908 words / 4.5 minute reading time

Some Useful Acronyms: European Energy Exchange (EEX), Organization of the Petroleum Exporting Countries (OPEC)

- The number of coronavirus cases in Europe and the UK continues to rise.

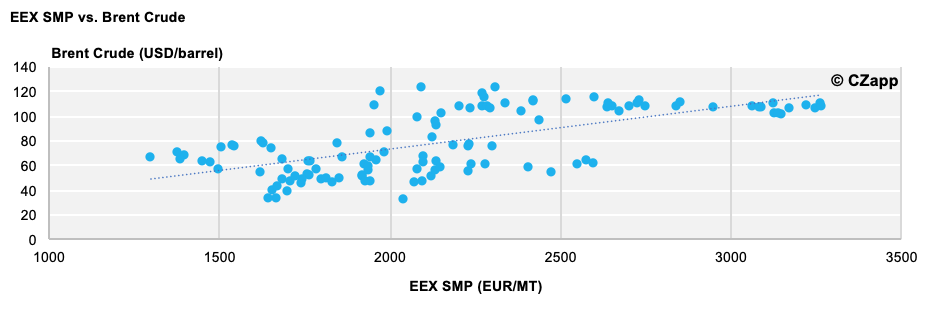

- EEX Skimmed Milk Power (SMP) and Brent Crude Oil prices are well correlated.

- The combination of coronavirus and an oil price war is causing EEX dairy prices to come under great pressure.

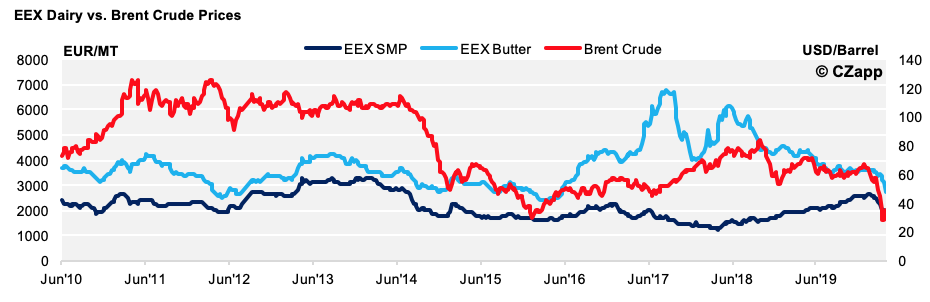

EEX Dairy vs. Brent Crude Oil

- Saudi Arabia began a price war on the 8th March, in response to Russia having not adhered to the planned OPEC+ cuts.

- A production capacity of 13 million barrels per day is targeted by Saudi Arabia, alongside price discounts to many major oil buying markets.

- Since this announcement, Brent Crude Oil prices have fallen from ~$45/barrel to just above $25/barrel (the lowest in 17 years). Prices have since bounced back up to around $35/barrel today following targeted production cuts by the USA and an OPEC+ meeting scheduled later this week which will attempt to resolve the Saudi/Russia tensions.

- EEX SMP and Brent Crude prices are 66% correlated.

- EEX Butter is much less correlated to oil prices, however, at only 24%.

- Given the recent movement in oil, it is likely that EEX SMP pricing has further a downside.

- The European Commission do appear to have opened Public Intervention on 1st of March 2020 for 109,000mt of SMP at a floor price of €1,698 EUR/MT. This typically remains open until the 30th of September each year.

- The key question now is whether the EU Commission will support the market by maintaining this fixed price if the world market moves materially lower, after only recently having cleared its stocks from the last major SMP price decline?

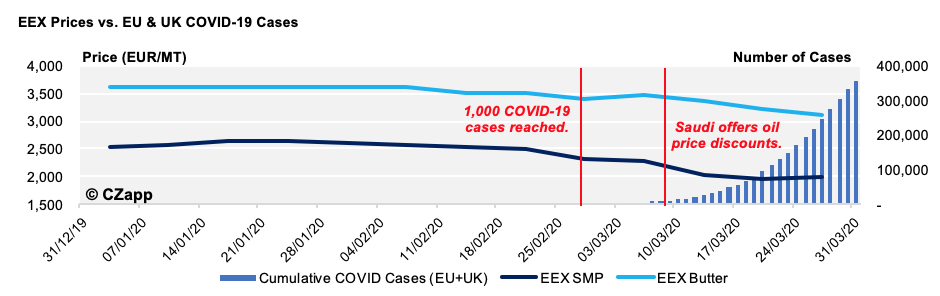

COVID-19 in Europe and the UK

- Europe’s first COVID-19 cases were reported on the 25th January.

- Since then, EEX dairy futures prices have either been flat or declined each week following, with one exception. This was when Europe and the UK’s number of cases reached 1,000. In this week, we saw a brief rise in butter prices, possibly due to traders seeking short term cover ahead of retail demand surging as consumers started to stockpile.

Stockpiling’s Impact on Consumption

- With lockdowns in place in many countries, the mix of dairy products consumed is being affected. Butter and cheese demand will be under particular pressure as foodservice channels are largely closed off, while retail fluid milk sales are booming.

Impact on the Supply Chains

- So far, it’s unclear whether COVID-19 cases are limiting processors’ ability to collect and process milk. At this stage, it would appear to still be a major risk, but one that has not eventuated.

- Cold storage, on the other hand, is stressed. Contacts in shipping lines have advised that buyers are not able to clear their containers as their own cold storage is already full with other products. In Ireland, for example, there is said to be one reefer container available for every three demanded. This situation is worth closely monitoring for the EEX Butter market.

- The number of COVID-19 cases continues to rise in Europe, but this has coincided with the oil price war. As you can see below, the close timing of major impacts makes it hard to distinguish which is the major driving force for price.

What Does the Future Hold?

- The top 20 oil exporting countries are littered with major dairy importers. The most impactful European dairy exports are those that go to Saudi Arabia, the UAE, Nigeria, Oman and Algeria.

- Low oil prices impact dairy through the following channels:

- With oil prices substantially lower, many of these oil exporting countries’ access to major currencies will be severely restricted. Thus their ability to buy products denominated in EUR or USD (such as dairy commodities) is constrained.

- Lower oil prices result in lower export receipts (money flowing into a country) and thus reduces these countries’ GDP. The flow on effects can cause unemployment to rise and thus demand for goods and services to fall. Though some dairy products are staples, consumers may still reduce demand where they can, and this lower demand can cause prices to fall.

Coronavirus

- The COVID-19 situation is even more uncertain. The key points I will continue to monitor are:

- Processors’ ability to collect and process milk. If this is impacted, supply could fall and prices could be supported. If not, then we are approaching the seasonal Northern Hemisphere flush, so the market will have to cope with more product at a time when supply chains are already stressed;

- Cold Storage. We may see product spoil if it is unable to be stored correctly. Though painful for the owner, this could support pricing for the wider market;

- People staying home and how this impacts their consumption and any past supportive impacts of stockpiling vs. future demand displacement caused by this.

Rumours of Saviours in the Market

- I am still hearing rumours that India will come into the world market to import a large parcel of SMP. My last report outlined why this is unlikely.

- Some people are demanding that the European Commission re-open Public Intervention for SMP. This actually is already open, it would seem, but after the last Intervention Programme, I am interested to see if they just hold the floor price and accept all product at this level…