420 words / 2.5 minute reading time

Yesterday, we discussed Cuba (Alimport). Today we’re moving onto Vietnam (Vinamilk), and tomorrow we’ll be finishing with Algeria (ONIL), the world’s largest dairy tender.

Vietnam (NVD/Vinamilk)

Vinamilk is the largest dairy company in Vietnam. It was established as the state-owned Southern Coffee-Dairy Company in 1976. It is now publicly listed making their dairy tenders essentially private, however, Vietnam’s State Capital Investment Corporation holds 36% of the shares (as 2019). Foreign investors hold over 53% of the shares.

These tenders are less formal than those issued by ONIL (Algeria) and Alimport (Cuba) given that they are issued by a corporate group. They are also more frequent and thus typically of smaller size (roughly every two months and <12k tonnes in aggregate).

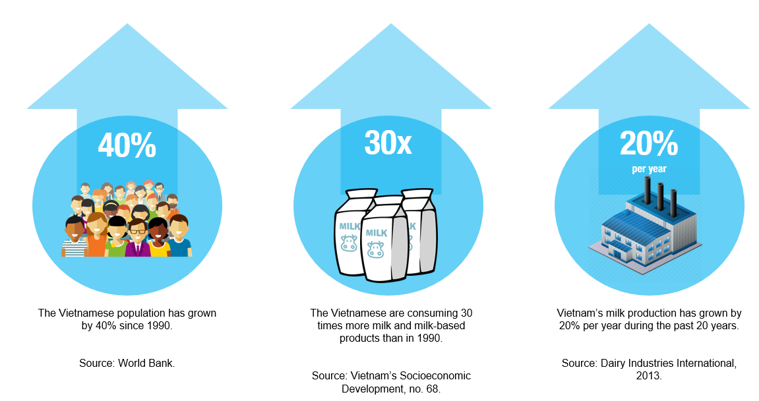

Vietnamese domestic production meets only 35% of the total demand of dairy companies, hence there is a large reliance on imports. Imports were $841m USD in 2018. Key suppliers of dairy to Vietnam are New Zealand (31%), the EU (18%), the US (17% share; this is growing fast at 13% YoY with notable gains in SMP trade) and Australia (5%). New Zealand is likely to maintain dominance in this trade because of its lower import tariffs due to the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership).

Other Tenders (or similar) of Note

Venezuela (CASA/Corpovex)

- They used to offer a large tender for Whole Milk Powder (WMP) every 4-6 months but are currently inactive.

Japan

- The majority of cheese imported to Japan is contracted in synchronised six monthly contract rounds whereby all of the main buyers purchase their demand for the next six months in unison.

- The Japanese Ministry of Agriculture, Forestry and Fisheries oversees large tenders for butter and SMP based on their view of supply and demand in Japan. Their target import volume is 20k tonnes for each product in this financial year (Apr’19 to Mar’20). These tenders are actually run by the Agriculture and Livestock Industries Corporation (ALIC). The total target volume is broken down so that ALIC run approximately four tenders throughout the year. There has been a notable swing in their demand away from SMP, towards butter in the past year; this could be a structural shift towards higher fat consumption as seen in many other developed markets, or may be a short term tightness in the Japanese supply/demand balance given the abundance of SMP when those targets were set a year ago.

Panama

- Similarly to Japan, a small group of dairy buyers in Panama issue tenders for their aggregated cheese and powders volume together.