A Quick Recap

In previous reports, we explained how aluminium is produced and focused on how aluminium beverage cans are manufactured, filled and distributed. This is the final part of that story, namely, consumer trends, before we move on to aluminium foils, food and related packaging and food cans.

Macro Trends

According to Business Wire, the global beverage market was evaluated at $1.545 billion in 2018.

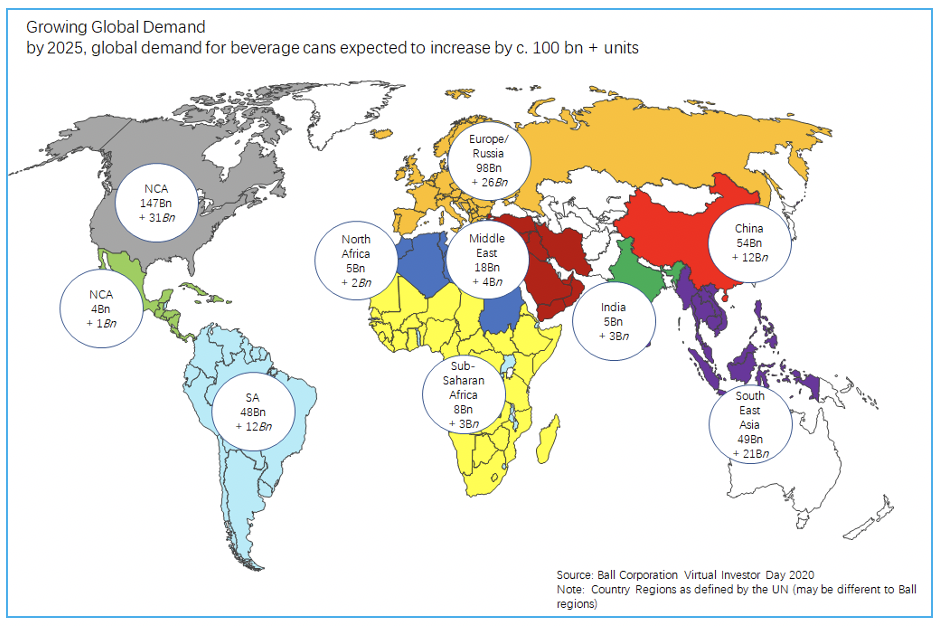

Until 2019, analysts had a relatively easy time predicting the future of aluminium cans. Depending on the opinions, global can sales were moving along at a healthy rate of around 4% Compound Annual Growth Rate (CAGR). Even stronger growth of up to 5-6% CAGR was projected in South America and in the Asia Pacific (APAC) region, where rapid urbanization, higher disposable incomes and a range of new product innovations and beverage flavours were all pointing to solid growth.

In the developed world, pending new environmental legislation on plastics and particularly single use plastics in Europe (especially), were also seen to be helping the industry. New aluminium can capacity was being planned to meet this anticipated new demand, especially with a shift from plastic to cans of water, and mixed drink alcoholic beverages.

For manufacturers of flat-rolled can stock, the picture was also rosy, albeit with an ongoing shift of production to the APAC region and especially China. This sector had only been minimally disrupted by global aluminium tariffs, compared to other large consumers of aluminium, such as the automobile industry, and can stock production remained profitable.

In 2020, COVID-19 upended the aluminium can business models, as it did with many other industrial cases. In the first wave in Asia, and in Europe and the US especially, restaurants and bars were closed or faced restricted hours, which saw a steep decline in onsite sales of beverages by the glass. Suddenly, consumers were picking up meals and canned beverages from outside restaurants or collecting multi-can beverages (cans and bottles) from the supermarket or by online order to consume at home.

Nobody knows how, when or even if a full recovery in the entertainment sector will take place, which makes it extremely challenging to provide guidance. Have consumer trends been influenced forever?

There is evidence emerging that the aluminium can industry has been a net beneficiary of this seismic change to lifestyles. Although global sales of beer and soft drinks have been rather sluggish in Q2 and Q3 of 2020, canned beverage sales have held up well. This has even caused a disruption to the supply chain. One of the leading manufacturers, Ball Corporation, in an investor presentation on the 6th October, explained that, in the US alone, there is a shortage of around 10 billion cans (around 9% of the entire 2019 market).

