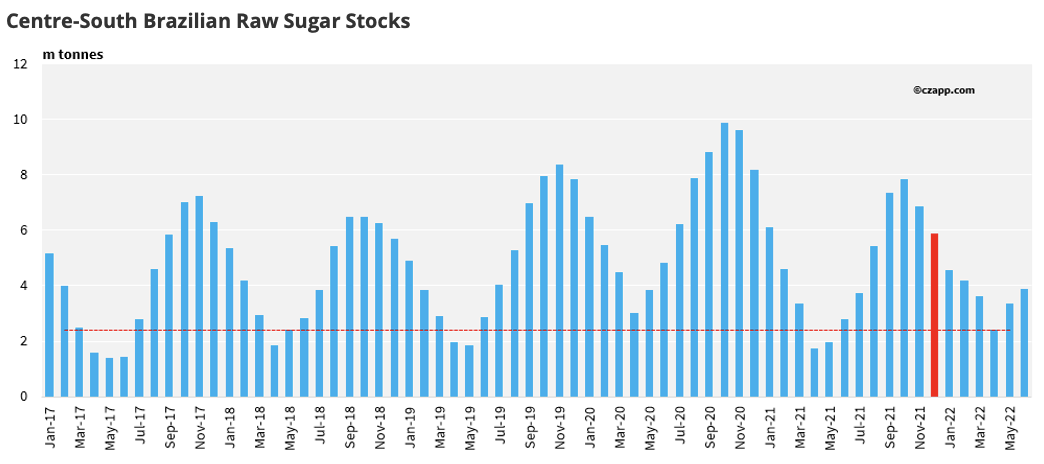

Mills in Centre-South Brazil also have plenty of stock available from the cane harvest, which is just finishing. Current stocks are normal for this time of year, despite the shortfall in cane crushed this year owing to drought/frost. This is because the production shortfall was counterbalanced by slow demand for sugar through 2021.

Even at the low point in the stock cycle in April 2022, stocks should still be at comfortable levels versus previous seasons. This suggests that CS Brazilian mills still have sugar to sell, and this sugar could be tendered against the H’22 expiry if it’s not sold in the next three months.

Sugar’s Recent Struggles: Low Demand

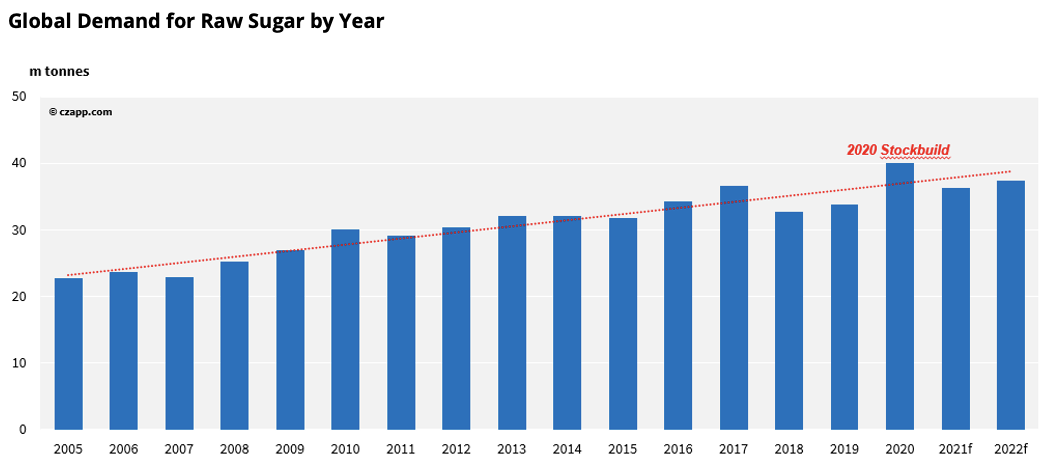

Demand for raw sugar has been poor all year, and this is still the case today.

This is partly because major refiners don’t want to pay higher prices, partly because the futures curve has been heavily backwardated for much of the year and partly due to the logistical disruption. Big sugar buyers took advantage of decade-low prices in 2020 to replenish stocks and so haven’t been under huge pressure to come back to the market.

