302 words / 2.5 minute reading time

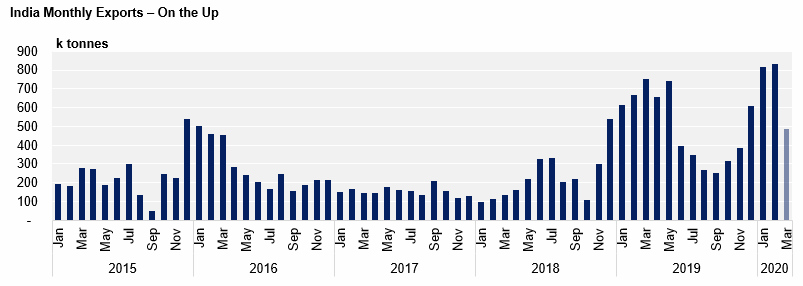

- India exported 832k tonnes of sugar in February, up 17k tonnes from the record Jan’20 shipments.

- March shipments eleven days in have shown a strong pace too, with 487k tonnes already nominated.

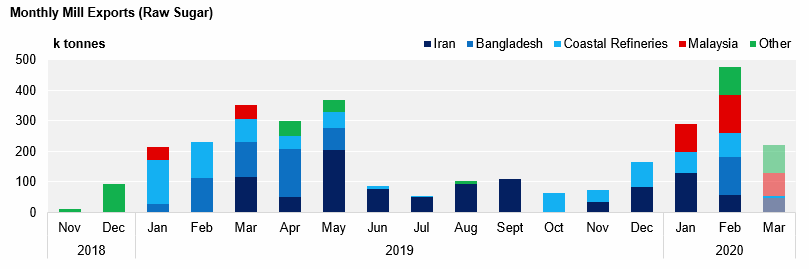

- February also saw the strongest flow of raw sugar exports from domestic mills we have seen since May’19.

Total Exports

- India exported 832k tonnes onto the world market in Feb’20, up from 611k tonnes year-on-year (YoY).

- March’s line up is already promising with 487k tonnes having been committed less than halfway through the month.

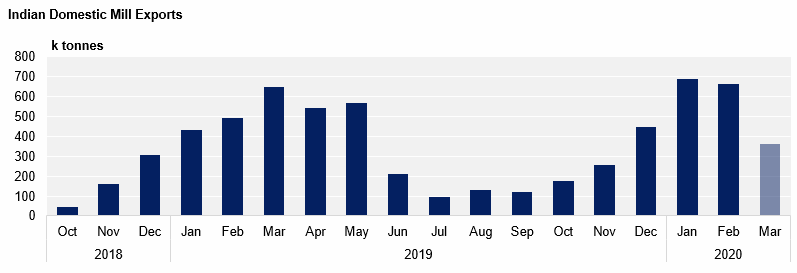

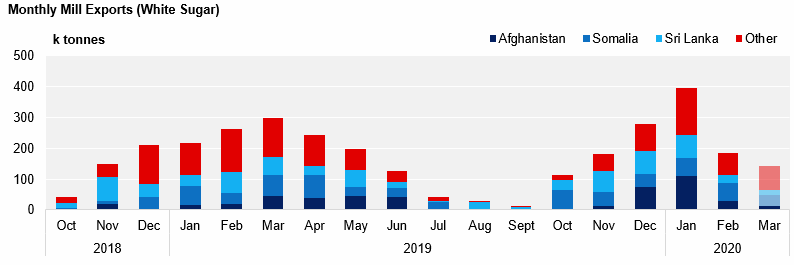

Domestic Mill Exports

- 662k tonnes of raw and white sugar were exported from Indian mills last month.

- March’s exports have started very well with 364k tonnes in the line-up already.

- February saw 476k tonnes of raw sugar ‘exported’ almost exclusively to Iran, Malaysia and coastal refineries, up from 290k tonnes in January.

- March already has 221k tonnes contracted, bringing this season’s raws exports up to 2.6m tonnes.

- Mill exports of white sugar in Feb’20 were far slower than they were in the same period last season, down 77k tonnes YoY.

- Malaysia’s strong raws offtake in February was due to Iranian payment difficulties meaning approximately 150k tonnes of sugar was diverted elsewhere.

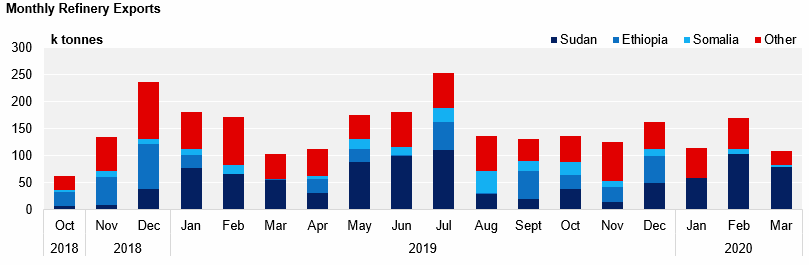

Coastal Refinery Exports

- Indian coastal refineries have exported at a slower pace in Feb’20 than they did in the same period last year.

- They only exported 103k tonnes, compared to 171k tonnes; this is a YoY decrease of 39%

- Shipments to Somalia and Ethiopia seemed to have slowed over the past two months, compared the average flows seen in the same period last year.

- Sudan’s offtake, on the other hand, is increasing rapidly; February’s offtake turned out to be its largest in seven months.