462 words / 2 minute reading time

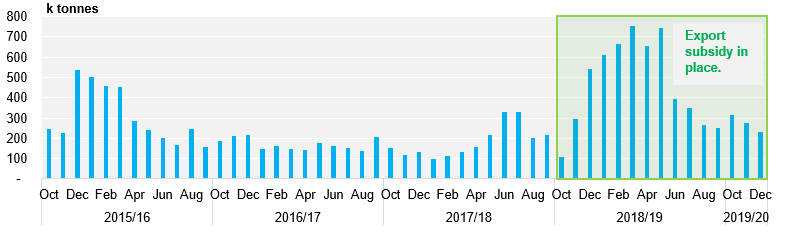

- 818k tonnes of sugar have been shipped out of India since the season started in October 2019.

- 472k tonnes of this is from the domestic mills in both raws and whites.

- Old crop sugar has been profitable to export thus far, and we think new crop sugar exports have just become viable with the market rally.

Domestically Produced Exports

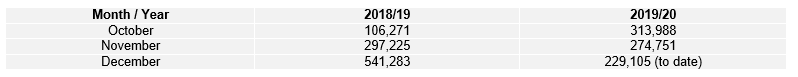

- Exports from mills have started strong, with 472k tonnes having already been shipped in Q4’19.

- This is 92% of last season’s Q4 exports, and we’re only halfway through December.

- With exports viable at current levels and production starting, we would expect shipment pace to pick up as we enter 2020.

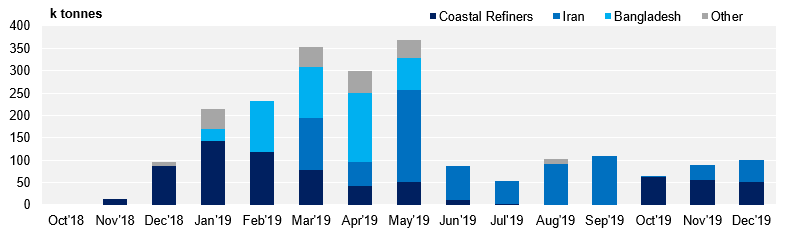

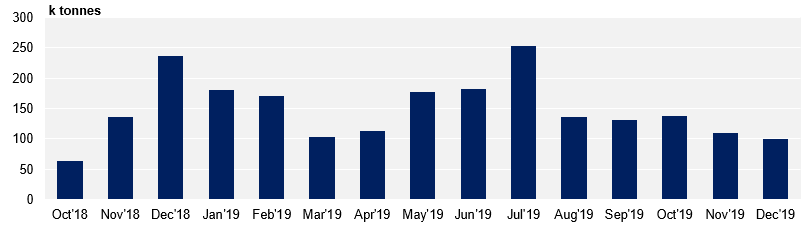

Monthly Mill Exports (Raw Sugar)

- So far 254k tonnes of domestically produced raw sugar has been exported, either to coastal refiners or through the Government-to-Government deal with Iran.

- In the 18/19 season, Iran, Bangladesh and India’s coastal refineries were all key destinations for Indian raws exports, responsible for 85% of domestic raw sugar offtake.

- As of yet, Bangladesh yet to receive any exports from India. In 18/19, they were responsible for 480k tonnes of Indian raw sugar exports and will likely remain vital to ensure strong Indian sugar offtake.

- With production starting and a rising No.11 price we expect exports to other regional refiners to occur in Q1’20.

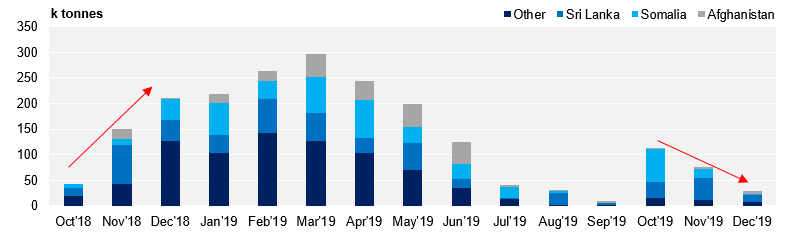

Monthly Mill Exports (White Sugar)

- For whites, mill exports got off to a stronger start than last season, but have slowed since moving into November and December.

- Exports are currently at 218k tonnes, almost half what was shipped in Q4’18, and while December is unfinished, there is a long way to go to reach the 404k tonnes exported in the same period last year.

- Key destinations such as Afghanistan, Sri Lanka and Somalia have continued to offtake Indian LQWs.

India Monthly Exports

India Monthly Exports – Off to a Strong Start

- Indian exports as a whole (including coastal refiners) in Q4’19, are off to a strong start, only slightly behind last seasons, with more likely to come before the end of December.

YoY Comparison of Indian Exports

Refinery Exports

Monthly Exports from Indian Coastal Refineries

- The Indian coastal refiners have exported 346k tonnes so far in Q4’19, slight less than last year’s 434k tonnes shipped.

- So far shipments to Somalia and Ethiopia have remained in line with last season while Sudan has almost doubled its Indian refined offtake compared to last year.

- It appears that sales into the Middle East have reduced with shipments to the UAE, Saudi, Qatar, Kuwait and Jordan all down on Q4’18.

- We are also yet to see sugar sail as far a field as West Africa as we did in 2018/19.