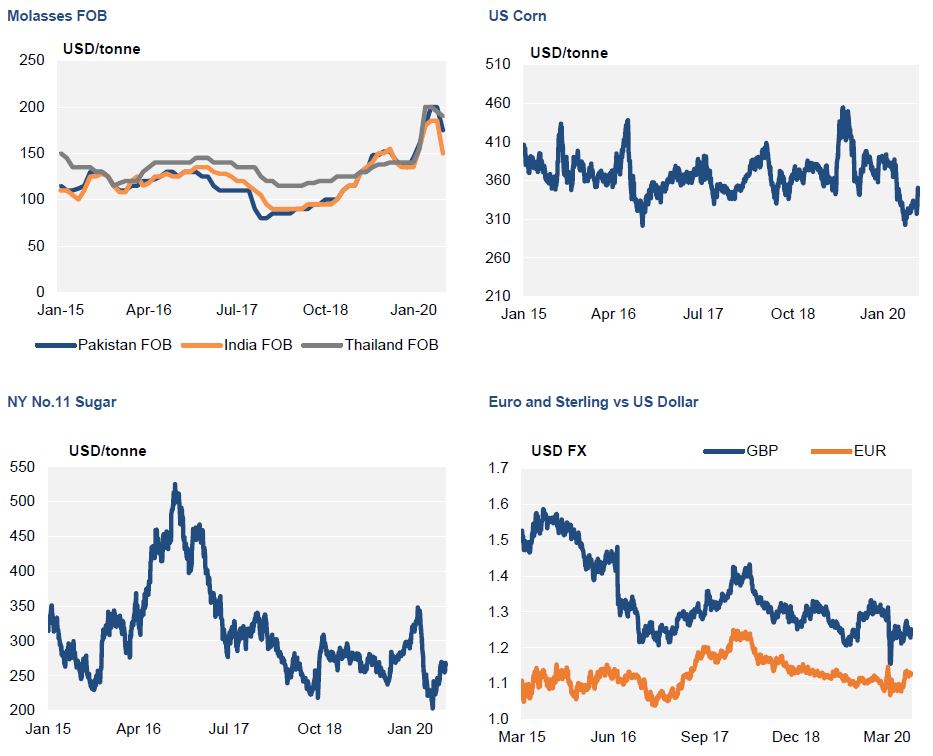

Two weeks ago we said the common sense was returning to the molasses market and that certainly seems to be holding true.

The latest news is the export ban on cane molasses from the Indian State of Maharashtra has been lifted and exports can resume. What does this mean for availability and prices? In terms of availability the exports in the short term will be limited as India is currently off-crop, so for the next few months supply will be restricted. The main focus will be when the new crop begins later this year, with the first exports in December for arrival in European and Asian destinations in early 2021. Therefore, in the short term the impact on supply and price is fairly benign but it does appear we will benefit from better prices in early 2021.

The Asian molasses market is facing a more volatile situation with competing variables working to confuse the picture. The market is much tighter in terms of physicals due to the poor 2019/20 Thai crop that has required imports of cane molasses and the forecast for the 2020/21 crop is also disappointing. This has served to tighten the physical market; however the re-emergence of Maharashtra cane molasses will hopefully address some of the supply-side shortage.

In Europe the sugar beet crop looks to be within the normal 5-year average, with some decreases in yields in Poland balanced by better yields in Germany, France and the Netherlands. Overall the latest EU sugar report forecasts yields to be 1% higher than the 5-year average. The main unknown factor in European beet supply will be the demand from fuel ethanol producers in Europe, with the lower fuel and gasoline demand during COVID-19 lockdowns hanging over the market. Some of this will be balanced by greater demand for anti-bacterial alcohol production. At this stage the beet molasses market looks to be fairly stable, with normal supply and demand fundamentals in place.

Looking ahead the forecasts for the EU beet crop will be finalised and we can start to understand prices for September – December. For cane molasses we will be monitoring India closely in the short term and also looking toward the end of 2020 then the first new-crop cane molasses will be available.