Main Points

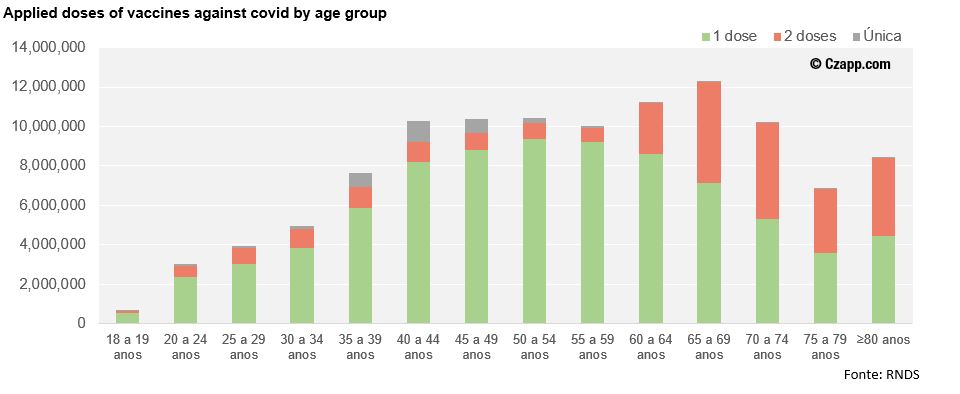

- The vaccination campaign advances, 40% of the Brazilian population has already taken the first dose.

- The economy picks up again and industrial production grows 1.4% in May, returning to the pre-pandemic level.

- July IGP-M retracted to 35.7%, but still with a high impact on costs.

Vaccination rhythm rebounds

- Last month, Brazil’s vaccination pace had slowed, but gained steam over the past few weeks with the daily distribution of vaccines approaching the 1.4 million doses per day mark.

- The country has vaccinated 40% of the population so far – 85 million people with at least the first dose.

- Despite recent news highlighting the halt in the application of vaccines in some cities, the outlook remains positive.

- For July, we expect the delivery of around 42 million doses.

- Some positive signs are already beginning to show, ICU occupancy rates have declined in most states throughout June, and vaccination rates are gradually advancing across the country.

- With the vaccination campaign underway, the economy is heating up again – GDP growth perspective of 5.3% for this year.

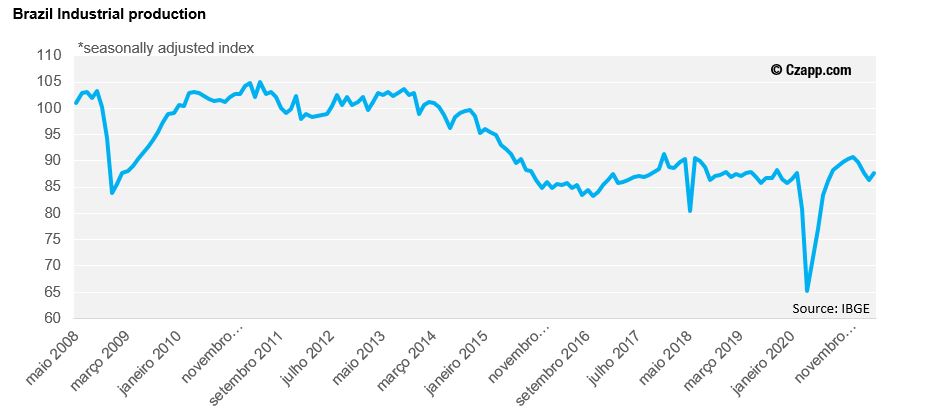

Resumption of industrial production

- After three consecutive months of falling production, industrial production grew 1.4% in May, the same level as pre-pandemic.

- Reflection of accelerated domestic and external demand.

- With this, it is likely that industrial production will continue to grow.

- Thus, greater electricity consumption is also expected to accompany production.

- This adds even more upward pressure on energy prices.

Even higher energy tariff

- The water crisis leads to the use of more expensive sources for electricity generation.

- National Electric Energy Agency (ANEEL) announced an increase in the electricity tariff flags for the month of July.

- This increase raised the red tariff flag 2 from 6.24BRL/100kWh to 9.49BRL.

- An 11.38% readjustment in the electricity tariff charged in the state of São Paulo was also approved by ANEEL.

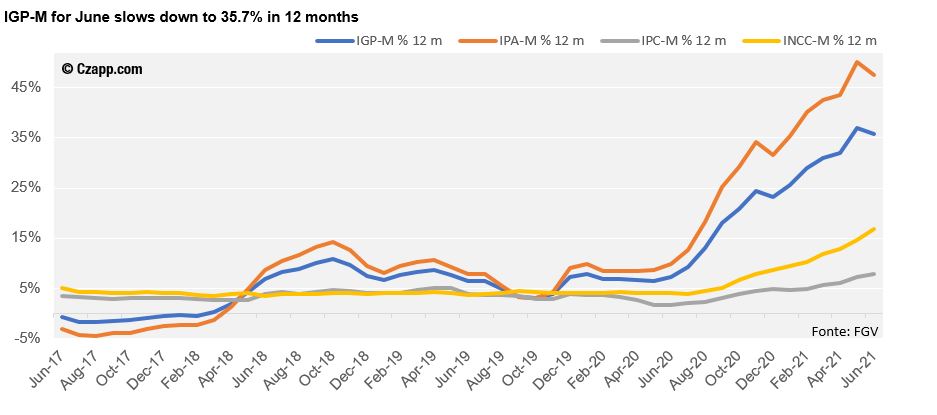

About June inflation…

- Inflation took a truce in June, the result of the IGPM was 0.6% – below expectations.

- The fall of the dollar against the real along with the retreat in the commodity dollar eased wholesale inflation.

- In the 12-month accumulated, the IGMP in July decelerated to 35.7% against 37% in May.

*IGPM is a monthly price indicator used to measure inflation.

- The reduction in wholesale inflation will decelerate the IGP-M in June, but we will still have impacts on production costs.

- For the final consumer, economists’ perspective is that the Broad National Consumer Price Index (IPCA) should end at 6.1% in 2021 – above the target ceiling of 5.25%.