542 words / 3 minute reading time

The beet molasses market has now set its sights on new-crop EU and Russian sugar beet. The majority of 2019/20 crop beet molasses has now been sold, bringing the new crop into focus.

The EU Mars report from the 18th May provides an initial preview of the EU sugar beet crop, the current forecast for the sugar beet yield is 75.4 mt/ha up 0.9% on the five-year average. This does hide some regional disparities, with Germany and Poland particularly at risk from the dry weather in April.

Overall EU crop forecasts do provide some confidence that supply of beet molasses will be sufficient, the main question at present will be EU and North American demand.

Across Europe beet molasses (and thick juice) is an important ethanol feedstock, it appears likely that there will be two different markets for ethanol:

1. Fuel ethanol demand will be lower on the back of the EU-wide coronavirus lockdowns and falls in gasoline demand.

2. Neutral spirit demand will be supported by increased demand for antibacterial products.

Overall the impact of lower fuel ethanol demand will outweigh the increase in neutral spirit demand, which could see demand for beet molasses fall in Europe.

North America has emerged in recent years as important destination for Polish beet molasses, with over 80,000 mt imported from Poland from the last season. Demand could be negatively impacted with the US forecast to have the largest corn crop in 70 years; there will be plenty of alternative corn-based feedstocks available.

The picture in Russia is less clear at this stage. With around 1 million hectares planted last year, there could be a reduction in supply, but in line with Europe domestic ethanol demand will be key in determining prices and the surplus available for export. Russia is the largest supplier of surplus beet molasses to the export market (sea vessel

shipment, ignoring cross-border truck/rail in the EU) with around 300,000 mt available for export.

Moroccan exports have been negatively impacted in 2020 due to persistent dry weather and an increase in domestic ethanol demand.

Egyptian beet molasses exports have been strong so far in 2020, with exports to the Mediterranean, North West Europe, Asia and North America.

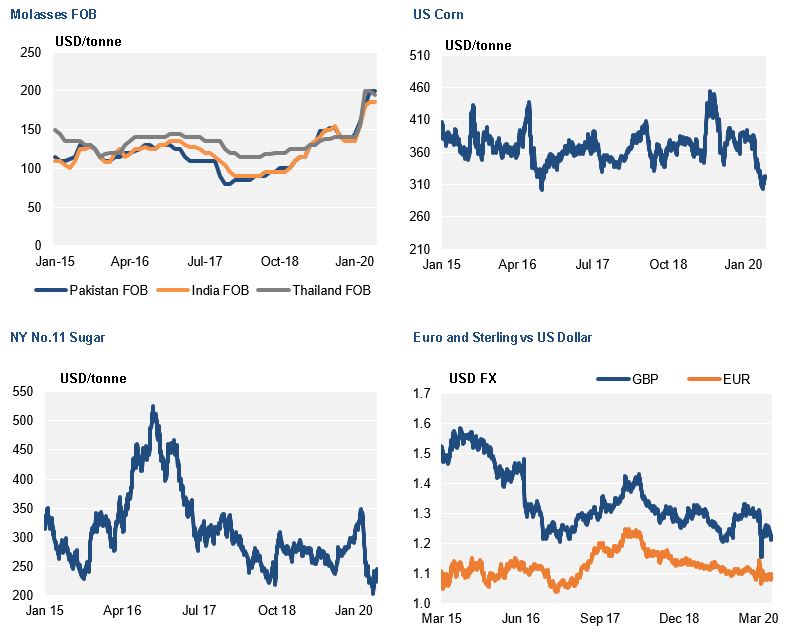

Price will be important in determining the overall demand for beet molasses, with cheaper feed commodities available pretty much across the board, molasses demand could be squeezed lower. This is a similar picture in the cane molasses market, with persistent higher prices placing the molasses market as an outlier compared to the majority of other commodities.

Looking ahead the important factors to watch will be the weather conditions across Europe, with dry weather in April placing EU sugar beet crops under pressure. The COVID-19 lockdown and consequent fall in gasoline and fuel ethanol demand could lessen any impact of any fall in EU beet molasses supply. The Russian market will generally follow a similar pattern. North American demand for imported beet molasses could fall with cheaper corn-based feedstocks available. Demand in Europe will be

supported as cane molasses feed markets are supplied by beet molasses prior to new-crop cane molasses which will arrive in Europe from January 2021.