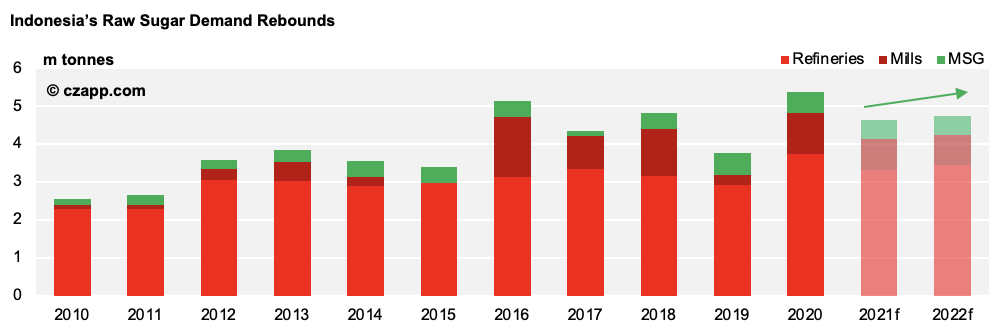

- Indonesia should import 4.9m tonnes of raw sugar in 2022.

- If it does, it’ll be the world’s largest raw sugar buyer for the second year running.

- It’ll also be the first time its raw sugar demand has increased since COVID hit.

Indonesia: The World’s Largest Raw Sugar Importer in 2022?

- We think Indonesia will import 4.9m tonnes of raw sugar next year, making it the world’s largest raws buyer for the second year running.

- With this, its raw sugar demand will rebound slightly from a COVID-induced drop.

Why is the Refineries’ Demand Strengthening?

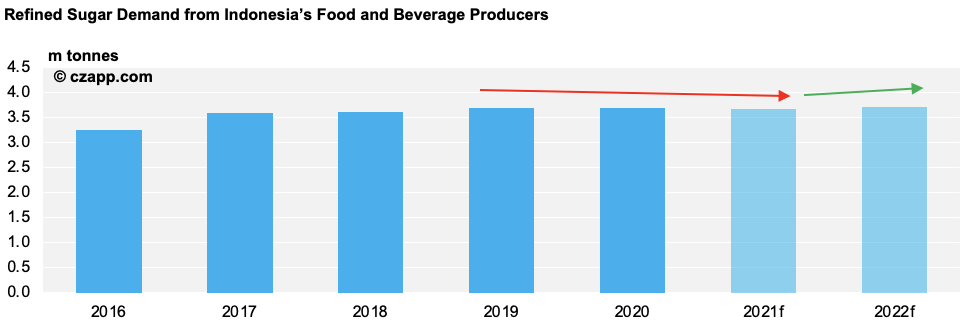

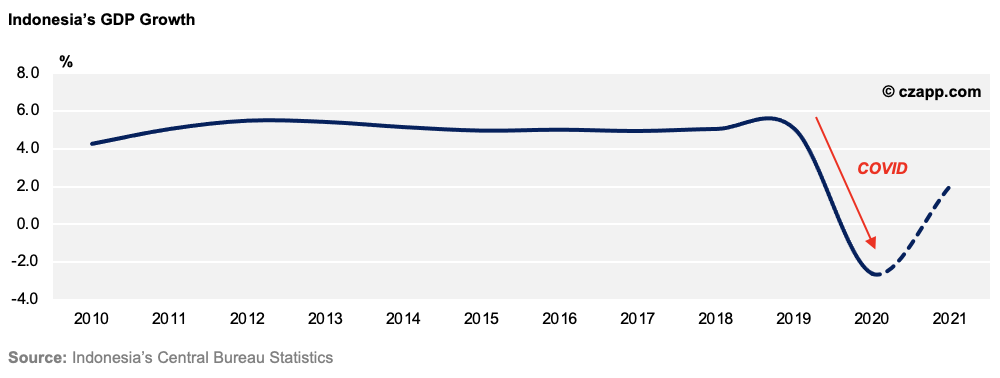

- COVID restrictions hit out-of-home sugar consumption in Indonesia, meaning demand from the country’s food and beverage producers dropped.