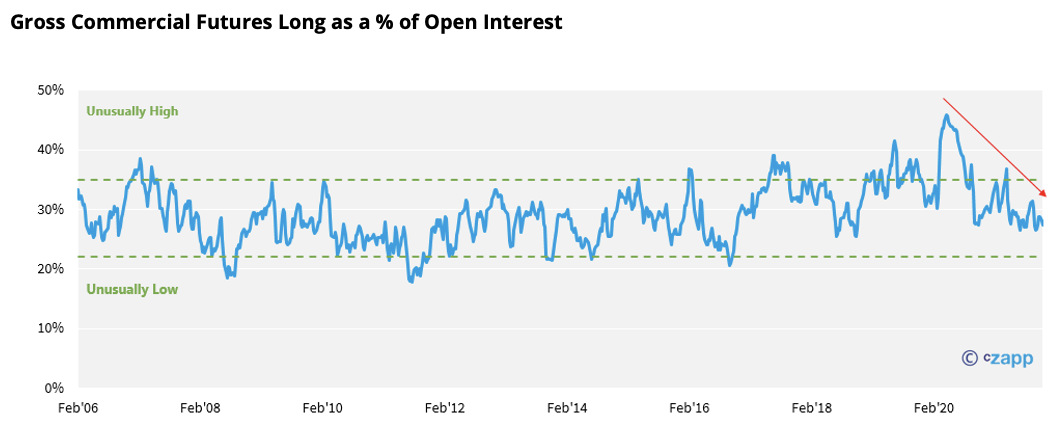

You can see the scale of commercial raw sugar buying that emerged during the peak COVID panic in March and April 2020, when raw sugar prices traded below 10c/lb. We’ve never seen sugar buying on this scale before from refiners. Since this time, the level of buying cover has reduced back towards normal levels. Despite this, commercial cover isn’t terribly low by historical standards. If buyers aren’t under pressure to step in, they’ll probably continue to chip away at market pullbacks.

Sugar’s Recent Struggles: Comfortable Speculators

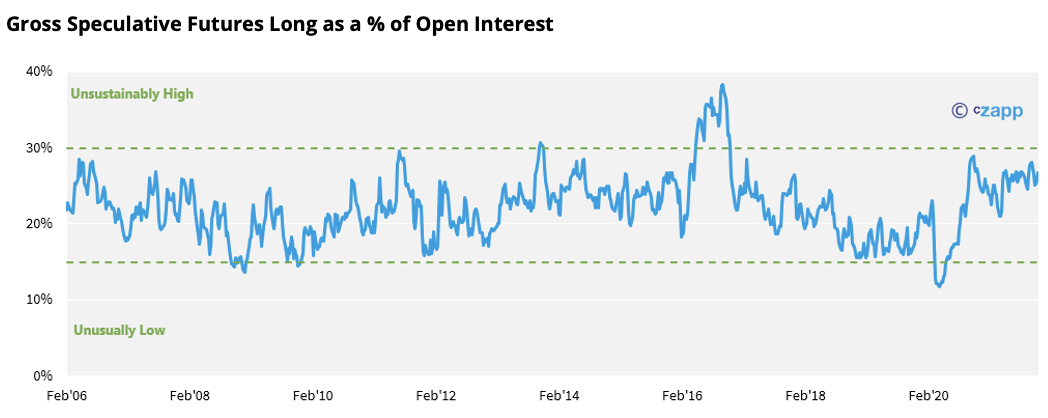

In contrast, speculators continue to hold a large long position in sugar. This was largely built below 15 c/lb, so the speculators aren’t under any pressure to liquidate.

It’ll take a major external risk-off even to trigger large-scale speculative selling; not even the emergence of the Omicron COVID variant has achieved this…yet.

This leaves us in a strange position. In a market where a succession of squeezes occur (many small but some large), there’s often someone under pressure; someone feeling discomfort. But if we look at the major market participants today, everyone looks comfortable: speculators aren’t under pressure to liquidate their longs, refiners aren’t under pressure to buy; producers have hedged well at attractive levels. This calmness won’t last indefinitely.

Sugar’s Outlook into 2022: Agriculture or Energy?

