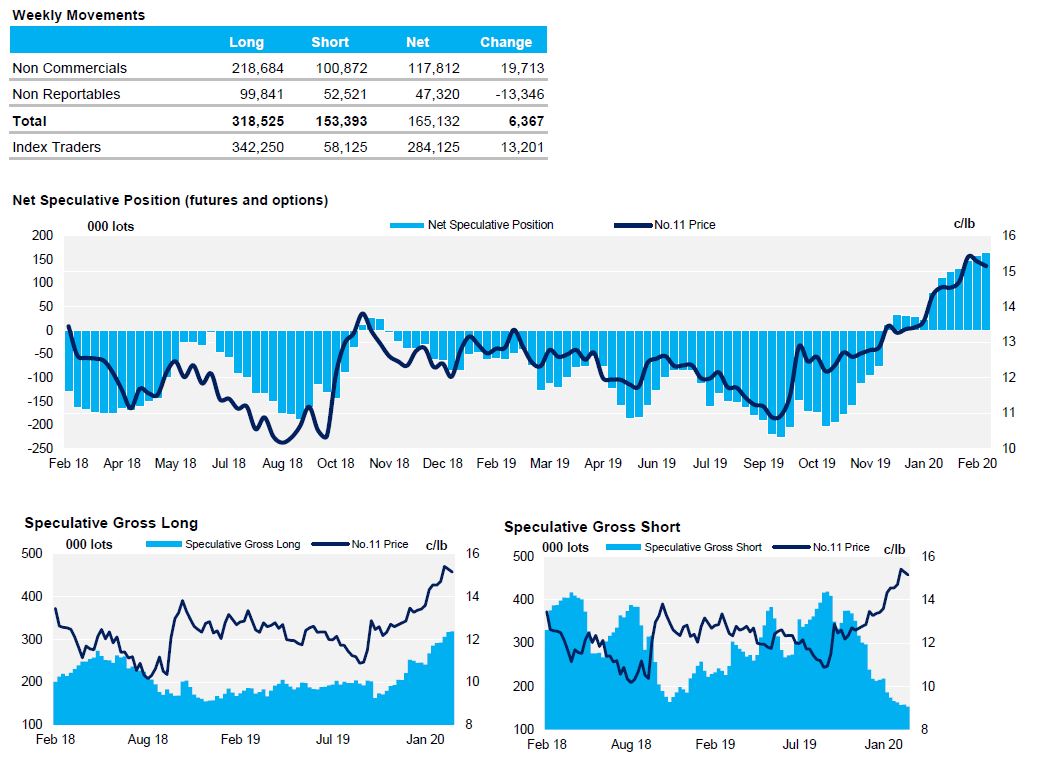

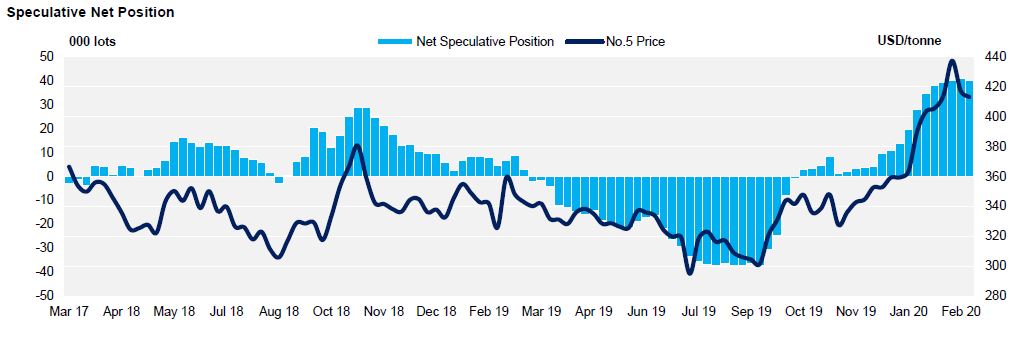

- The net spec position of both No. 11 and No. 5 continued to plateau; the data recorded by the CFTC doesn’t yet include most of last week’s sugar market collapse.

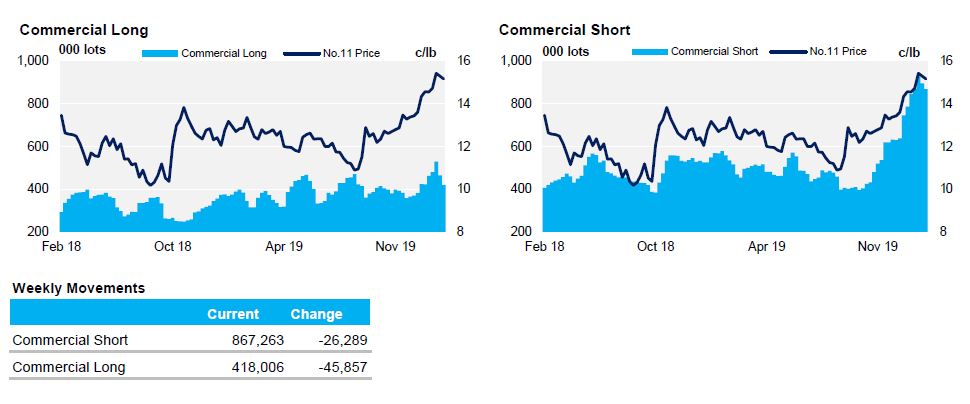

- In the No. 11 size of the commercial short and commercial long positions both fell despite a good level of both buying and selling, as hedges were closed before the H expiry.

- The No. 11 incremental rise in net spec position resulted from a slight increase in spec longs and a remarkably stable spec short position, which changed by less than 100 lots.

