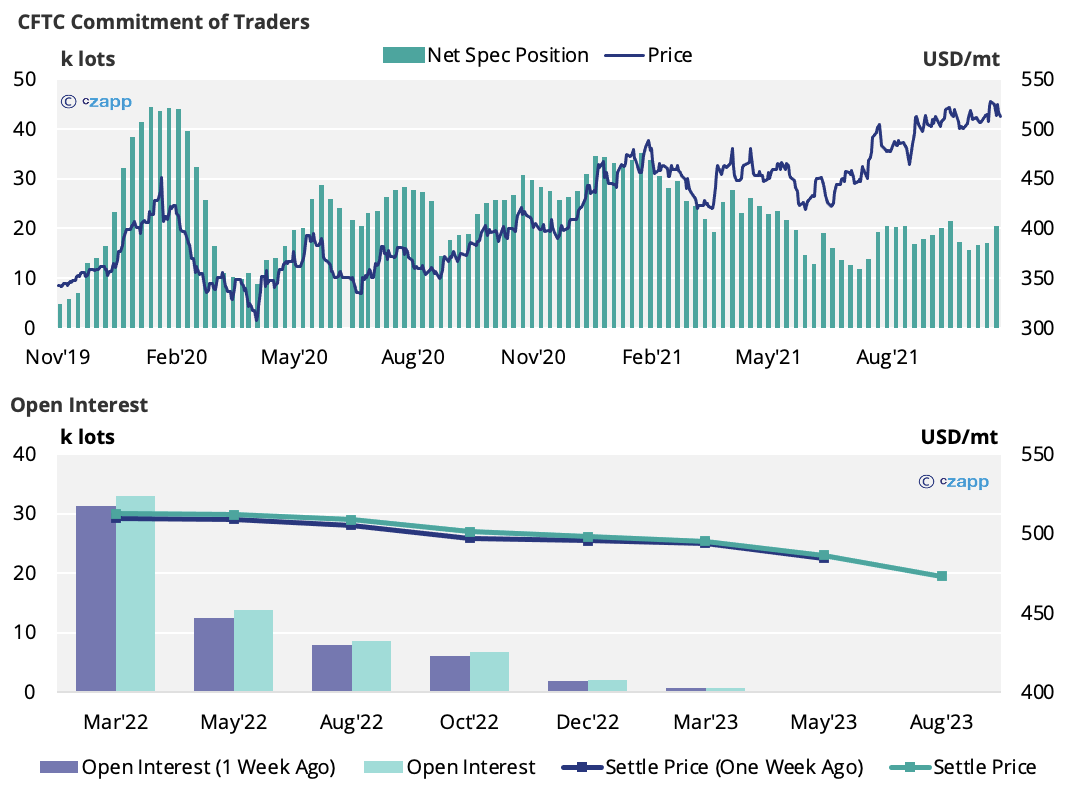

- New COVID concerns have hit the market, causing a sharp drop in the No.11 and No.5 prices.

