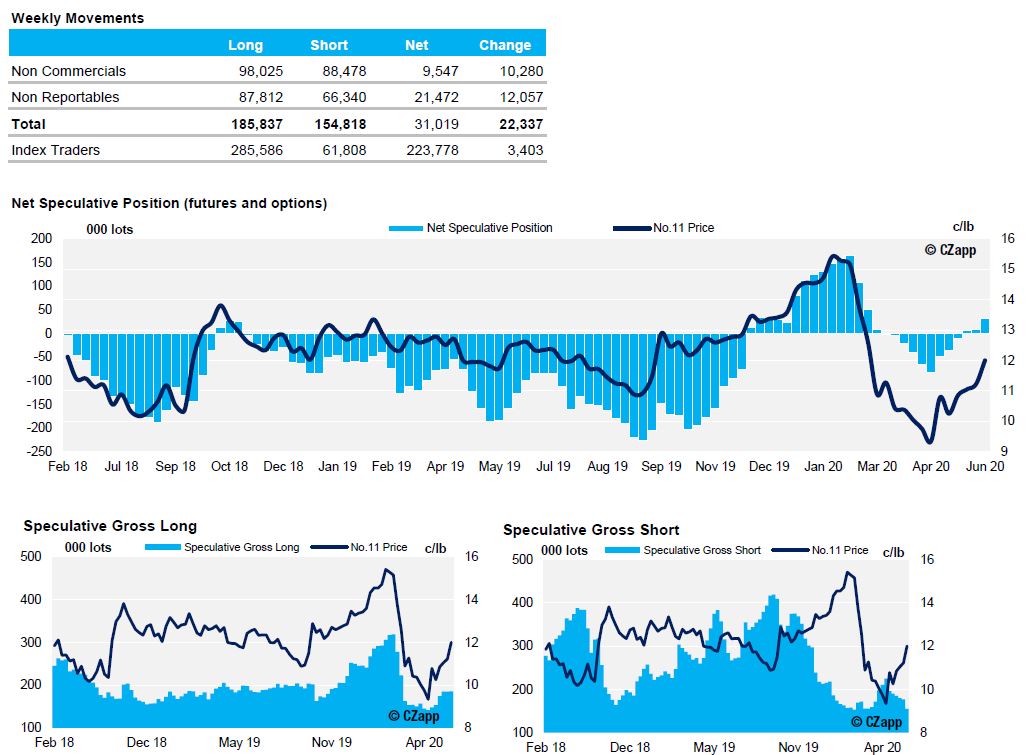

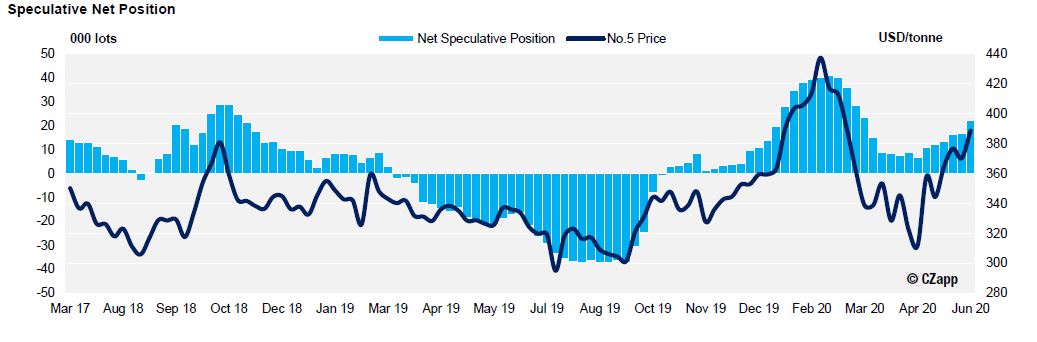

- In Raw sugar specs continued to build their net long position, extending to over 30k lots.

- This was driven by specs buying to close their short positions, rather than opening new longs, which drove the price towards 12c.

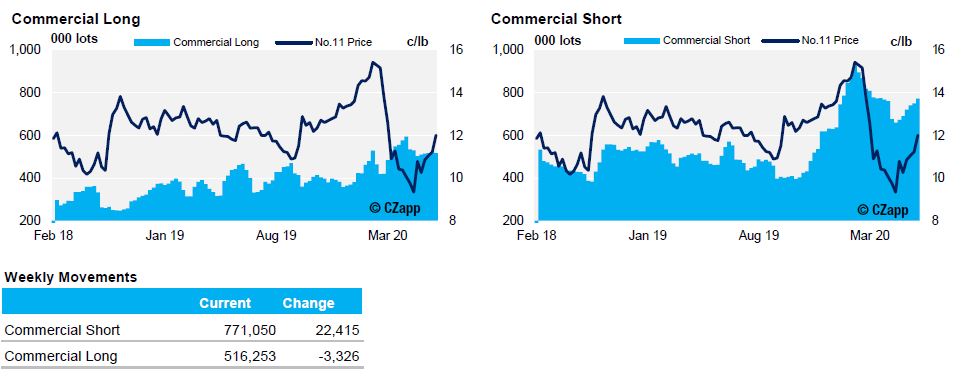

- Commercial sellers are exceptionally well hedged for this time in the year, meaning that No.11 price is vulnerable to spec activity.

