915 words / 4.5 minute reading time

- With the Brazilian crush now underway, a small volume of raw sugar produced from genetically modified (GM) cane may be exported.

- This sugar have been widely accepted, with the exception of the EU and Russia, potentially due to coronavirus-induced anxiety surrounding global food security.

- At present, only a very small fraction of Brazilian sugar production used GM cane, but the success of the new variety is being closely monitored with a view to increasing its use in Brazil.

Brazil’s Export Structure Remains Largely Unaffected

- As detailed in the first piece of this series, GM cane is being grown as part of this season’s Brazilian crop.

- Based on the planted area with GM cane, less than 0.5% of the sugar produced this season will be effectively originated by the new GM variety.

- There had been concern about countries banning imports of this sugar due to its GMO origin, but it seems most countries have agreed that sugar cannot be a GM product as the processing removes all genetic material.

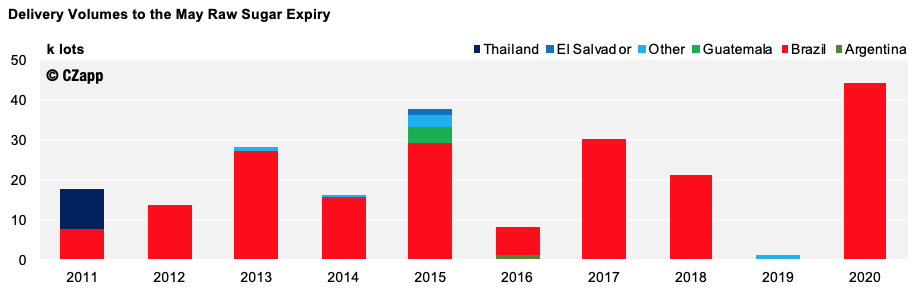

- Exports of Brazilian sugar have, therefore, got off to a great start this season; this included a record delivery of 2.2m tonnes to the May expiry of Brazilian raw sugar.

- This suggests that most of the usual destinations, as well as ICE futures exchange, are happy to receive GM cane derived sugar.

- The global raw sugar supply will be especially dependent on Brazil in 2020; we think they will account for 70% of global raws exports.

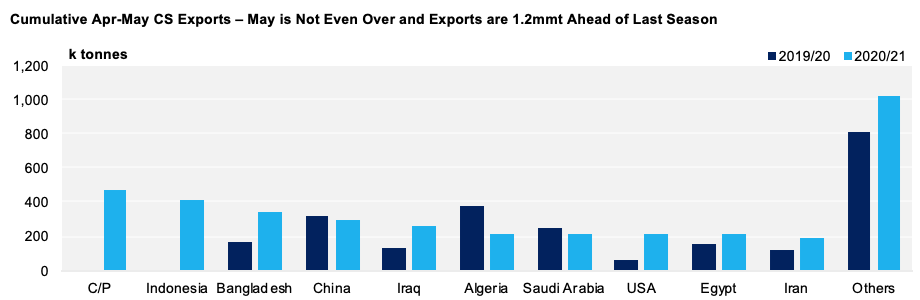

- Over 4m tonnes of Brazilian sugar has been nominated or shipped since the beginning of the Brazilian cane harvest in April; this is a record for May.

- Iraq, Yemen and Tunisia, three countries that have blanket bans on GMOs and account for around 2m tonnes of demand, have all accepted the non-GMO certification of the sugar.

- China’s acceptance was another major concern, so much so that the Brazilian government sent an envoy over in 2018 to discuss the sugar as non-GMO.

- China seems to have accepted the new classification, since over 400kmt of Brazilian sugar have been nominated to China so far this season.

- The dominance of raw supply by Brazil has likely facilitated the acceptance of the sugar, with most countries reliant to some extent Brazilian raws.

A Two-Tiered Raw Sugar Market Looks Unlikely

- Sugar flows appear largely unchanged.

- However, this is just the first obstacle to jump over, in terms of getting the sugar to consumers; it is unclear how the sugar will be handled in country at present.

- Some consumers prefer GMO-free products; in the US GMO-free whole foods are around 50% more expensive.

- There is concern, therefore, that this may be replicated on a global scale with Brazilian sugar becoming cheaper than that from other origins.

- We are skeptical that Brazilian sugar will be sold at a significant discount:

- Only in the US and EU does significant avoidance of GMO derived foods by consumers occur, and these two markets accounted for less than 5% of Brazils exports in 2019.

- With the global sugar supply dependent on Brazil, most countries will require at least some Brazilian raws.

- Most of the world’s major sugar refineries are optimized to use Brazilian VHP raw sugar.

Brazilian Producers Will Control the Pace of GM Cane Adoption

- The current export infrastructure remains the same and the demand for Brazilian sugar has been sustained, allaying fears about rejection of the sugar.

- It, therefore, looks as though a shift towards embracing GM cane will be decided based on whether Brazilian growers find the new variety beneficial.

- The initial reports of the cane have been positive, with the in-built insect resistance in the varieties appearing effective, reducing insecticide needs.

- Also, the yield of the GM cane appears to be equally as good any other varieties, though we always expected an increase in agricultural yields due to favourable weather and increase in cane field maintenance.

But…

- Despite the encouraging preliminary results, an increase in area planted with the new GMO variety might be slow.

- Growers in Brazil are cautious of acting in any major way on these early results, after previous disappointments with new varieties that failed to live up to their promise.

- Also, due to the cost of producing GM crops, the royalties on them are very expensive ($600/ha vs. R$200/ha for other varieties).

- Millers will need to compare whether savings on insecticide use are enough to compensate for the expensive royalties.

- Even if the GM varieties prove to be worthwhile, there are some areas that will not adopt them as the prevalence of cane borer, the target pest for these specific GM cane, changes from region to region, so there would be no value in their use.

- However, there are other varieties in development by CTC that provide other useful traits such as environmental stress tolerance, which could be useful to a wider selection of producers and would see an expansion in the use of GM Cane.