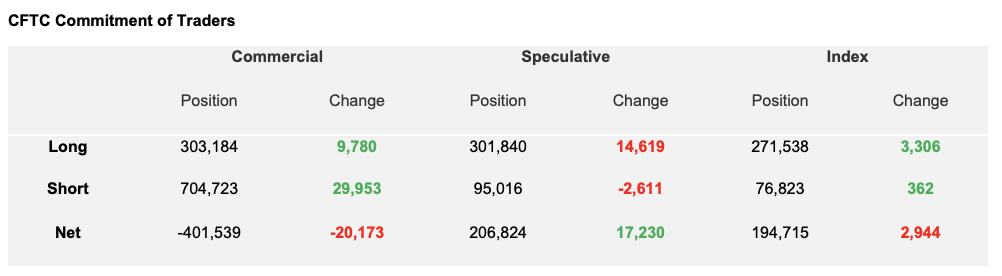

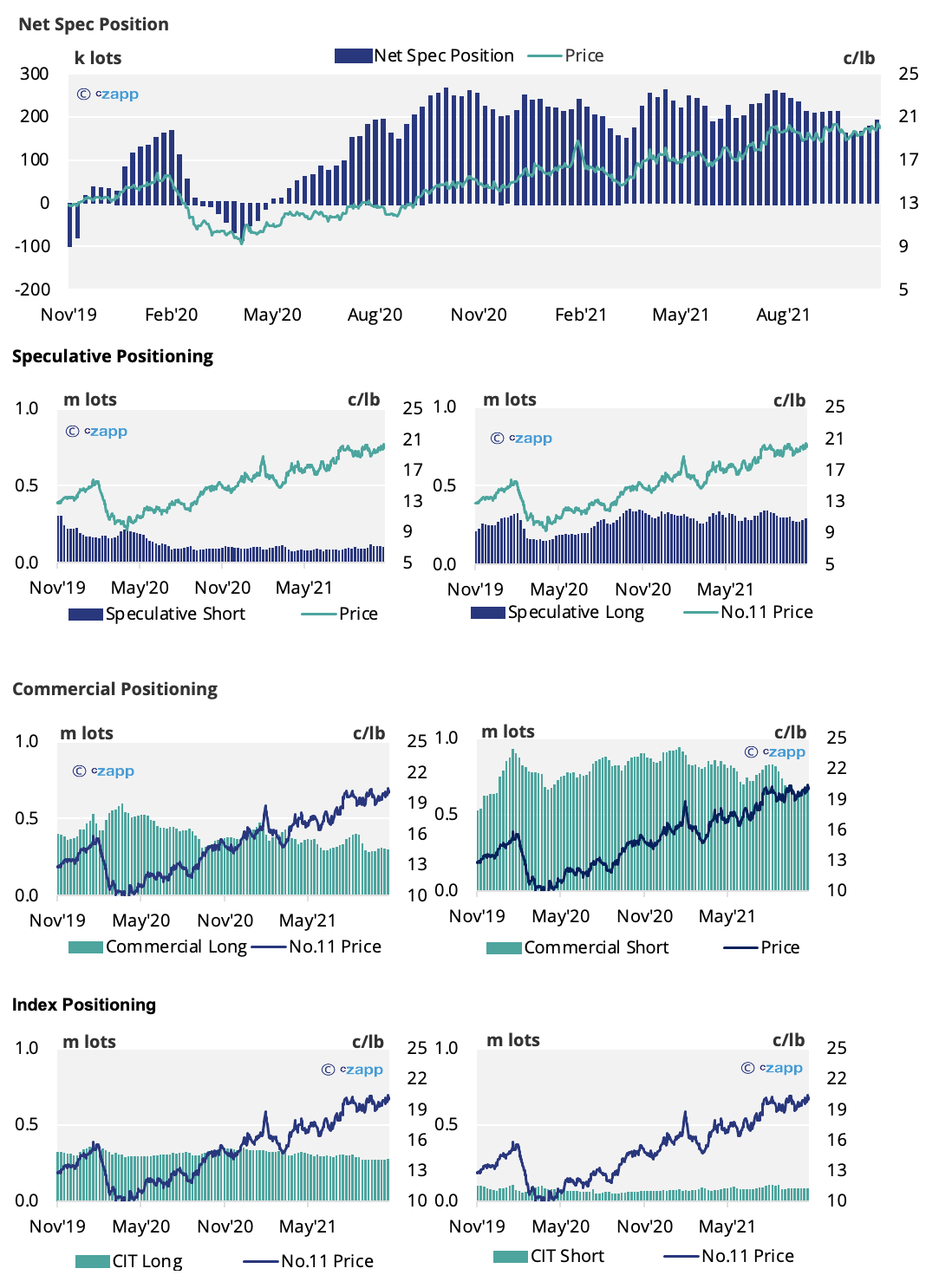

- This was likely caused by the specs exiting long positions.