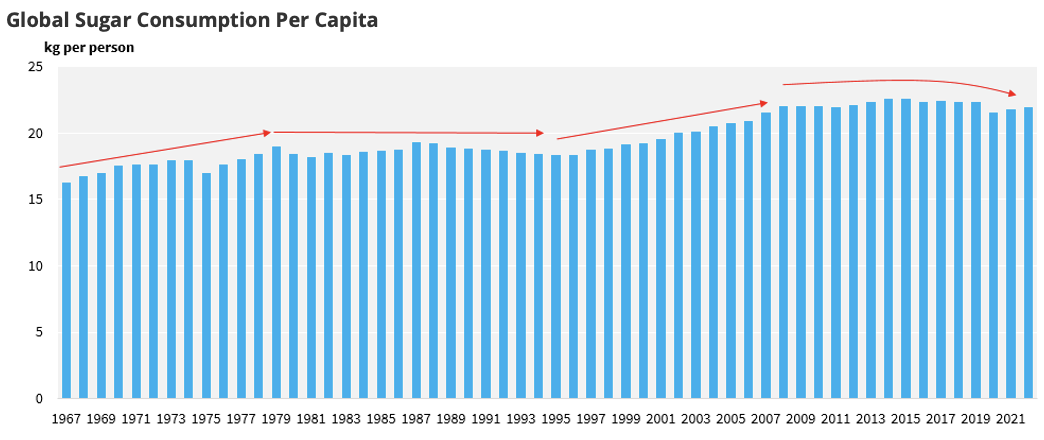

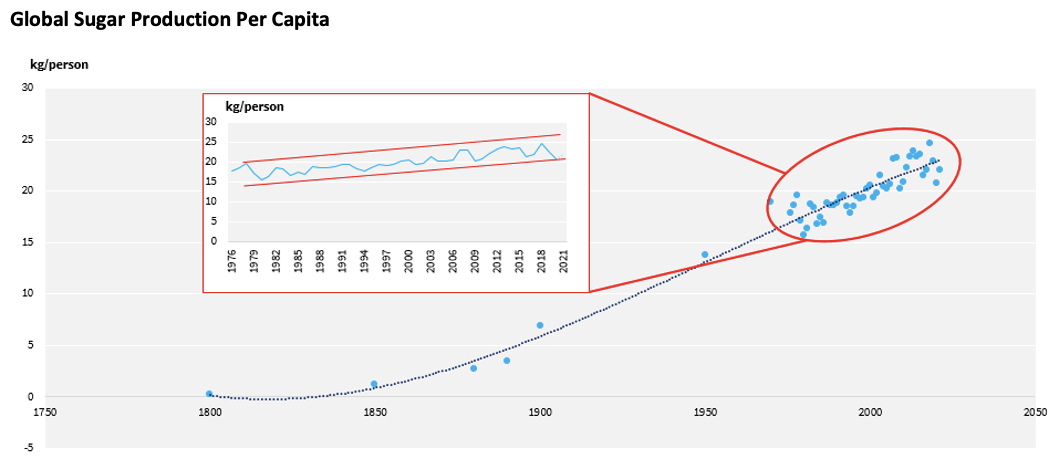

We mentioned earlier that sugar can either be considered an agricultural commodity or an energy commodity depending on whether sucrose is eaten or turned into ethanol for road fuel. For most of history, cane and beet have been food crops, but the outlook for sugar consumption has never been as poor as it is today. Global sugar consumption hasn’t grown on a per capita basis for a decade. Growth in parts of Africa and Asia is being offset by a retraction in parts of Europe and the Americas.

We think this is in part due to increased consumer awareness of sugar intake, in many cases thanks to increased government regulation on the food industry (soda taxes, front of package labels). Increased use of other sweeteners and consumer satiation also probably play a role.

A decade ago, we used to think that sugar consumption globally would grow at 2% a year, 1% in line with population growth and 1% because of increased wealth. But now sugar consumption is barely keeping up with population growth.

COVID has only played a small role in this trend. The virus’ arrival hit the out-of-home dining sector hard in 2020, leading to reduced per capita sugar consumption in some regions. But we’ve since learned how to live with COVID better, and aggressive lockdowns seen in 2020 are unlikely to be repeated, even despite the emergence of the Omicron variant. This means we think sugar consumption will recover into 2022, but only back to where we were in the middle of the 2010s.

