In our last report, we said we would be monitoring crop estimates closely; the one causing the greatest concern is the Thai sugar crop.

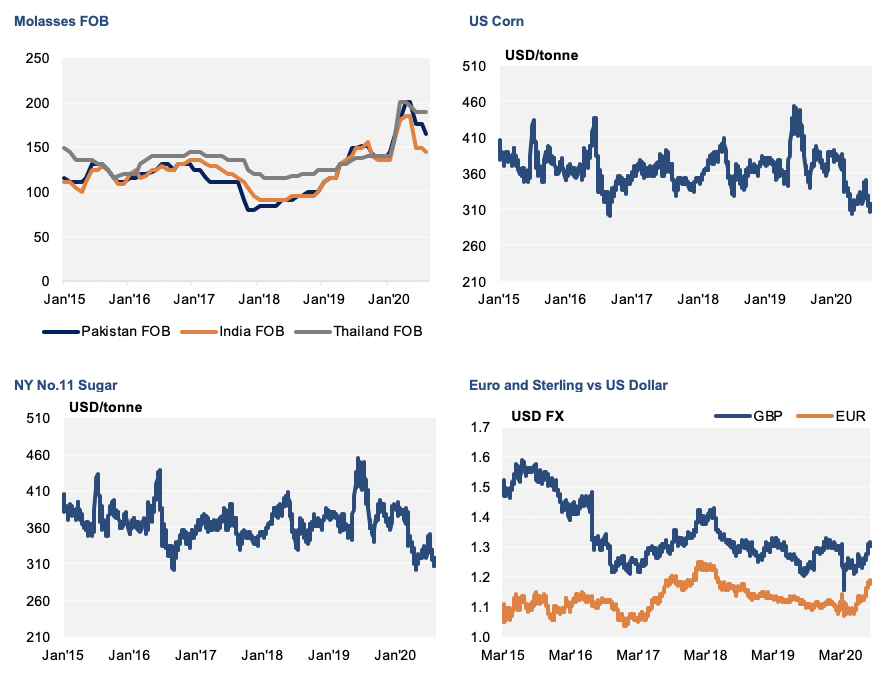

UM had been estimating a crop at around 80m tonnes of cane, with an expectation that it could fall further. This week, forecasts have been downgraded to 65m tonnes of cane. This is really going to challenge the viability of Thai cane molasses exports. In this current off-crop period, we are seeing imports of cane molasses into the Thai market; we could find this extends right up until new crop later this year. In terms of exports, we could see very limited exports, and imports begin earlier in 2021. This is a huge change for the molasses markets, with Thailand regularly supplying 500k tonnes of cane molasses per year for export in recent years.

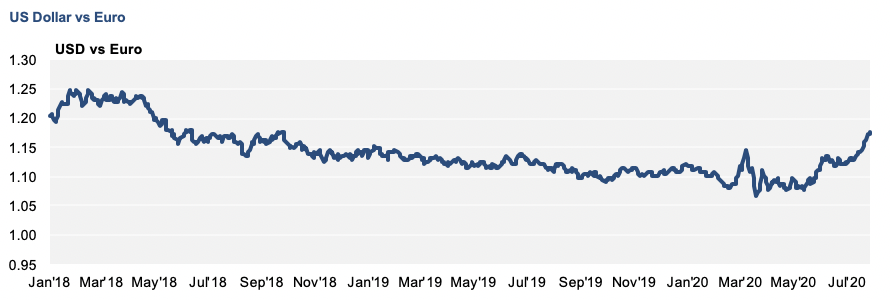

In other markets, it’s all fairly quiet, with everything ticking along as expected. In Europe, the movement in currencies is driving some interest in pricing in Euro and Sterling, which have strengthened vs. the US Dollar in recent weeks. Asian industrial demand remains subdued in light of COVID-19 recessions/impacts across the region.

The European beet crop looks to be broadly in line with the five-year average according to the latest EU MARS report (27th July). We will continue to watch this closely, in particular the final numbers expected from Poland and Germany. Dry weather has persisted as a concern throughout the year so far, with a very dry spring largely balanced out by better rains. However, things are dry at the moment and it will be interesting if this has an impact in the final stages of beet development.

In the next report, we will have some final numbers in EU sugar beet crop production just prior to the beet campaign commencing across the continent. We will also hope to see the molasses market pick up once the summer market comes to an end, and hopefully once economies start to kick back into life after the COVID-19 induced downturns.