Bulk Shipments

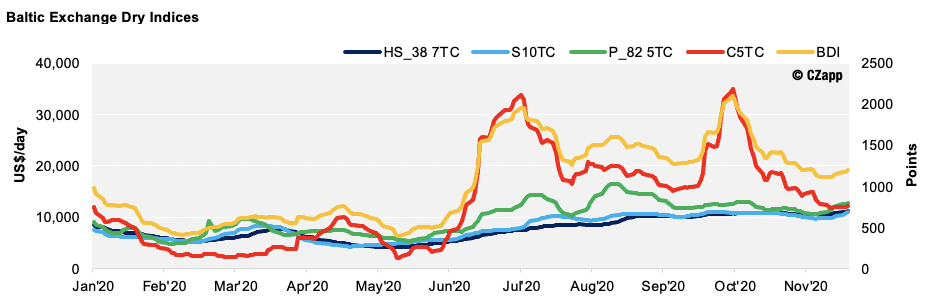

The Baltic Dry Index (BDI) settled at 1197pts on the 25th November, down 204pts from our last update. A weakening Capesize market contributed in the main towards the lower BDI levels, however, stronger prices in the Panamax, Supramax and Handysize sectors helped curb these losses.

With Cape values appearing to find a floor at around $12,000 per day, the BDI started to recoup some value in the last week on the back of this strength in the smaller sizes. Recent activity in Dec’20 Forward Freight Agreement (FFA) pricing suggests there might be one last hurrah for owners in 2020 before battening down the hatches for the stormy waters ahead, where we see Q1’21 FFAs trading at significant discount to spot and Dec’20 prices.

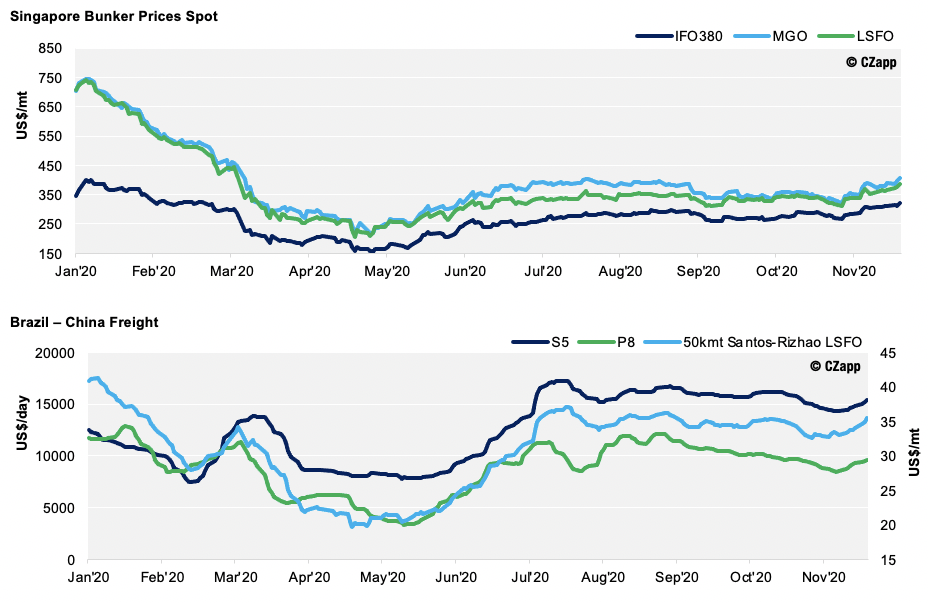

Singapore Low Sulfur Fuel Oil (LSFO) and Marine Gasoil (MGO) bunker prices tracked crude higher, both gaining close to 15% in value since our last update.

Our Santos – Rizhao 50kmt route assessment is back above $35pmt, having been sub $33pmt at the end of last month.

Containerised Shipments

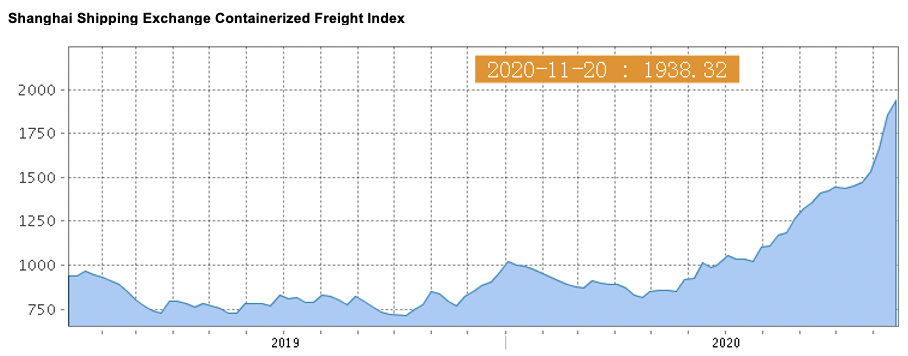

The Shanghai Containerised Freight Index continued to rise this week, with increases seen across all lanes captured.

While the year-to-date (YTD) container volume remains down year-on-year (YoY), unprecedented demand in Q4 is posing the potential of making up for the downfall in volume seen from April to June this year. Rates from Asia to Northern Europe and the US West Coast are amongst those hardest hit with a 20% increase in rates compared to the previous week.

After years of teetering on the edge of profitability, the container lines are set to recognise the highest profits seen in almost a decade with Sea-Intelligence projecting the earnings before interest and taxes (EBIT) for the main carriers to be approximately USD 14.2bn for 2020.

With the majority of the global container fleet now active, and sweeper services having been rolled out to accommodate excess demand, congestion at major ports and transhipment hubs is leading to delays, rollovers and bottlenecks in equipment supply. According to Ocean Insights, Singapore, a major transhipment hub, saw rollovers of 31.1% in October. With equipment stuck in the US and Europe, carriers in many instances are loading empty containers on the backhaul in an effort to capture head haul demand.

With demand out of the Far East so high, many carriers are no longer honouring contract rates and volumes, forcing shippers to book on the spot market in order to secure space.

The container market outlook for 2021 remains uncertain. Some believe that pent-up consumer demand for services is likely to resurface in 2021, particularly in the event that a vaccine is successfully rolled out on a global scale. 2020 demand levels are unlikely to be sustained, particularly as demand in many regions has largely been supported by government unemployment schemes. However, even if demand drops off, the carriers’ ability to manage capacity leads many to believe that, while rates can be expected to drop lower than current levels, they will remain high for 2021.

Other Opinions You Might Be Interested In…