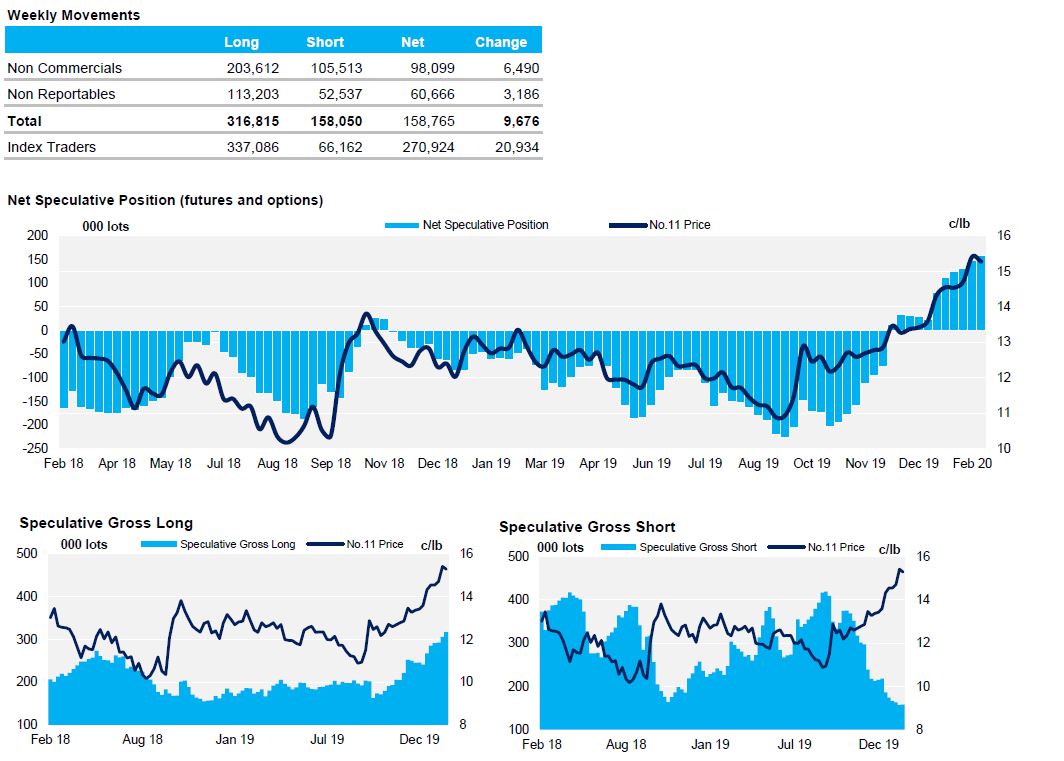

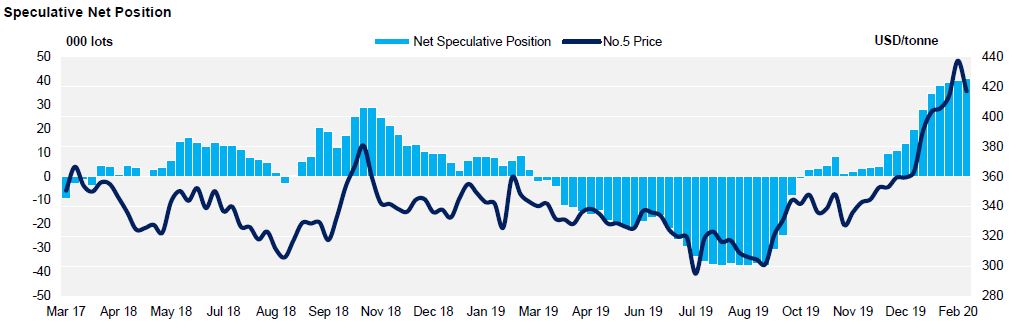

- The net spec position in both No.11 and No. 5 has plateaued; in the No. 11 spec buying and selling were almost balanced for the week (69k bought, 59k sold).