- Things are now picking up slightly, as restrictions slowly ease, meaning demand should show slight growth in 2022.

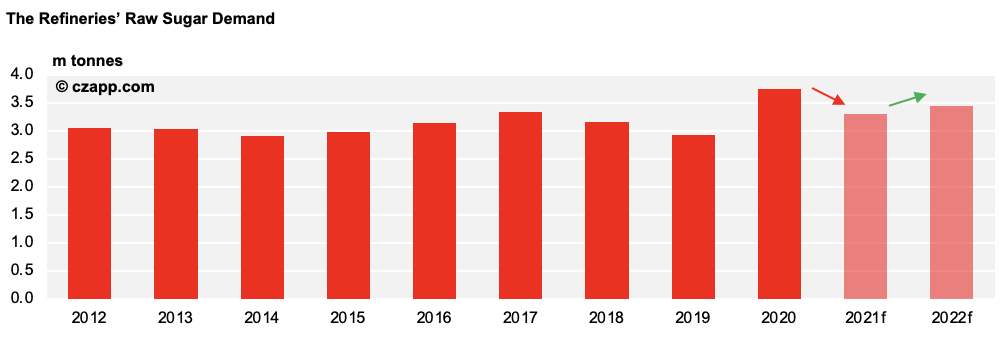

- The refineries should receive 3.5m tonnes of raws import permits this year and the next.

