- It’s time to look at somewhat surprising volatility in the plastics (resin) supply chain.

- We explore how supply side volatility is caused by direct changes in the petrochemical process, as well as other important factors related to geopolitical events, currency fluctuations, transportation costs, and more.

- To round off the discussion, we look at some key risk management strategies that can be used to handle resin volatility.

Price Volatility Across the Plastics Industry

We previously explained that the production of plastics, notably resins and films, are a product of the oil, natural gas and petrochemical industry.

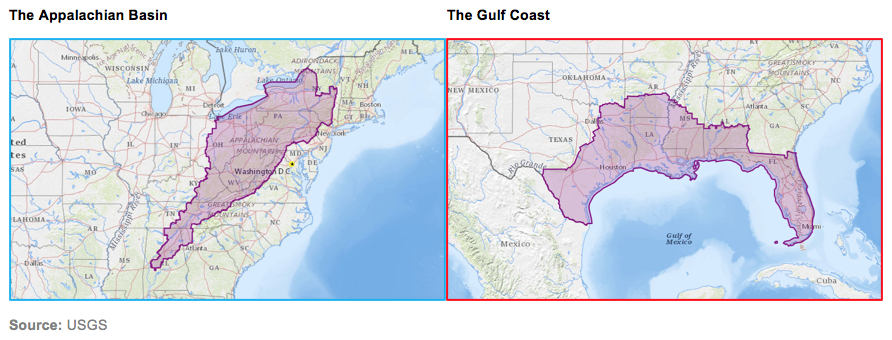

Although we already discussed how crude oil is turned into monomers, you can also extract monomers as Liquid Natural Gas (LNG) from the natural gas pipeline. LNG monomers include ethane, propane, butane, isobutene and pentane. The US shale boom, which took place between 2010 and 2019, gave the US a competitive edge in ethane (and ethylene) production, especially in the Appalachian Basin and Gulf Coast areas.

However, this price advantage was not the same for propene (propylene), as natural gas yields little of this and benefits the European and Asian oil-based plastic producers. LNG prices are also much more stable than those for crude oil.

It’s important for food and beverage manufacturers and packaging producers to know the source of the resin being used and their supply chain vulnerability. For example, a company making or using polypropylene (PP) for, say, cartons for cream cheese, is in a very different volatility cycle to one making polyethylene (PE) fruit juice cartons. Equally, some receptacles are more vulnerable to plastic price changes than others. Consider the case of water in a plastic bottle and a sandwich…

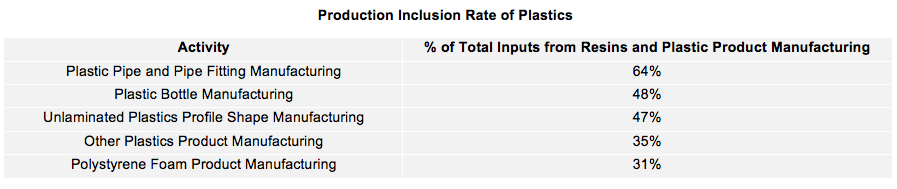

According to one source, plastic bottles and plastic packaging materials have some of the highest usage rates of resins per unit and are therefore particularly vulnerable to resin volatility.

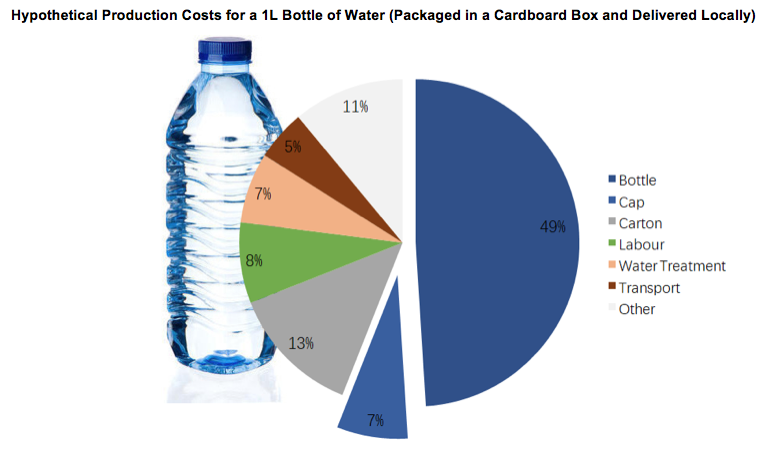

The contents of the package also has a bearing. Consider the costs associated with producing a bottle of water.

As well as the bottle, the plastic cap is also likely to be made of plastic. In this example, the manufacturer is vulnerable to changes in plastic prices, which is one of the reasons great attention is paid to added value by branding (i.e., to dilute the risk of plastic price volatility).

The opposite is the case in this example…

The costs in this sandwich are attributable to the ingredients, and the plastic (and paper) cost is only a minor part of the equation.

(Other) Causes of Supply-Side Price Volatility

Supply-side volatility doesn’t just come directly from changes in the petrochemical process.

Other factors to consider include:

- Stocks and Inventory

- Geopolitical Events

- Tariffs

- Transportation Costs and Freight Rates

- Currency Fluctuations

- Premiums and Discounts in Different Geographies

- Volume Purchases, Depth and Length of Relationship with the Supplier

- Changes in Consumer Preference or Recycling Demands

Even the weather can have an impact.

On the 14th February, a record breaking winter storm blanketed the US; frozen blades in windfarms and massive power outages made international news.

Almost all Gulf refineries were closed and over 80% of the US’ PP and PE ceased production. Transportation was also affected and the Port of Houston, rail services and resin deliveries ground to a halt.

Spot resin prices had already been high because of the increased monomer prices, as well as a tendency in recent years for resins, as with many other industries, to be made ‘just in time’ rather than supply from stocks. It will take several months to sort out this backlog, and resin imports will be required to satisfy demand. Ethylene and PE prices jumped at least 25%, if they could even be found or delivered, and PP was a similar story.

Similarly, the drop in water levels in the Rhine River last year caused chaos as it’s a key artery for the transport of petrochemical products in barges. 1000 tonne parcels of styrene had to be traded at 700 tonnes and trading took place with a new clause: ‘if water levels permit’. This ‘once in a century event’ also occurred in 2018 and now there’s even talk of having to redesign barges with flatter bottoms.

How to Manage Your Risk

Hedging, once the domain of metal and agricultural commodity traders, is constantly broadening its scope and, in the last ten years, that includes the plastics and resins sector.

As most resin prices have a correlation of more than 80% with crude oil, a basic form of hedging is using this as the price gauge and hedging accordingly. This can be done by trading futures or derivatives.

Physical suppliers of plastics and resin typically do not offer beyond four months forward. Longer tenor price risk can be managed using OTC (Over The Counter) swaps, which are settled against a variety of indices. This type of risk management can also be embedded into a physical contract by Czarnikow, meaning that buyers and sellers can avoid the cost and complexity of setting up margin accounts and hedge accounting.

If you’d like to explore how Czarnikow can help you hedge packaging, please talk to Maximilian Kirby (MKirby@czarnikow.com).

Final Thoughts

Volatility is a key issue for food and beverage manufacturers in the plastics supply chain and a risk analysis is useful.

The level of granularity on resin and plastic price data will vary according to the business. Some will leave the analysis to the plastic supplier but, others need to be more involved.

In the next article, we’ll look at where resins and plastics are produced and how that can also cause volatility.

Other Opinions You Might Be Interested In…