683 words / 3 minute reading time

- Thailand’s Ministry of Energy has approved a new Community-Owned Energy Power Plant (“CPP”) programme for biomass, biogas and solar energy production.

- The programme will be rolled out between 2020 and 2024.

- It aims to bring stalled small-scale energy projects into operation around Thailand.

Very Small Power Plants

- Very Small Power Plants’ (VSPPs) are power plants that can produce up to 10 megawatts (MW) of energy.

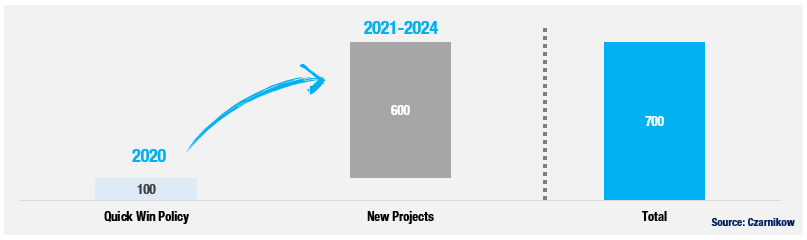

- A new VSPP mandate plans introduce more of these power plants, which will have an estimated collective production of 700+ megawatts.

- The mandate has been well-received by investors after a prolonged period of very few Power Purchase Agreements (PPA).

- Each Thai province will receive a specific allocation for the new capacity in an effort to bring energy generation closer to local energy consumption areas in remote rural regions, whilst lowering the burden on the expansion of Thai transmission lines.

- The Government has a two-part strategy to bring the VSPP mandate into fruition.

- The “Quick-Win” Agenda: Bring 100MW of plants into operation across the different renewable sources by the end of 2020.

- Commission the remaining 600MW of projects and have them enter commercial operation between 2021 and 2024.

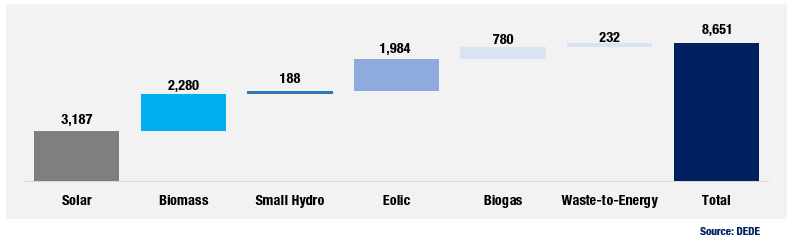

Estimated Additional Installation Capacity (MW) from VSPP (≤10MW) projects:

The Alternative Energy Development Plan

- In 2018, Thailand’s Ministry of Energy published the ‘Alternative Energy Development Plan’ (“AEDP”), estimating a total biomass capacity of 5,570MW by 2035; 3,290MW are already in operation.

- Most biomass plants in Thailand are VSPP’s and export up to 10MW of energy; these are primarily powered by sugarcane bagasse raw materials.

- 700MW of new capacity will be implemented by 2024 through the scheme, and the energy projects will vary between using biomass, solar energy and biogas.

- This is a mid-term goal to reduce some of the additional capacity entering the grid by 2035, as shown on the chart below:

AEDP as of 2018 – Additional Installed Capacity by 2035 (MW installed capacity)

- The “Quick-Win” agenda predicts that the CPP’s will commence commercial operations by May 2020.

- This is a tight timeline for new entrants and potentially limits the new installed capacity to projects that have either successfully completed the regulatory licensing phase, are already operating, or are completing construction phase.

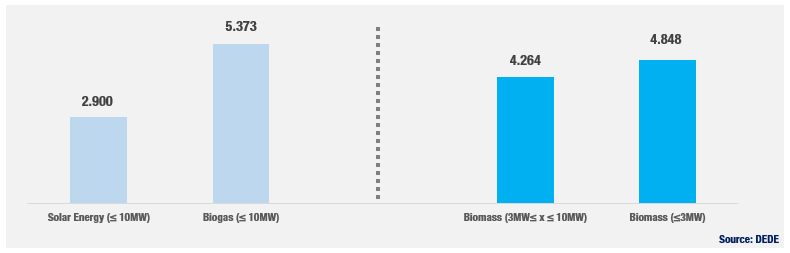

PPA Price Break-down per energy source (THB/kWh):

- Unlike previous PPA’s, which were organized as a reverse-auction, the CPP PPA price is the given variable, and with the community as a shareholder it is possible that the cost of operating such a VSPP may be higher, as the risk of operation is higher.

The Community Power Plants Investment Structure

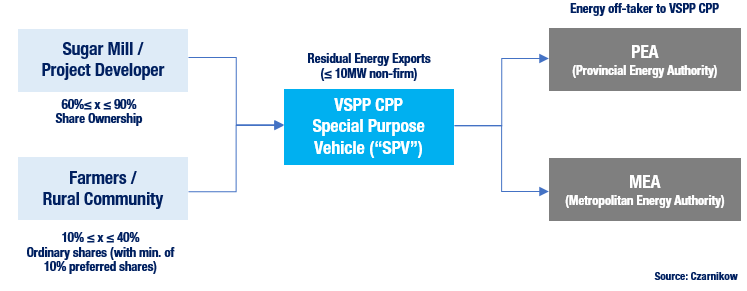

High-Level Overview of CPP operation:

What is Being Discussed?

There are currently two potential operating models suggested for the operationalization of the CPP VSPP’s in Thailand.

The first operating model is shown above, with the direct shareholding participation of the farmers and/or direct rural community (min. 200 legal addresses or “households”) who live at a given radius from the CPP and/or provides raw material to the CPP.

The second model is a co-ownership Joint-Venture (JV) between the Government and the private operator, where private players may own up to 90% of equity in the VSPP.

What are the Next Steps?

- The Thai Government is currently brainstorming with private operators, in an attempt to define what operating structure and community benefit-sharing scheme will be adopted.

- We know the mandate will award a 4.26thb/kwh Feed-in-Tariff (FiT) for VSPPs.

- If the price is a given, then what is the object of the bidding process later in 2020?

- For now, it seems the winner of bidding process is defined by how competitive an operator will be in sharing value generated from the CPP with the community (i.e., purchase price for biomass materials, community development fees, preferred dividend policy etc.).