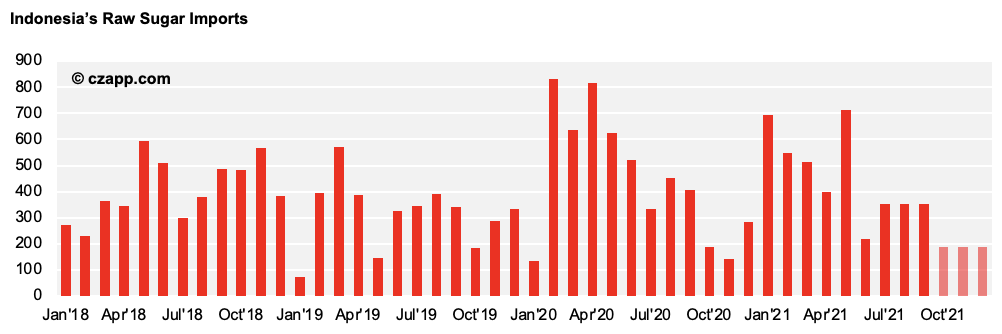

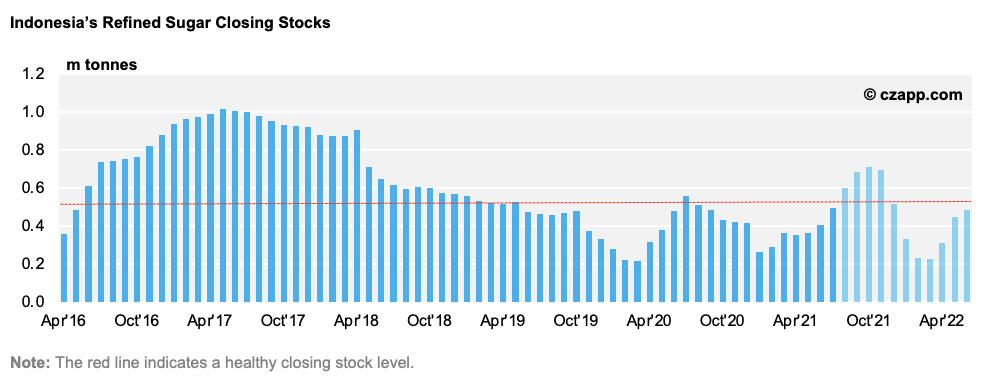

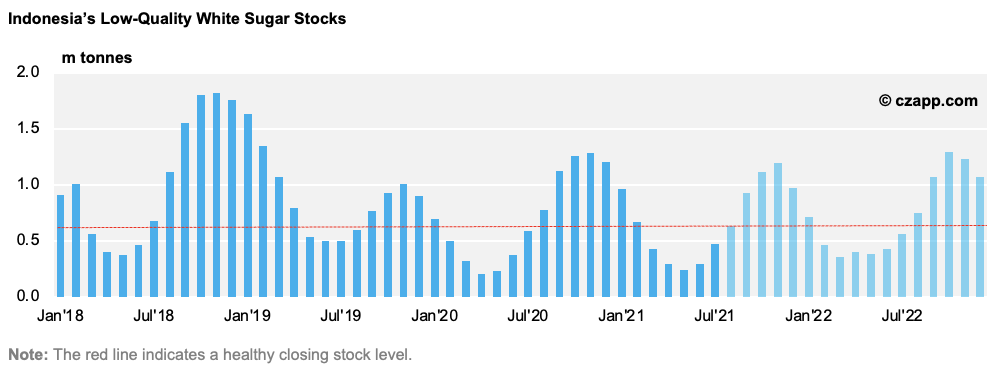

- However, it’s unlikely we’ll see the Government release these permits early in December, as was the case last year, as stocks are higher.

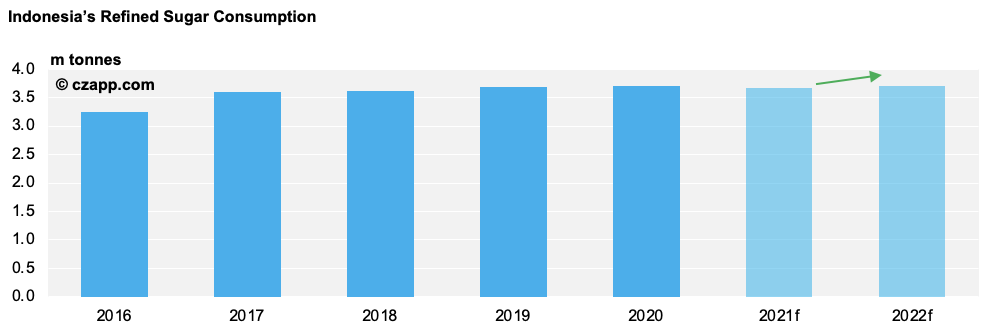

- To add to this, Indonesia’s refined sugar consumption isn’t set to grow by very much in 2022.

- It should consume 3.67m tonnes of refined sugar this year, down 40k tonnes from our 2022 estimate.

- This is because COVID’s impact on the economy has been significant, meaning the rebound in household food and beverage consumption could be slower.

