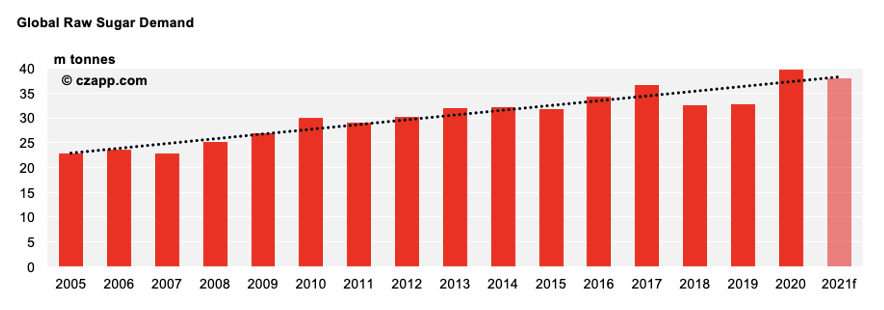

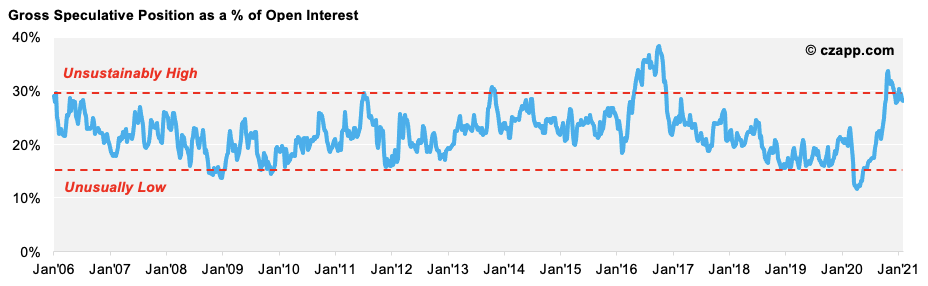

The strength in raw sugar started in 2020 as major buyers took advantage of decade-low prices below 10c. Raw sugar offtake in 2020 was 39.7m tonnes, the most ever. This was supplemented by heavy speculative buying, and finally by Trade Houses becoming more positive on the market towards the end of the year.

As we move into 2021, the world sugar market is grappling with a lack of supply. Europe and Thailand are the world’s two major low-cost refined sugar producers, but both had poor crops in 2019/20, leaving a shortfall in refined sugar supply. Meanwhile, everyone expects the Centre-South Brazilian cane harvest to be lower in 2021 than it was in 2020 due to dry weather. This shortfall in supply means prices have risen to try to ration demand.

I do wonder who buys the market now we are at 17c. Speculators hold a large long position in sugar. In the past, it’s been difficult for them to sustain a gross long of more than 30% of open interest, which is roughly where they are today.

The trade is now mostly positive the sugar market. This leaves consumers and producers as possible sugar market buyers. Consumers have had to adjust to higher prices, which I think means that their buying is becoming more hand-to-mouth. You can see that in their futures positions today; they are buying as the March’21 futures expiry approaches. The market hasn’t given them enough opportunities to cover large tonnage at attractive prices.

Meanwhile, it’s possible producers have to buy back hedges in the event of crop failure, which is why everyone is so obsessed with Brazilian rainfall right now. Will the cane crop be 580m tonnes, or perhaps significantly lower?

Source: Refinitiv Eikon

Because we can’t really identify a large buyer of futures today at 17c, we worry a bit about the price path in the short to medium term. Longer term, we remain quite positive to the sugar market; it’s going to be difficult to reverse a decade of underinvestment in production, so the undersupply will probably persist.

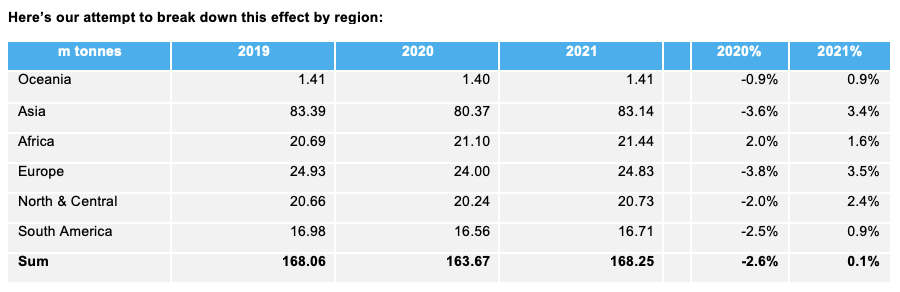

Sugar consumption was hit in many regions thanks to COVID lockdowns, which reduced out-of-home consumption. Soft drinks were the major casualty as bars, restaurants, theatres, cinemas and sports events all closed. However, snack food sales increased during this time, reflecting a shift in consumption as people stayed at home. We also saw in the second half of 2020 that the world learned to adapt to COVID, so sugar consumption started to revert to normal.

The scale of the consumption loss varied by country. Key factors were the scale/strictness of the lockdowns, success in combating COVID, existing dietary habits and also whether sugar was the primary sweetener in soft drinks.

Opinions You Might Like, Based on These Questions…