The start of 2021 has seen the relatively benign conditions for cane molasses from the end of 2020 continue.

India continues to provide a consistent supply of cane molasses for export and its cane crop is progressing well. This is helping offset the decline in exports from Thailand, whose cane crush has had its slowest start for six years and will struggle to reach 70m tonnes.

The Central American supply of cane molasses is on track and following expectations early in the crush.

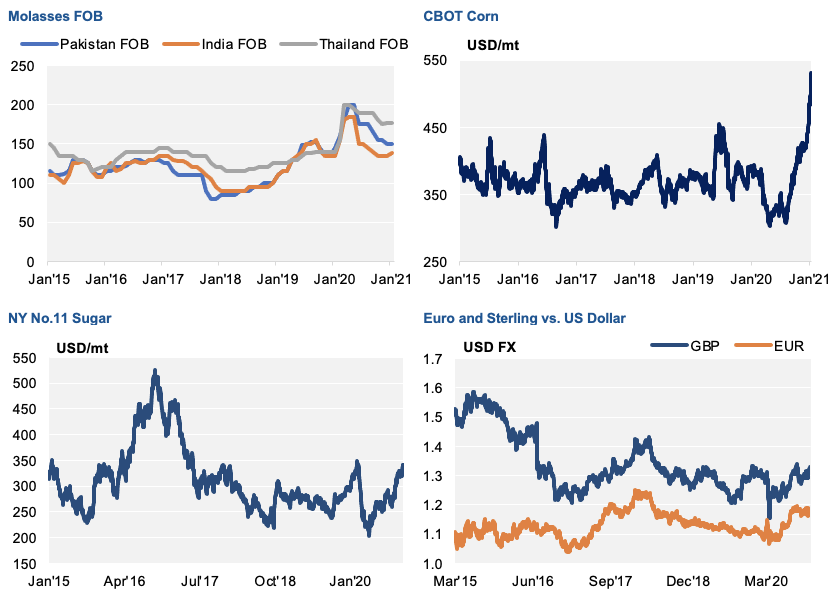

The strengthening of Euro and Sterling versus the US Dollar over the last six months has helped relieve some of the pricing pressure in local currency terms in Europe, combined with higher corn and wheat prices. CBOT corn is trading at 5.25 USD/bu compared to 4.09 USD/bu at the start of December 2020.

The beet molasses market has seen prices increase steadily in recent months in reaction to the poorer than expected EU crop and lower Russian production. The supply situation will be improved shortly when Egypt will come to the market with an expected minimum 300k tonnes of beet molasses available for export between March and October. The first public tenders for beet molasses in Egypt have not taken place yet but are expected within the next few weeks.

Overall, the molasses market is benefiting from broadly better conditions than in 2020, when molasses prices increased during the peak of the first wave of COVID-19 in contrast to many other commodities. Since then, the main competing feed commodities have increased in price and the molasses price has fallen both in Dollar terms and in local currency terms in Europe. The question will be for how long will these conditions continue, the current COVID-19 induced volatility will make forward projections difficult; we will continue to update the market and watch for any warning signs.

Other Opinions You Might Be Interested In…