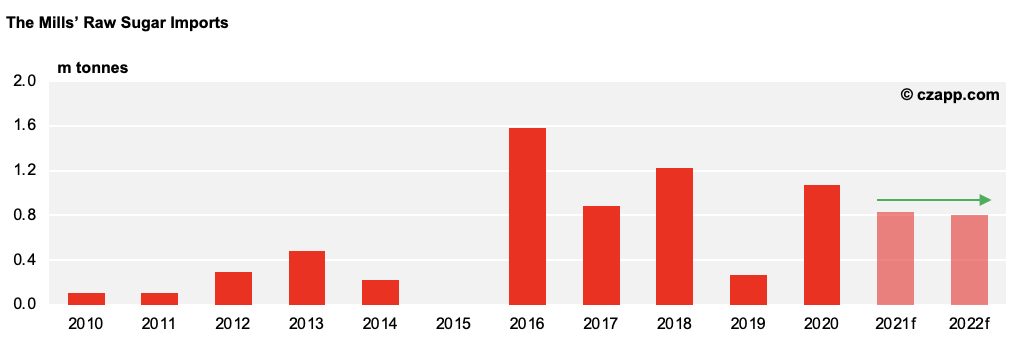

The Mills Continue to Import Raw Sugar

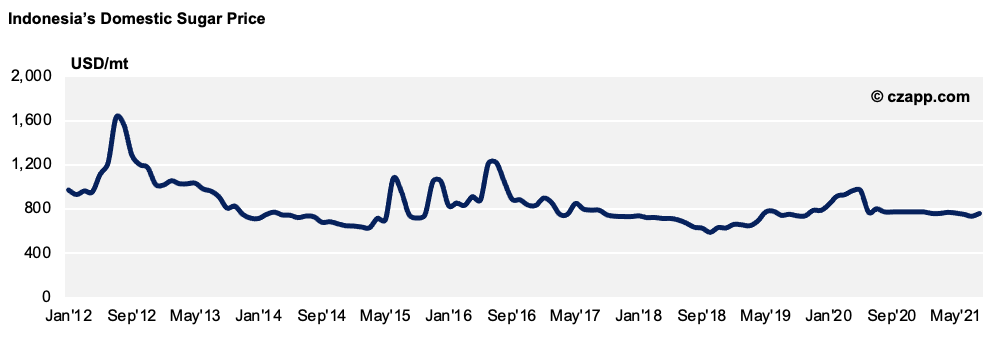

- The mills’ raws demand should be unchanged as the Government must ensure the domestic sugar price remains supported.

- We therefore think they’ll import between 700 and 800k tonnes of raw sugar in 2022, as they did this year.

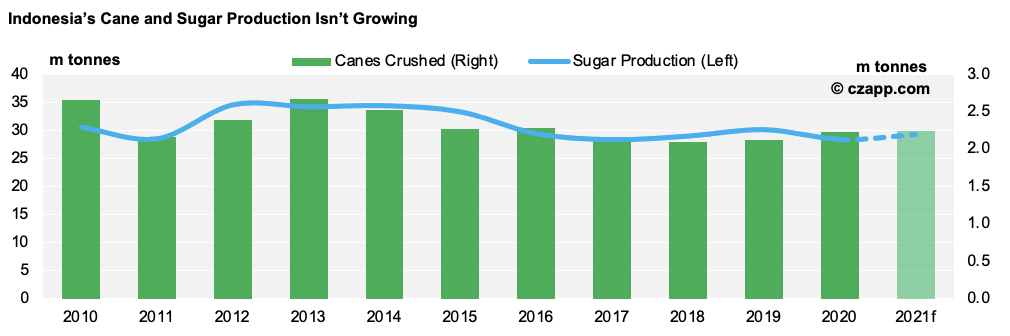

- They’ll only produce around 2.2m tonnes of sugar from the harvested cane, whilst demand is at 3.6m tonnes.

- So, these imports should also enable them to keep their low-quality white sugar stocks at a healthy level.

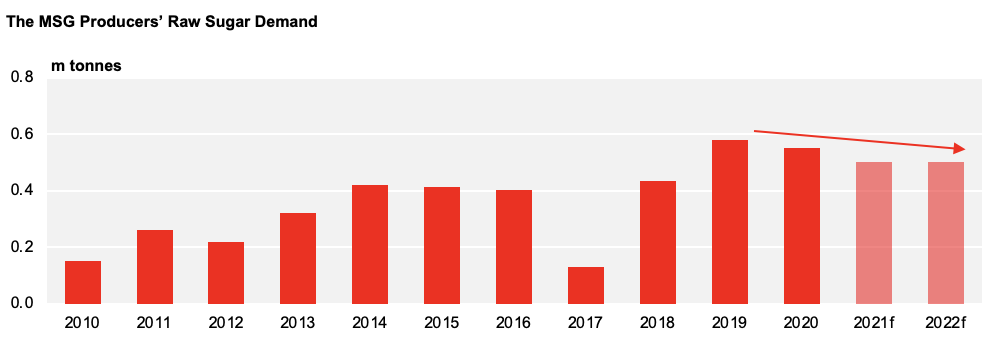

- Moving on, the Monosodium Glutamate (MSG) sector could import 500k tonnes of raw sugar.

- Due to a stagnant growth in sales, the MSG producers’ raws demand has seen a small decline since 2019.

Where Will Indonesia’s Sugar Come From?