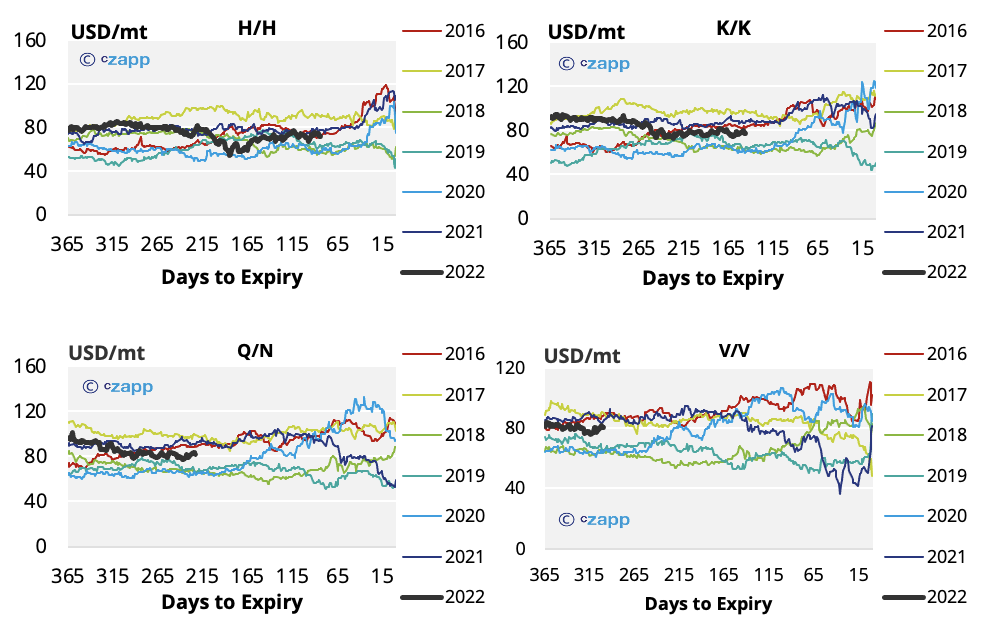

- The white premium is showing some strength, though, with the K/K, Q/N and V/V all above 80 USD/mt.

New York No.11 (Raw Sugar)

- The No.11 price has followed other commodities and weakened over the past few trading days, with concerns surrounding the Omicron variant.

- The front month price is now only slightly above 19 c/lb.

- This is likely because the specs closed positions, which with a large net spec long means disproportionate selling.

