Indian raw and white sugar exports are viable at current market levels.

Note: You can monitor India’s sugar export parity in the Interactive Data Section.

In spite of this, it’s struggling to export white sugar at the minute, as the ongoing container shortage continues to strain logistics.

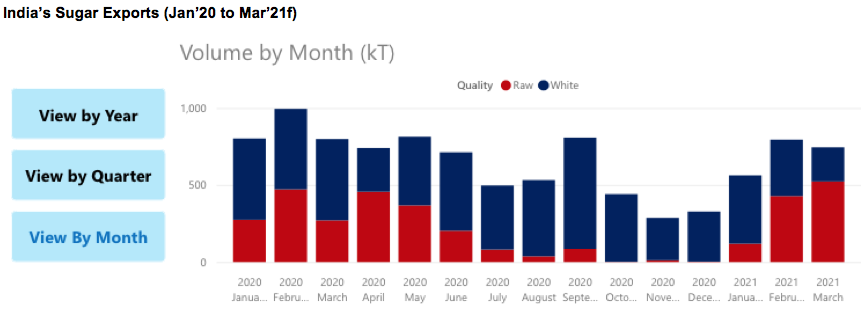

Having said that, it was able to export 671k tonnes of sugar in February, up 183k tonnes month-on-month.

429k tonnes of this was raw sugar, up 311k tonnes month-on-month.

Note: You can monitor India’s monthly sugar export pace in the Interactive Data Section.

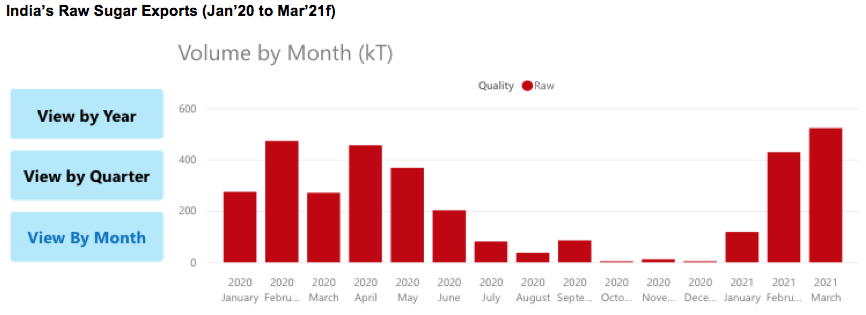

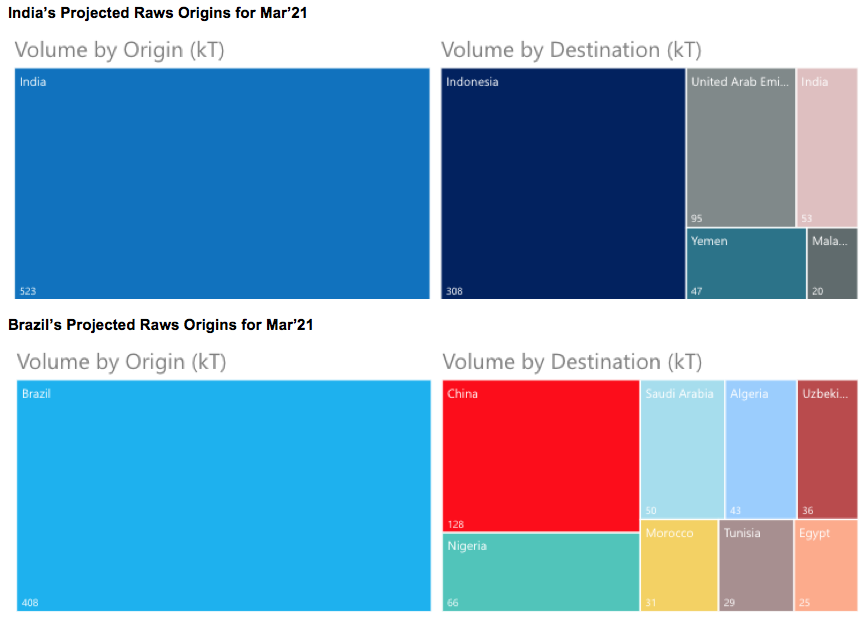

This flow should hold strong in March as well, with its raws flow alone set total 522k tonnes at present. This is because the strong bulk freight market means Indian raws are more competitive into the likes of Indonesia right now, displacing Brazilian supply.

Note: You can monitor past and future sugar export origins for all exporters in the Interactive Data Section.

India’s white sugar flow will likely remain hindered by the lack of containers, however, with 222k tonnes currently in the line-up. In spite of this, these exports remain viable, thanks to this year’s poor supply from Thailand and the EU, following poor crops.

Note: You can stay in the loop on all our sugar production estimates in the Interactive Data Section.

We therefore think India will look to export more white sugar in bulk vessels in the coming months, as they are easier to get hold of at present.

All in all, India’s exported 2.3m tonnes of raw and white sugar so far this season. If this current pace continues, we think it will export around 5.5m tonnes of sugar this season. This would mean it fails to fulfil its 6m tonne sugar export quota for 2020/21.

Other Opinions You Might Be Interested In…

- India’s Sugar Exports Improve as Raws Shipments Spike

- Market View: A Period Of Calm; What Next for Sugar Prices?

Other Interactive Data You Might Be Interested In…