ICE No.11 Futures Speculative Positioning (values as of 25th February 2020)

ICE No.11 Futures Commerical Positioning (values as of 25th February 2020)

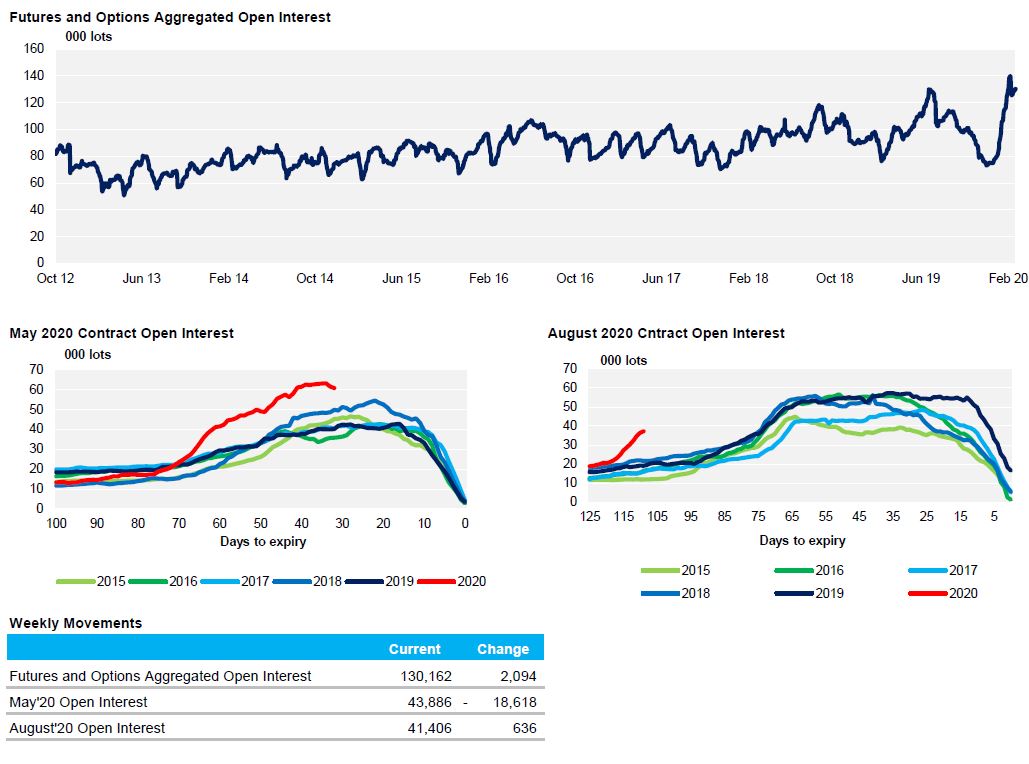

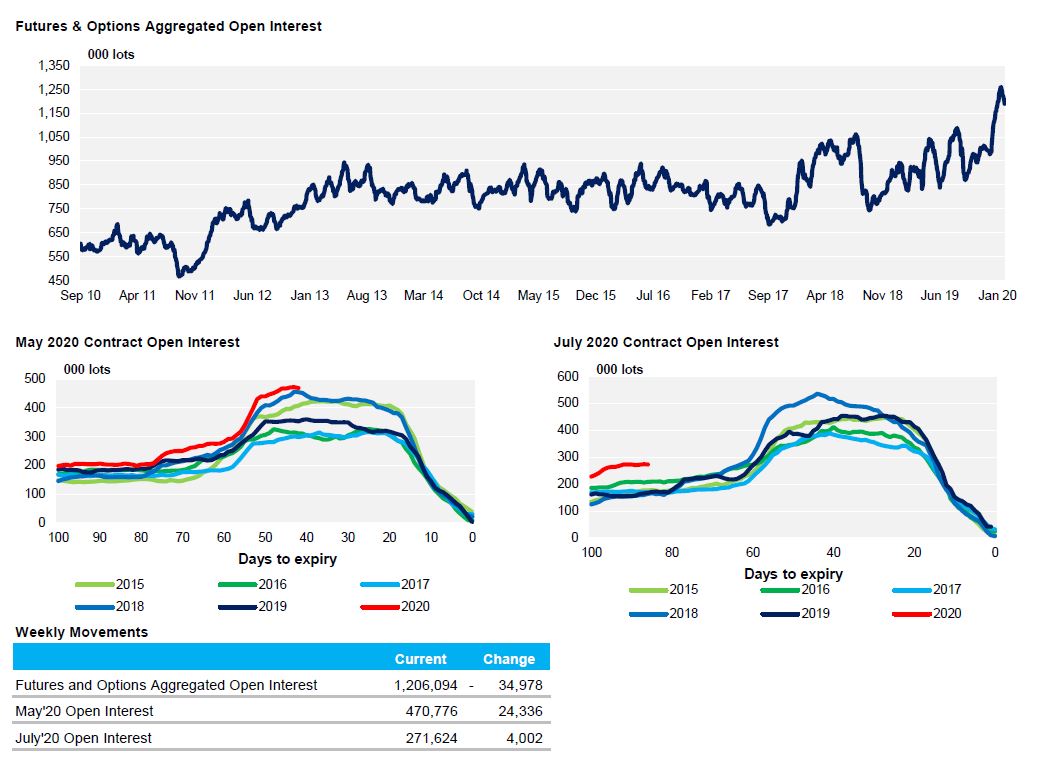

ICE No.11 Futures Open Interest (values as of 25th February 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 25th February 2020)

ICE Futures Europe Open Interest (values as of 25th February 2020)