Based on this outlook, it’s hard to justify why sugar prices should keep rising. If global sugar consumption remains at 20kg per person per year and the global population peaks near 10b people, sugar consumption would peak at 200m tonnes a year. Sugar production in 2017/18 was 188m tonnes, and so almost sufficient to feed the world.

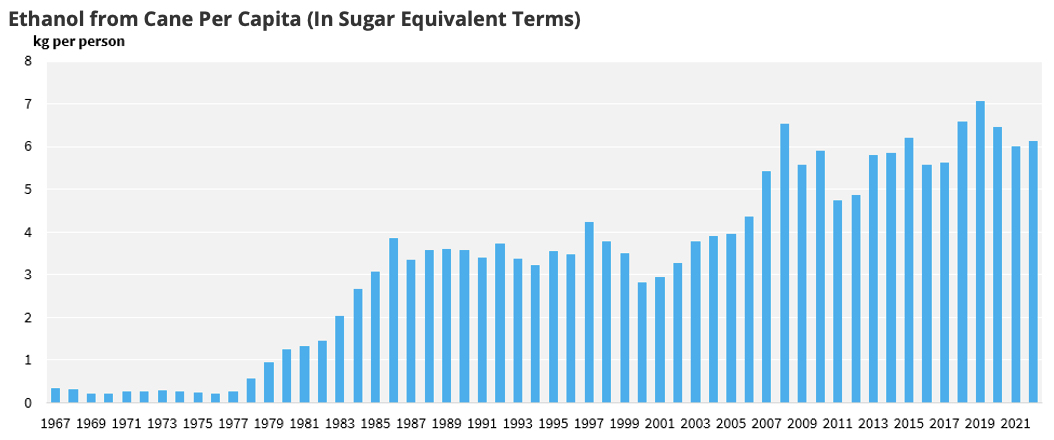

Instead, the outlook for sugar consumption depends on cane and beet being seen as energy crops. Ethanol from sucrose could transform the sugar market in the next decade. Of course, this is nothing new. Brazil has been using ethanol as a road fuel for more than 40 years. We could just as easily have said that ethanol would transform the sugar market in the late 2000s, but recent developments have given us renewed confidence.

Look to India, which has committed to blending 20% ethanol in gasoline by 2025. At current trends, this will add a further 6m tonnes sucrose consumption in the country, and this could continue to increase even if the blend doesn’t rise as vehicle ownership becomes more widespread. India will no longer be the world’s lowest cost sugar supplier. We have previously pointed out the parallels with the reform of the EU’s sugar sector, which led to the bull market of 2020 and 2021. India’s reform will lead to higher sugar prices in the coming years.

It’s possible that some of the new vehicles in India could be electric vehicles. However, this would run counter to India’s commitments made at COP26 in Glasgow. 70% of India’s electricity is generated from coal. In effect, electric vehicles in India would be fuelled by fossil fuels. India has committed that 50% of its energy use will be from renewable sources by 2030. Given this, ethanol is a better fuel for vehicles than coal-generated electricity.

COP26 was also the first to explicitly target fossil fuels, with a statement being released aiming to phase down coal use and phase out unsustainable fossil fuel subsidies. 140 countries accounting for more than 90% of global GDP committed to becoming net zero carbon. China committed to peak CO2 emissions by 2030 and to be carbon neutral by 2060.

Thailand committed to net zero by 2065. Both countries already have well-developed ethanol blending. It’s not too much of a stretch to imagine that ethanol use might be further increased while countries transition to greener electricity supply.

The problem here is that there’s been very little investment in cane or beet growing/processing in the past decade. Prices have been in a 10-year downtrend; there’s been no incentive to invest! This means that if we look at sugar production on a per capita basis, we’re currently at the bottom of a century-long uptrend. If we need sucrose for energy as well as sugar, the world simply isn’t growing enough cane or beet. We therefore need higher prices to be sustained to drive investment in the sector.

If you have any questions, please get in touch with us at Jack@czapp.com

Other Insights That May Be of Interest…

Indian Ethanol: Triggering a Sugar Bull Market?

World Sugar Market Five-Year Forecast