They also said that, with no sign of the shortage abating, imports will need to continue into 2021 and even into next summer’s peak selling season. Suddenly, beverage producers were forced to concentrate on their mainstream products and curtail niche brands. In May 2020, Molson Coors, the brewing conglomerate, suspended sales of some minor products due to a shortage of recyclable 12-ounce cans.

To show how difficult it is to predict the current market, in 2019 some commentators were predicting a significant switch to convenient canned beverages in major sports such as the English Premier League, Serie A and LaLiga in Europe and NFL, NBA, and MLB in the US.

Now, the stadiums are empty.

In the recent investor presentation, one of the leading producers of aluminium cans displayed a healthy long-term growth projection, whilst adding in many of the short-term caveats we have already discussed.

The Contents

Water is a fast-growing market, as are new flavours, such as infused teas, coffee, health drinks, and unusual fruit flavoured drinks, such as yuzu, ice cucumber and ginseng in many offerings. Coconut water sales in Asia are also still growing rapidly.

Sports and energy drinks are another fast-growing market, both of which are normally produced in cans. This is bucking the trend towards miniaturization, as those thirsty gym goers like a big 500ml can. However, a 250ml can also retains popularity. This $55 billion market is estimated to be growing at over 7% CAGR.

Consumer preferences are also changing for alcoholic beverages. Regular beer sales are struggling in some mature markets, though recording significant growth in South America, and there is a thirst for craft beers and minimum/low alcohol beers. Consumer growth is being driven by new and trendy canned cocktails too, spiked seltzers, wine in a can, etc. Almost all of these favour aluminium cans.

The Packaging

Water is a hot market. It has grown to a $20 billion global market. Traditionally, water has been the domain of the resalable plastic bottle, which is also easier to produce in different sizes. To maintain their competitiveness, the plastic/PET bottle manufacturers are looking to increase their recycling rates and biodegradable attributes, either voluntarily, or in Europe’s case, because bans on single-use plastics coming into force in 2021 are forcing them to.

For now, most of the leading water products come from manufacturers that have both aluminium and plastic options available and they are experimenting with consumer acceptability of the former. Examples include Danone’s Flyte in the UK, Aqua D’or in Denmark, and Perrier (Nestlé) in multiple markets. Coke is looking at putting Dasani into aluminium resalable cans and Pepsi is testing Aquafina at some food service outlets. Some redesign of assembly lines is also going to be needed.

Soft drink cans are mostly getting smaller. In Europe, the standard 330ml can is slowly being usurped by 150ml, 200 ml and 250 ml cans, which are popular with younger and healthy consumers. These smaller cans reduce calorie intake, sugar consumption, waste, spending, and they are good for consumption when on the go. Also, minimum product line reconfiguration is needed, which is a big win.

Cans are also becoming sleeker. The standard 330ml versions are considered more visually appealing and elegant. They have proved popular in the important Asian market.

‘Resalable’ is the buzz word in the aluminium camp. It would require some reconfiguration of production lines if adopted in large quantities and/or screw tops become fashionable.

Both plastic/PET and aluminium cans are likely to come under increased scrutiny for contamination of the beverage, for micro plastics in bottles and, in both cases, a growing issue is suggested, but not fully proven; contamination by bisphenol-A (BPA). The can industry has been responding to this by developing low or zero coatings.

Recycling will continue to be an important driver. Worldwide, consumers in every known survey want this to be highlighted and, for aluminium, mostly understand the basics. A tighter definition of ‘recycling’ may appear as a result.

Boxes of beverages, such as the cardboard one and the five-litre wine box may take a larger portion of the market and are considered reasonably environmentally friendly, although separating the three components, inner, box and plastic tap presents recycling issues.

Conclusion

The aluminium can market is likely to grow in the future, but on less upward trajectory than we’ve seen previously. New packaging and flavours will abound and need careful market research to find the best opportunities as fashions and tastes change quickly in this industry.

Other Opinions You May Be Interested In…

- Aluminium: The Basics You Need to Know

- Aluminium: A Closer Look at its Carbon Footprint

- Aluminium: The Anatomy of the Can

- Aluminium: From Beverage Factory to Consumer

- Aluminium: New Can Manufacturing Technologies