Opinion Focus

- Russia has attempted to import 350k tonnes of duty-free refined sugar.

- Sourcing the right quality sugar at the right price has been difficult.

- The government will therefore set up a state stockpile.

Why Buffer Stocks?

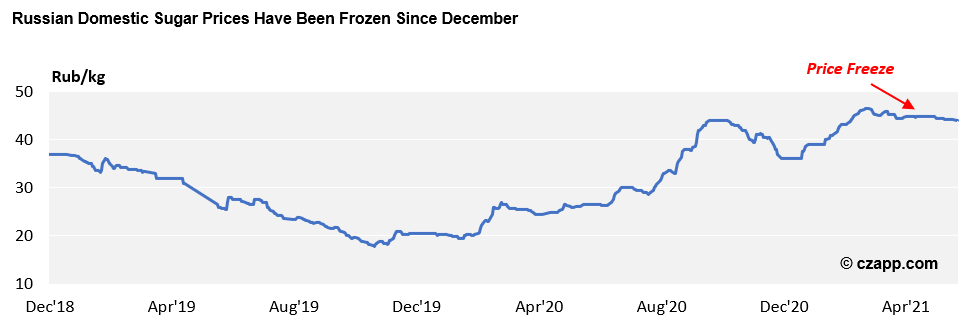

- The Russian domestic price rallied by 70% in the year up to April 2021.

- To control food price inflation, the government and the major sugar producers agreed in December to freeze sugar prices at RUB 36/kg (USD 496/mt) wholesale and RUB 46/kg (USD 634/mt) retail.

- In addition, the government is attempting to import 350k tonnes refined sugar duty-free between 15th May and 30th September.

- White sugar import duty is normally $340/mt.

- These imports are being handled by the United Grain Company, OZK, of which the government is the majority shareholder.

- However, sourcing this sugar has not been straightforward; Russia’s First Deputy Prime Minister recently complained that, “We bought sugar with great difficulty…. everything is sold out”.

- The government has therefore decided to set up a sugar intervention fund and a state stockpile for up to 500k tonnes sugar.

- This system has been used in the Russian grains market since 2001 and is also similar in operation to is the Chinese government stocks.

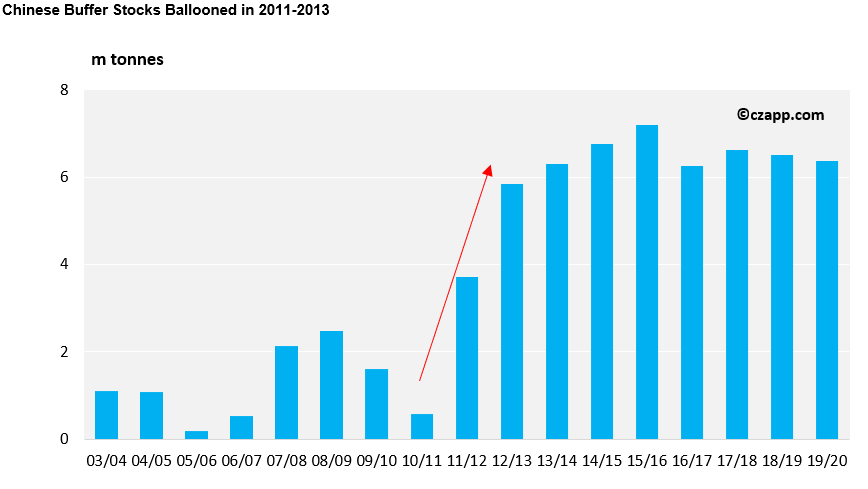

- China started to build government sugar buffer stocks to ensure adequate sugar supply more than 20 years ago.

- However, these also became a way of ensuring domestic sugar prices didn’t fall too low during 2011 to 2013, which could have damaged local sugar producers.

- The stockpile therefore built to 7m tonnes by 2016.

- It remains above 6m tonnes today.

How Will the Buffer Work?

- The aim is to dampen price volatility.

- When Russia didn’t produce enough sugar to cover its needs this used to be achieved by having a variable import duty-rate, but now Russia is close to being self-sufficient in sugar the government needs new measures.

- When prices fall below the minimum set level OZK will buy sugar, and when prices rise above the maximum level, the sugar will be

sold. - The trick will be to ensure that domestic prices remain at levels which are suitable for local sugar producers and consumers.

- It will also be interesting to see if the Russian government can avoid building massive stocks in the event of a prolonged period of low sugar prices, as happened in China.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…

- Czapp Explains: The Vietnamese Sugar Industry

- Czapp Explains: Thailand’s Raw Sugar Industry

- Czapp Explains: Thailand’s White Sugar Industry