- India is the world’s largest mango producer, accounting for around 50% of global pulp production each year (400k tonnes).

- However, this year’s drought and COVID-induced labour shortages could mean its supply is reduced.

- India’s Alphonso season is underway and the Totapuri season will begin the second week of June.

Indian Alphonso Mango Production

- India is home to the Alphonso and Totapuri varieties (among others).

- This year, several Alphonso regions have been hit by drought, meaning flowering could take between six and eight months.

- Flowering has reportedly been staggered, which suggests there’s some inconsistency amongst the fruits’ maturity.

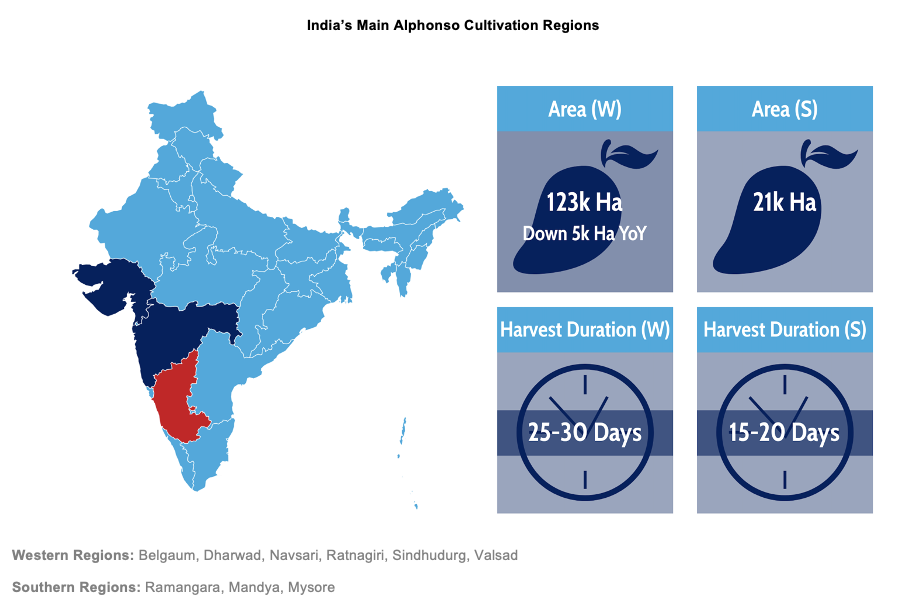

- As you can see above, India’s Alphonso production takes place in the Western and Southern part of the country.

- We think yields will be poorest in Bangalore, Ramanagar and Mysore (the South), where farmers fear losses of up to 20%.

- With this, just 40% of the crop could be available for processing into Alphonso Puree.

- This could cause problems as demand is strong now COVID has increased consumers’ desire to adopt healthier diets, and because the product is irreplaceable in most of its recipes.

- New crop offers for Alphonso should be announced by mid-May and producers will mostly be offering on an FOB basis, with higher CFR levels, given the expensive ocean freight out of India, which won’t likely improve anytime soon.

- We also think the weakening Indian Rupee and more expensive packaging costs (up 40% YoY) will mean mango prices are higher in 2021.

Totapuri Production

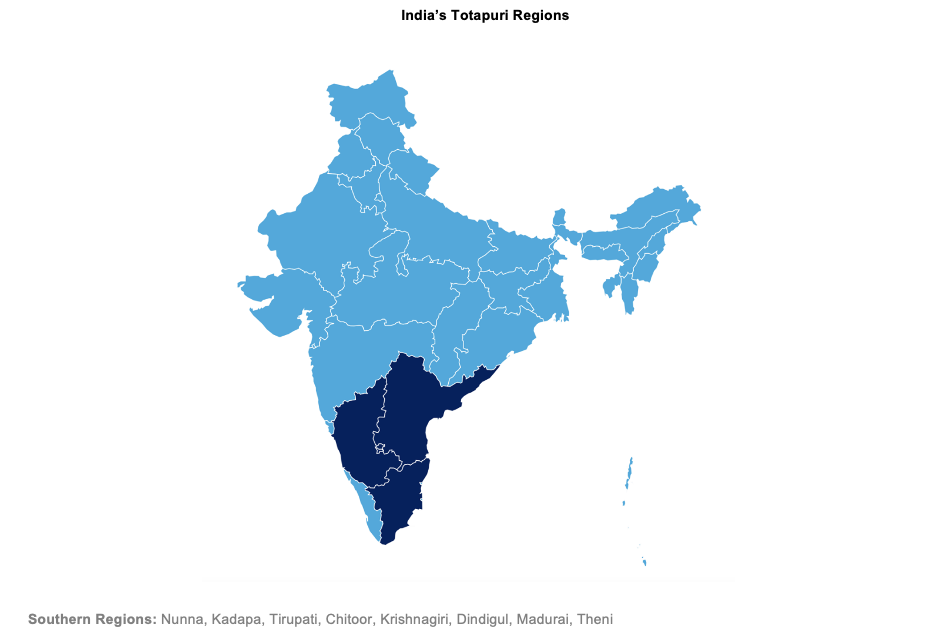

- India’s Totapuri harvest is due to commence in Andhra Pradesh, but Tamil Nadu and Karnataka won’t kick things off until the first week of June.

- With this, offers will be available around the second week of June.

- However, the situation is poor for Totapuri as Andhra Pradesh, Tamil Nadu and Karnataka have also endured temperatures as high as 44°C; these areas represent 90% of Totapuri variety production.

- Again, these conditions have hit flowering and fruit setting, and some farmers worry they may lose up to 60% of their crop.

- Anticipation surrounding unseasonal rains between the end of the May and the first week of June only adds to this risk.

- All in all, we think Totapuri production will be down 10% year-on-year.

Who Can Fill This Void?

- Mexico is the world’s second-largest producer and is home to the Tommy Atkins, Atulfo and Kent varieties.

- Its Tommy Atkins harvest commenced in February (in the South at the state of Chiapas) and will move north to Jalisco and Nayarit in May.

- Sinaloa will soon follow, with its harvest set to conclude at the end of August.

- All being well, Mexico will have around 150-200k tonnes of processed fruit available to export as individually quick frozen, dried fruit and puree.

- Colombia is the third-largest mango producer, but it won’t be able to make up for India’s shortfall as its varieties are not suitable.

- Three varieties are grown here: the Magdalena River variety, along with Tolima and Cundinamarca.

- Heavy rains could impact the production of the latter two, but we don’t yet know how severe this will be.

- Elsewhere, in Colombia’s coastal regions, harvesting got underway in April and the inland regions are set to kick things off later this month.

- Unlike with India, Colombia could produce more than it did last season, and we currently think it’ll have 120k tonnes available for processing.

- Increased ocean freight rates are a challenge here as well, however.

If you’re interested in buying Mango Pulp and Concentrate, please email TAguilar@czarnikow.com.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…