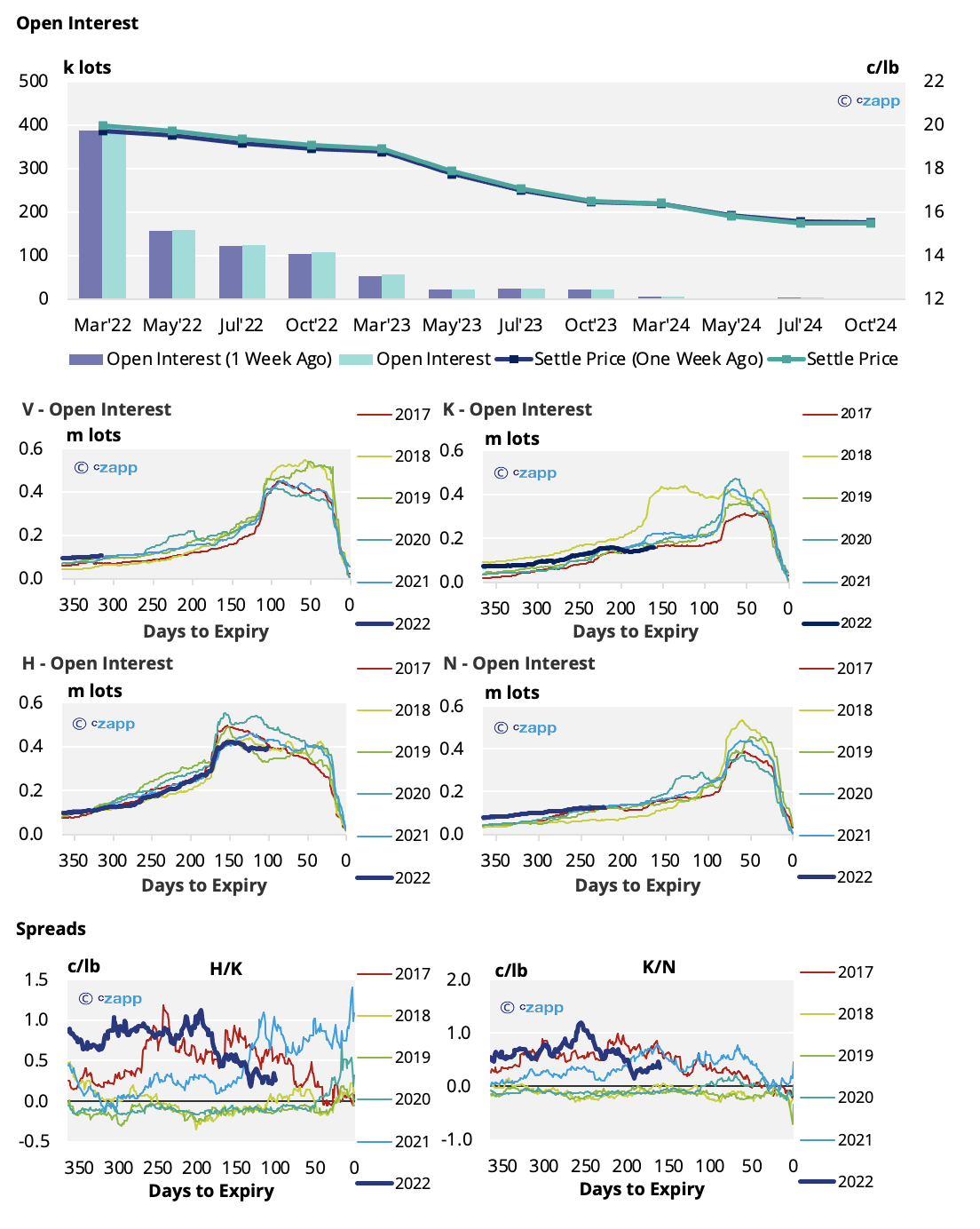

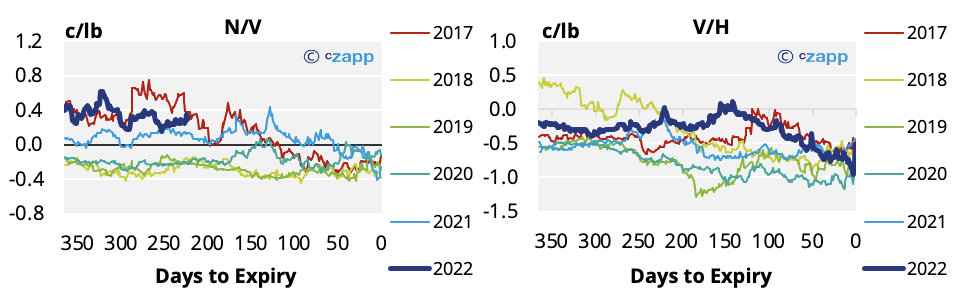

- This drop in price didn’t have a great effect on the spread structure, so the N, K, and V contracts are below 18c.

- This should be increasingly attractive for raw sugar consumers.

