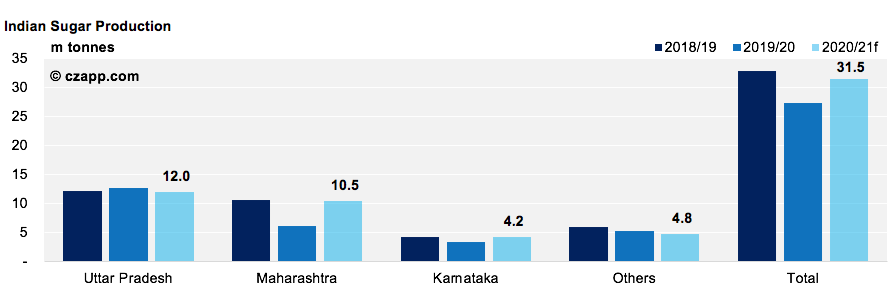

- India has produced 25.5m tonnes of sugar so far this season, up 4.3m tonnes year-on-year, but down 1.2m tonnes from the record 2018/19 season.

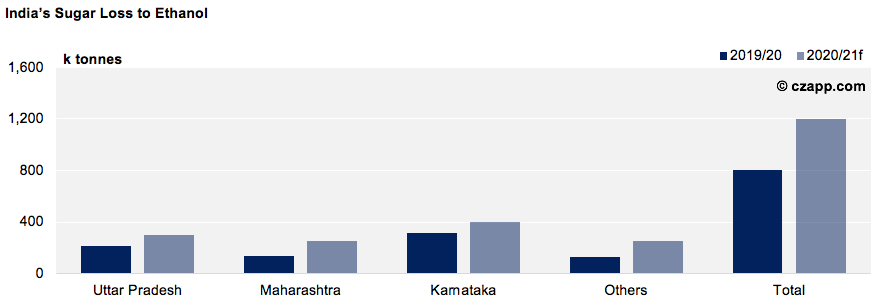

- This comes as India’s main sugar producing states have all started to increase diversion of cane to make ethanol.

- We think India will produce 31.5m tonnes of sugar this season; assuming 6m tonnes exports closing stocks will be unchanged in 2021/22.

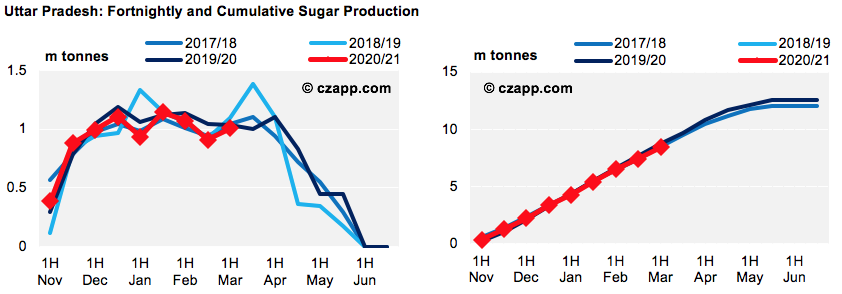

Uttar Pradesh: Sugar Production Down as Ethanol Diversion Increases

- Uttar Pradesh has produced 8.4m tonnes of sugar so far this season, down 300k tonnes year on year (YoY).

- This is because it is diverting more cane towards ethanol production.

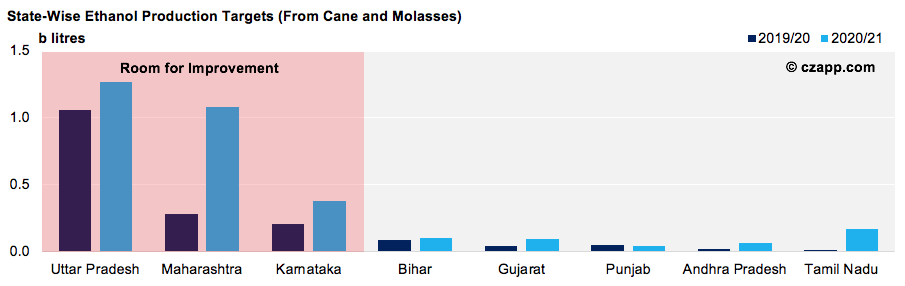

- We think it may produce 1.3b litres of ethanol this year, up 300m litres YoY.

- All in all, we think Uttar Pradesh will production 12m tonnes of sugar this season, down 650k tonnes from last season’s record.

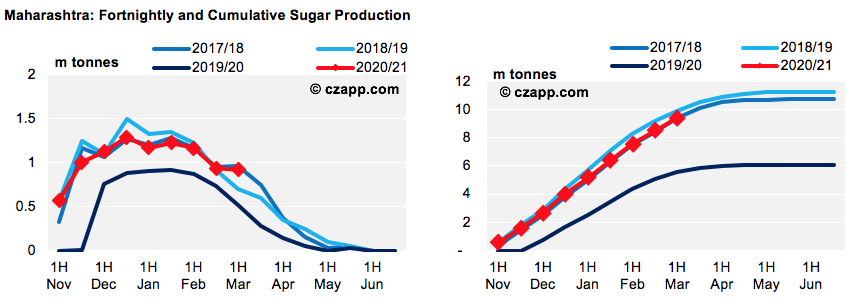

Maharashtra: Sugar Production Up, But Larger Ethanol Diversion Ahead

- Maharashtra has produced 9.4m tonnes of sugar so far this season, up 3.8m tonnes YoY.

- This is because, this season, we’ve seen its cane acreage, agricultural and sucrose yields increase following a timely monsoon.

- Also, 140 of its 188 mills are still crushing whereas, last year, just 90 of its 146 mills remained active.

- We think Maharashtra will produce 10.5m tonnes in total, up 4.3m tonnes YoY, yet still 250k tonnes shy of the 2018/19 record.

- It seems unlikely that Maharashtra will top the 2018/19 record this season, as it strives to hit its 1.1b litre ethanol production target, having produced just 279m litres last season.

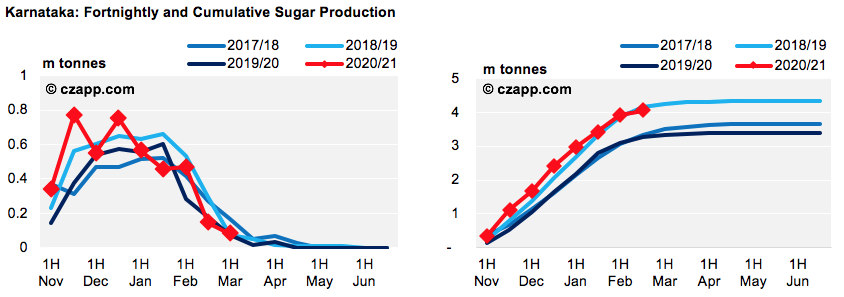

Karnataka: Final Four Mills Left

- Karnataka has produced 4.1m tonnes of sugar so far this season, down 800k tonnes YoY.

- With just four (of 66) mills still operational, we think Karnataka will produce 4.2m tonnes of sugar in total, up 800k tonnes year-on-year, and just 100k tonnes off the 2018/19 record.

- Karnataka has also increased cane acreage, agricultural and sucrose yields following last year’s well-timed monsoon.

- However, its ethanol production must jump this year, from 206 to 379m litres, if it’s to hit its target set by the Government.

- This means it too will need to divert more cane and molasses towards ethanol, falling 100k tonnes short of the 4.3m tonne record set in 2018/19.

A Recap of Our Indian Sugar Production Estimates for 2020/21

Monitor India’s Production Pace Using This Interactive Data Tool.

Here’s Another Opinion You Might Be Interested In…