577 words / 3 minute reading time

Two weeks ago, the plan for this report was to add more detail to EU sugar beet crop projections and Asian cane molasses demand, however, events seem to have overtaken these plans!

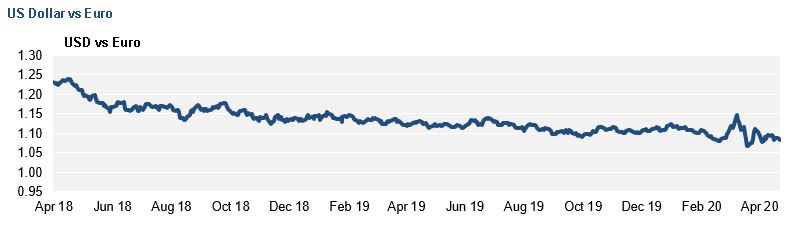

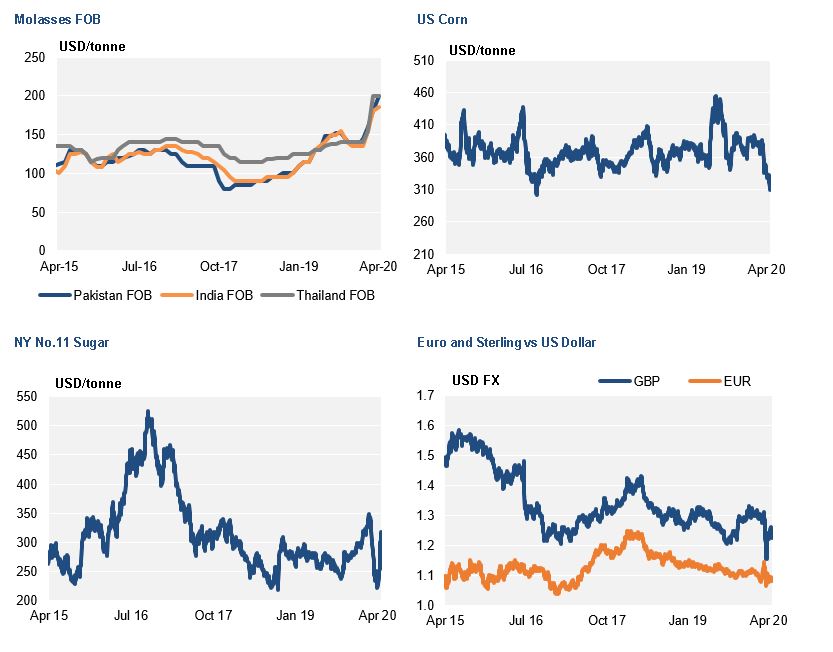

Cane and beet molasses prices now look to be the exception in the world of collapsing commodity and equity prices; we still have not seen a meaningful drop in prices. In the last two weeks, we have seen WTI oil trade at negative prices (!), US CBOT corn is at a 10-year low, raw sugar is under 10 USc/lb and fuel ethanol demand could fall.

There are different factors underpinning the moves in commodity prices, not just the macroeconomic impacts of COVID-19, oil is a combination of a shortage of crude oil storage in the US and continued shale oil production. Probably the most perplexing relationship is that between sugar and molasses prices. The common sense view would be that molasses and sugar prices are very closely correlated, but in practice we can see prices move in different directions for a sustained period. One main reason is Brazil

does not feature at all in the world of molasses trading, there is no surplus exported and no imports to cover a deficit. When Brazil is driving the world sugar price, we can find the molasses price to be totally dislocated from sugar price movements. On the other hand, when India is a driver of global sugar prices, the markets are much more closely related, as India is an important supplier and consumer of cane molasses in the world market.

The current lack of correlation in sugar and molasses prices is a perfect combination of both factors. Broadly, Brazil is behind the fall in sugar prices, as it is assumed the sugar/ethanol mix will be tilted back towards producing more sugar as ethanol demand and prices are under severe pressure. As noted above, what happens in Brazil is not really a concern of the molasses market, so molasses prices have been unaffected by this. In India, the molasses market is currently affected by an export ban of cane molasses from the State of Maharashtra, which is restricting the global supply of cane molasses which has caused prices to rise. While NY11 has declined to under 10 USc/lb, cane molasses prices have remained stable in recent weeks and are trading at premiums to the average price in 2019.

Ethanol markets are more closely correlated to the price direction of molasses, rather than the sugar markets. If we look globally, the main use for cane molasses is to be converted to ethanol domestically, in most cases to support a Government-mandated ethanol/gasoline blend. This is where the volatility created by COVID-19 will be felt if we see substantial changes to ethanol demand and, therefore, demand for molasses from this sector.

The question above asked: how long can molasses prices be the exception to the majority of other commodities? The answer is not a straightforward one, but the overall COVID-19 induced weak global macroeconomic picture will eventually be felt in the molasses market. The main driver may be the crude oil and ethanol markets, as ethanol is the main destination for domestic molasses globally, rather than impacts from the sugar market and sugar pricing.

Over the next few weeks, we will update how molasses eventually react to the current volatile commodity and equity markets.