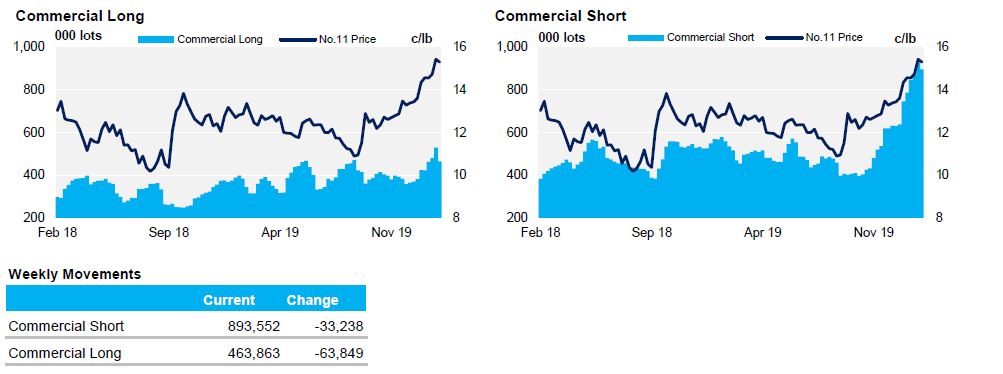

- In the No. 11 the commercial short position reduced for the first time this year, but still remains at a high historically level.

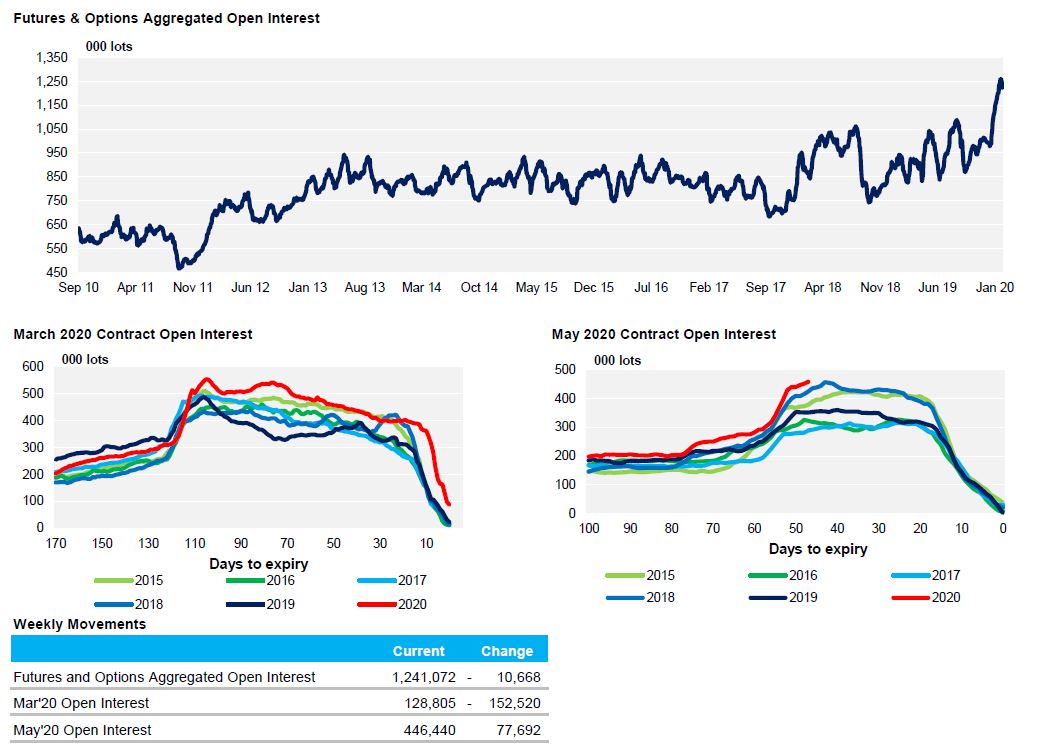

- Coming up to the No. 11 H expiry the OI is also large; expect a big delivery or more price volatility as a large volume of positions are closed.