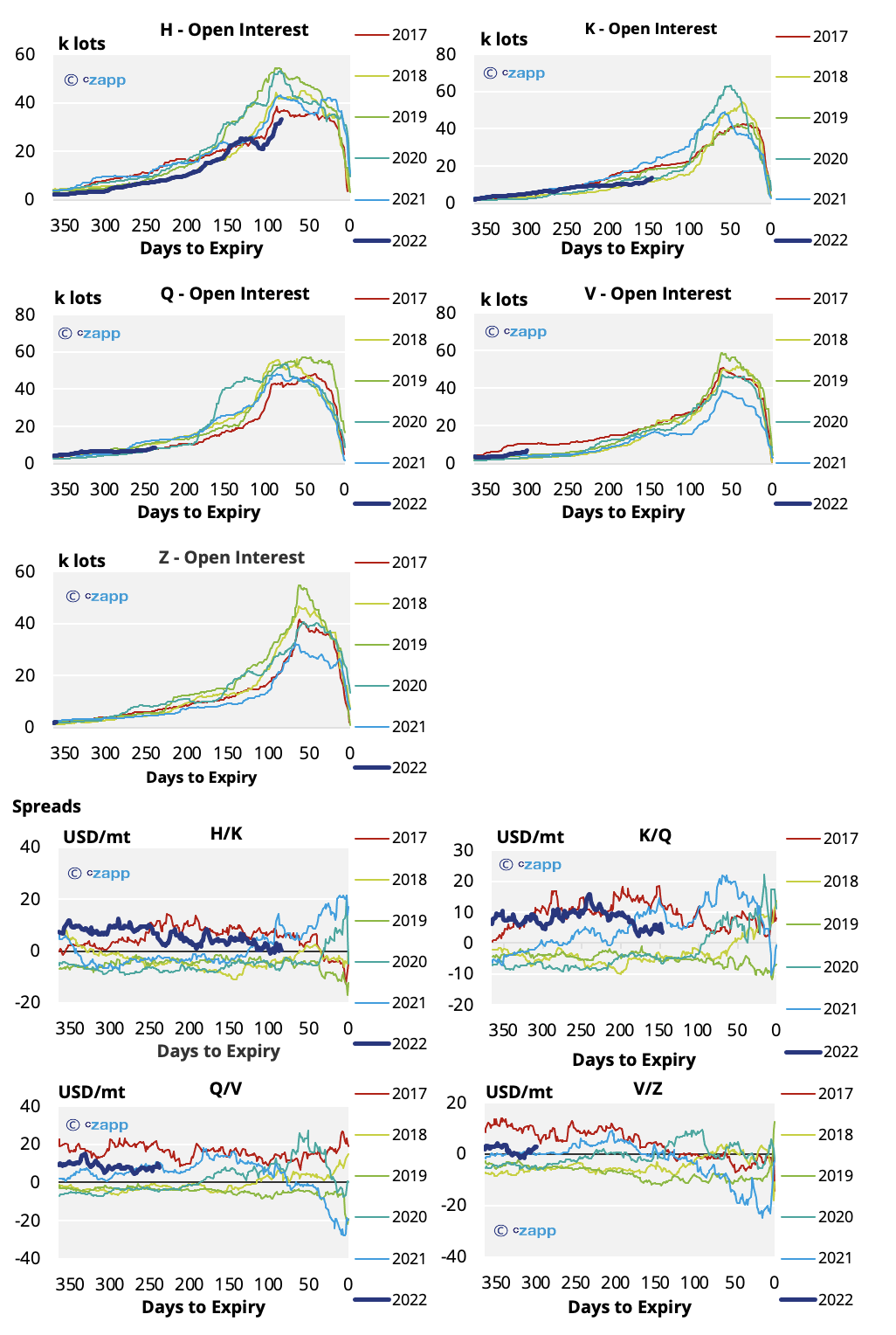

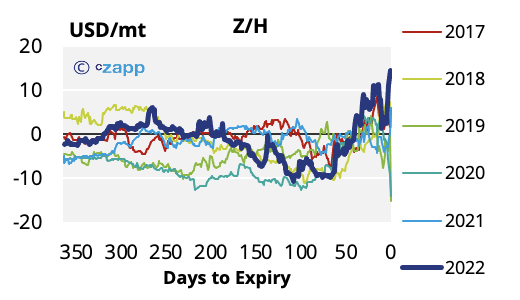

No.5 London (White Sugar)

- The No.5 market followed the same trend as the No.11 and has weakened across the board.The H’22 open interest is below historic levels, which could be a concerning sign for physical demand.

White Premium (Arbitrage)

- The 2022 white premiums have strengthened in the past week.

- However, the level remains lower than the margin needed by the refineries, especially considering how high freight rates have impacted refiner costs.Recent weakening in bulk shipping costs have reduced the margin required, though.

Other Insights That May Be of Interest…

World Sugar Market Five-Year Forecast