ICE No.11 Futures Speculative Positioning (values as of 9th June 2020)

ICE No.11 Futures Commerical Positioning (values as of 9th June 2020)

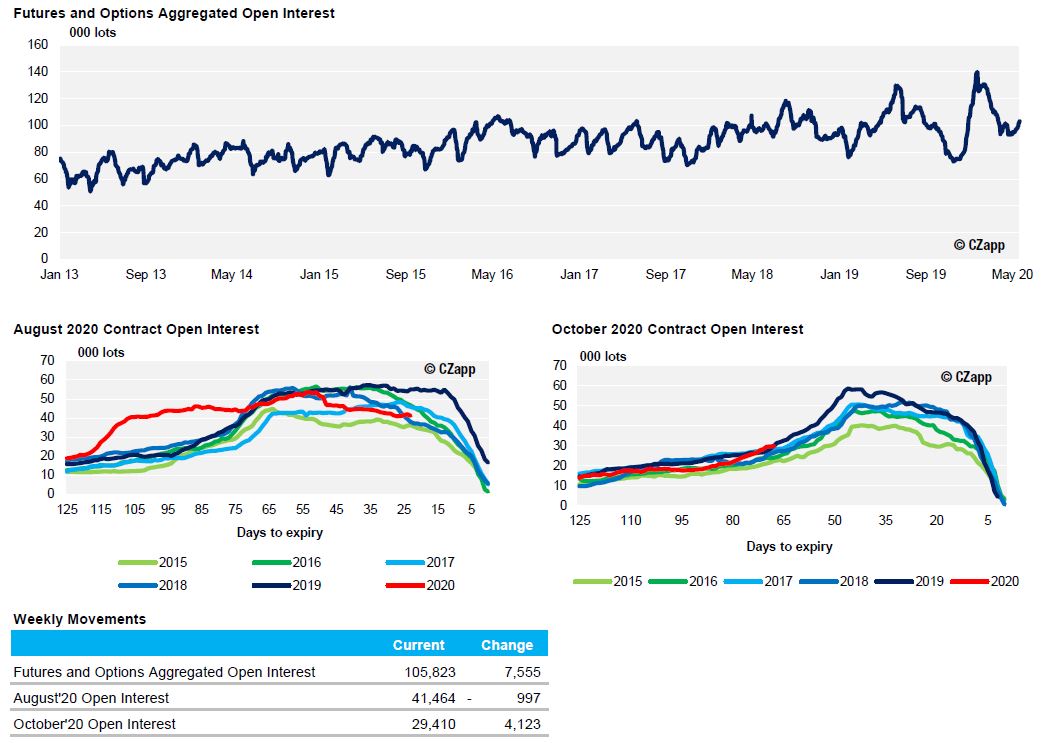

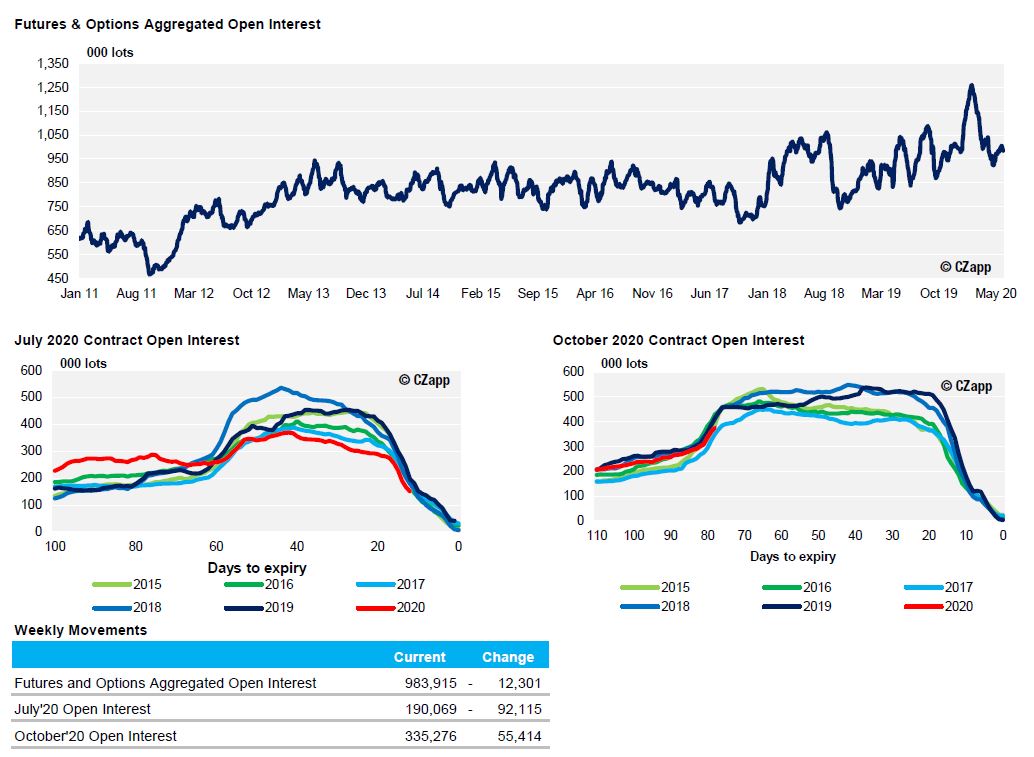

ICE No.11 Futures Open Interest (values as of 9th June 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 9th June 2020)

ICE Futures Europe Open Interest (values as of 9th June 2020)