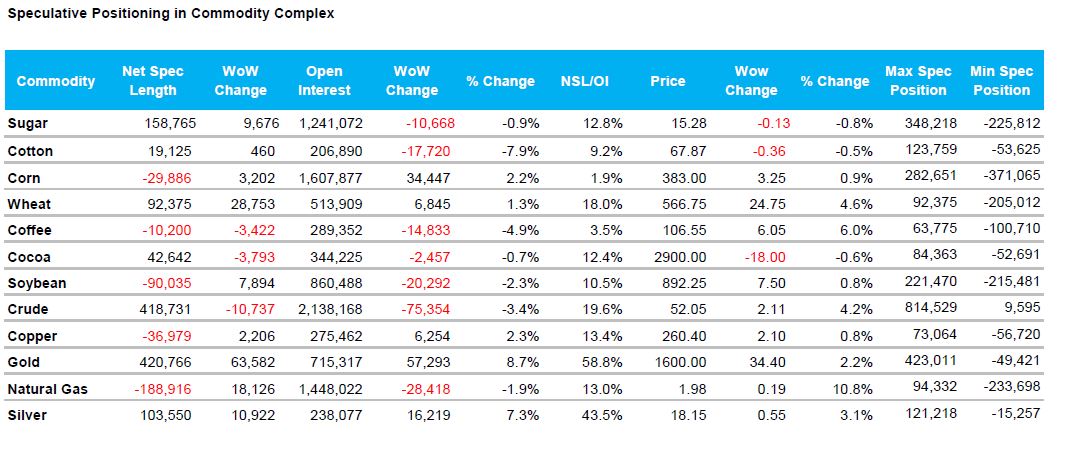

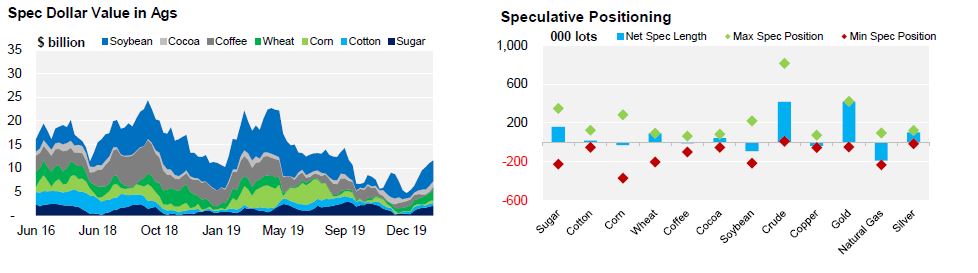

ICE No.11 Futures Speculative Positioning (values as of 18th February 2020)

ICE No.11 Futures Commerical Positioning (values as of 18th February 2020)

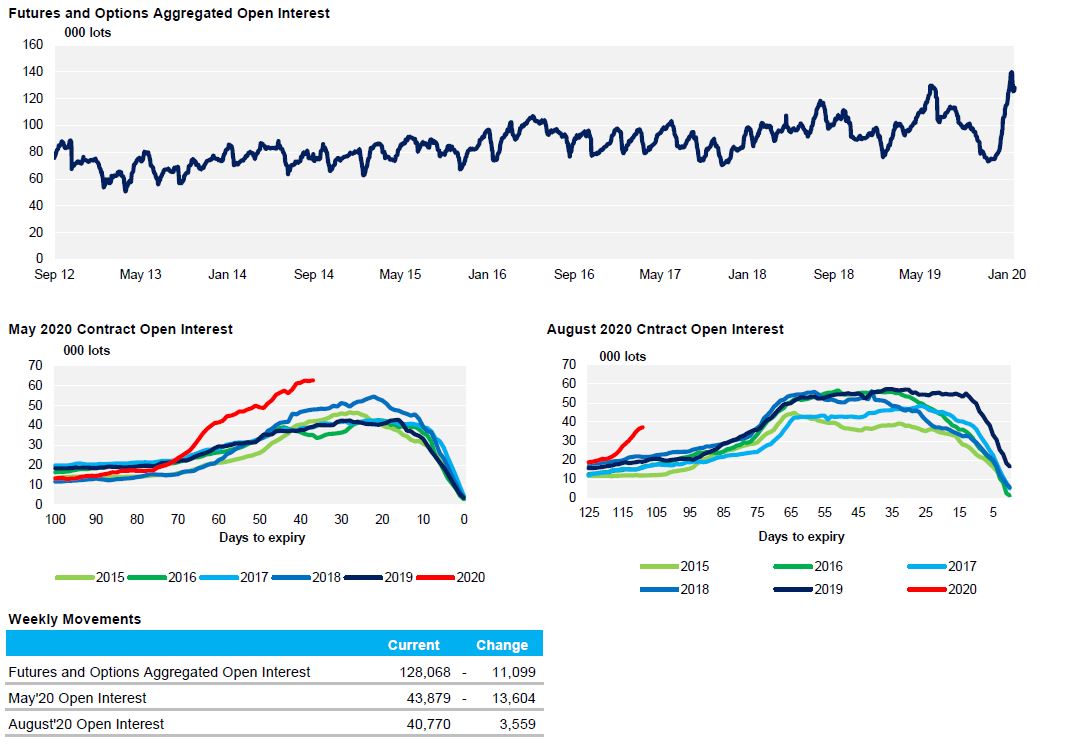

ICE No.11 Futures Open Interest (values as of 18th February 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 18th February 2020)

ICE Futures Europe Open Interest (values as of 18th February 2020)