The United Kingdom doesn’t make enough sugar to meet its needs. It produces around 1m tonnes each year, but sugar consumption is closer to 1.8m tonnes. It imports the shortfall each year.

Now the UK has left the European Union, Europe will on paper be better supplied. However, in reality, the EU will continue to export sugar to the UK under a duty-free trade deal.

Meanwhile, the UK will continue to import raw sugar from the world market under a 260k duty-free quota, and it also has trade agreements in place with South Africa, Andean countries and Central American countries.

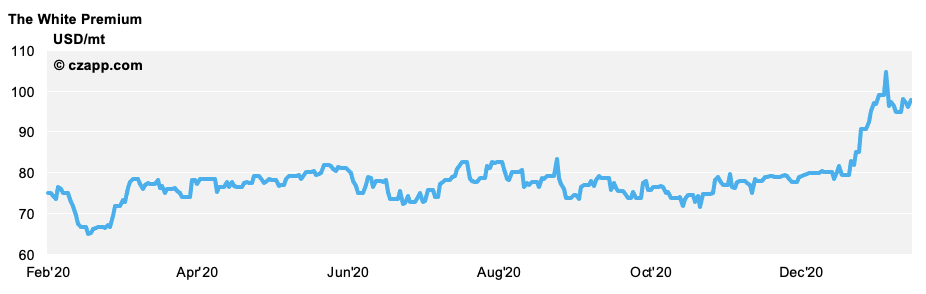

Most of India’s subsidized white sugar exports will be high-colour whites, not refined sugar. However, local refineries will seek to buy domestic raw sugar to process into refined for subsidized export.

Refined sugar supply around the world is quite tight right now because the world’s two largest cheap suppliers (the European Union and Thailand) are both suffering from poor sugar production. This means Indian refined exports have helped to contain refined sugar prices. Nevertheless, refined sugar prices have been rising faster than raw sugar prices in recent weeks. This is partly because of the difficulty in sourcing containers around the world.

Indian ports have been heavily congested and container availability has been scarce. As long as this continues there will be questions around how quickly India can ship refined sugar to the world market. In due course as these container problems fade, it’s likely that the white premium weakens a little once more.

COVID had a profound impact on sugar prices last year. It triggered the sell-off in March as the world’s investors abandoned risky assets and sugar consumption in many countries was hit by lockdowns. However, these effects are now in the past. Speculative money has returned to all commodity markets, sugar consumption in most countries looks robust and supply chains have reconfigured; we’ve learned to live with COVID.

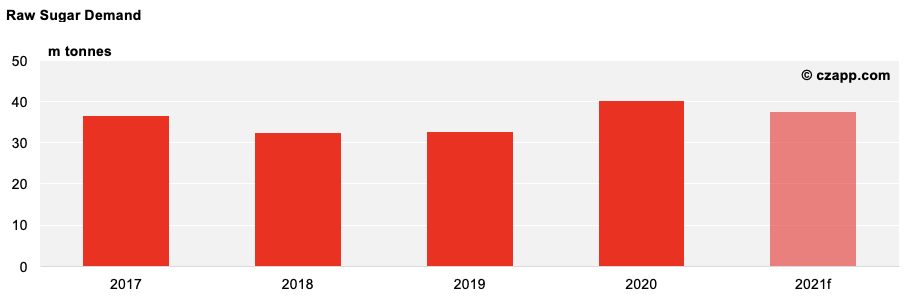

One interesting aspect is that last year’s decade-low sugar prices seem to have led to many countries restocking. Or perhaps countries have been restocking foods to ensure security of supply during the pandemic. In either case, this means it will be difficult to replicate some of last year’s strong sugar import demand, and so perhaps the legacy of COVID for 2021 is slightly negative for prices?

I think one underappreciated threat is the risk of increased regulation around sugar consumption, perhaps more sugar taxes or restrictions on advertising.

I wonder if COVID will lead to a renewed interest in health – it seems to lead to worse outcomes for people with underlying health conditions, some of which are linked to being overweight. We’ve already seen the number of sugar taxes around the world increase in recent years. It’s possible COVID accelerates that trend, which could be bad news for sugar consumption growth in the coming years.

The opportunity is much the same as it always has been. Sugar is a high energy product. This means that as a food it’s a cheap source of calories and it tastes good to eat.

The pandemic has also showed us how robust sugar consumption around the world can be in the face of massive disruption.

And, of course, sucrose can be fermented to make ethanol, which can then be used as a road fuel, either by itself or blended with gasoline. People will always need to travel, and so I’d expect vehicle ownership around the world to continue to increase. In the medium term these won’t all be battery-powered, and so the world’s ethanol demand is likely to increase.

Opinions You Might Like, Based on These Questions…

- French Sugar Production Falls to 10-Year Low

- The Long Read: Sugar Consumption and Reformulation

- The Long Read: Sugar Taxes & Demand

- Market View: The Pullback Continues

- Container Danger: Box Shortages & Sugar