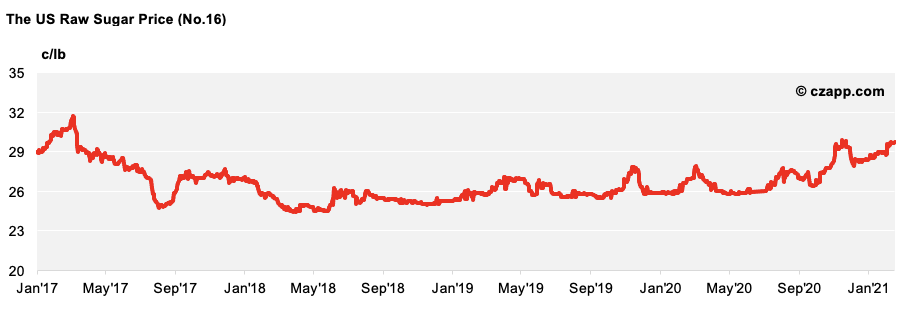

Firstly, it’s important to note that the No.16 is very illiquid, so the price movement is not necessarily that strongly related to the domestic market. In fact, most buyers negotiate on a flat price basis for the year and don’t use the No.16; it’s mostly used to hedge raw sugar imports under the Mexican quota and Tariff Rate Quotas (TRQs).

As such, the recent highs could be because the buyers (the refiners) have hedged their exposure, knowing a certain amount of sugar would be coming their way from Mexico, but sellers in Mexico have not started selling into this yet.

On the other hand, the market also needs to make sure TRQ imports are still competitive for importing countries, especially with the rise in the No.11. If I were a world market and TRQ holder currently, I’d look to export to the world market in March, and TRQ come July to maximise returns. The function of the No.16, in this case, would be to ensure the US market remains attractive to quota holders.

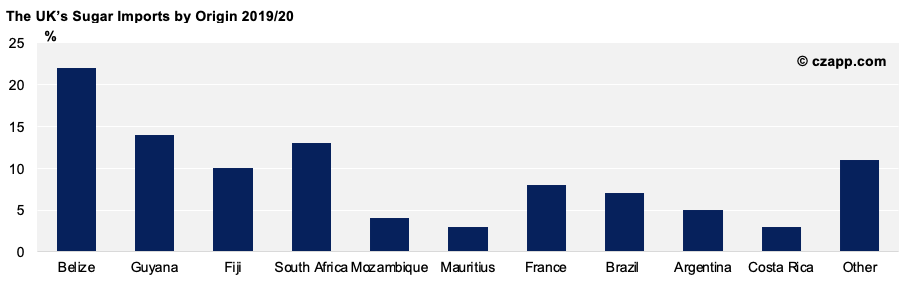

The new British raw sugar quota is small enough, at 260k tonnes, that it probably won’t change Brazil’s move to increasing its use of GM cane seed. This move is part of Brazilian plans to increase their agricultural efficiency, so any one buyer is probably not significant enough to change policy by themselves.

In some countries, consumers/lawmakers care a lot about whether GMO cane is used to make sugar, even though the sugar itself contains no genetic material. Other countries do not have the same stipulations. Refiners who find it difficult to accept sugar made from GMO cane may need to adapt their supply chains in the coming years.

Opinions You Might Like, Based on These Questions…

- Brexit: What’s Changed for Sugar?

- Genetically Modified Cane: What Does it Mean for Brazil?

- Genetically Modified Cane: Brazil Leads the Way