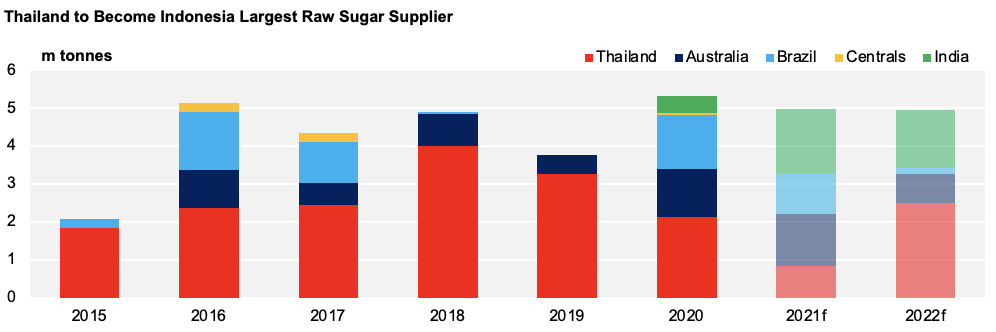

- Thailand should be the world’s largest raw sugar supplier next year, with its cane crop set to rebound.

- · It should also be Indonesia’s primary raw sugar supplier, exporting 2.5m tonnes there in total.

- · If it does, it’ll occupy 50% of Indonesia’s raws imports versus 17% this year.

- The next largest suppliers, on a global basis, will be India (3mmt) and Australia (3.4mt).

- 1.5m tonnes of India’s raw sugar will go to Indonesia, and 776k tonnes Australian raws will go there.

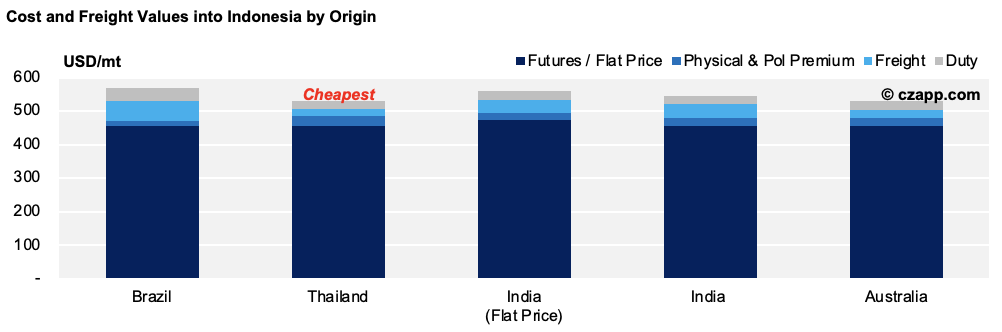

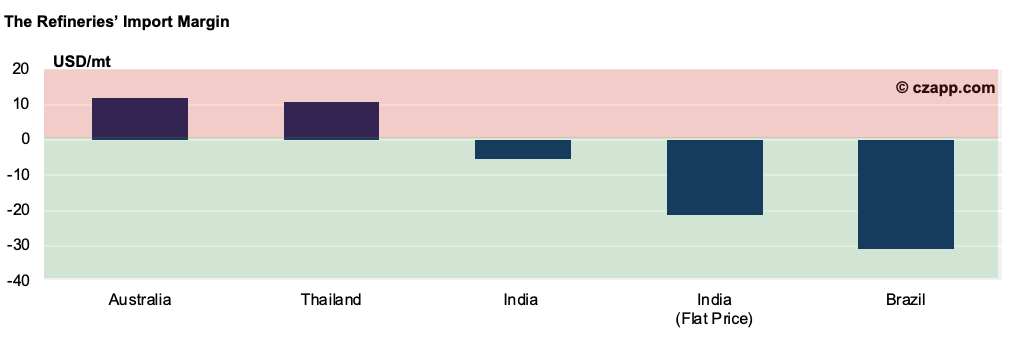

- In spite of all this, the increasing No.11 and higher freight rates mean the domestic price hasn’t been rising in tandem and the refineries’ import margins have taken a hit.

Other Opinions You Might Be Interested In…

- Costly Freight Weakens Refiners’ Profitability

- Asian Sugar Consumption Hit by COVID and Slow Population Growth

- Thai Sugar Production to Improve in 2021/22

Explainers You Might Be Interested In…