1047 words / 6.5 minute reading time

A Brief Overview

Last week, we released the first section of Czapp’s new seven-part dairy series. We spoke about New Zealand, one of the world’s dominant dairy producers. This week, we’re turning our attention onto the USA.

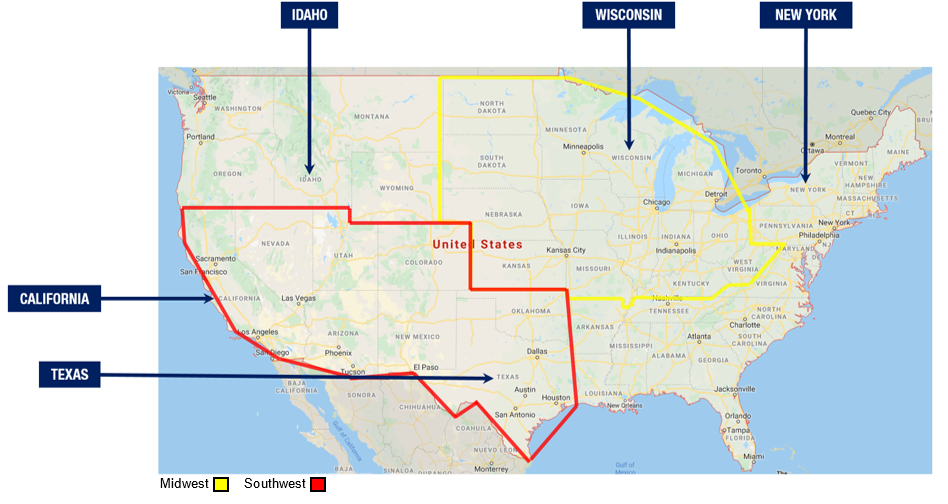

- In the US, dairy production comes from 24 major states.

- The largest producers are California, Wisconsin, Idaho, New York and Texas respectively.

- Roughly one-third of the nation’s production comes from both the Midwest and Southwest.

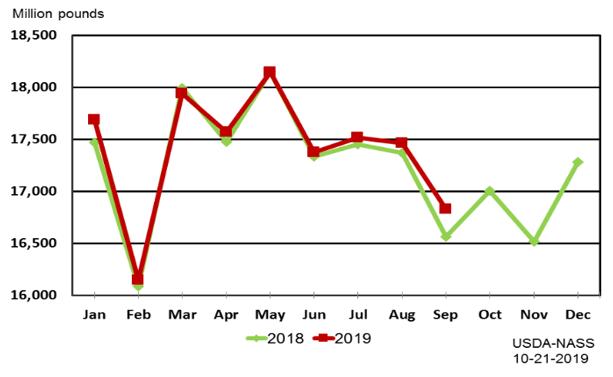

- In the first half of 2019, after several years of constant growth, US milk production flattened.

- Since July, it has turned more positive again, with provisional production for September 2019 up 1.3% year-on-year (YoY), at a national level.

- In recent years, the top production states have been characterised by the consolidation of farms into more corporate-style operations.

- Through this transition, yields have steadily risen in the top states (+1.8% YoY in September 2019), while cow numbers have peaked and are still on a slight decline (-0.1% YoY in September 2019).

Map of Key US Dairy Production Regions

US Dairy Production

- Given a sustained period of lower milk prices, we have seen smaller states’ production reduce as farmers have exited the industry (cow numbers down 7.5% YoY in these states in September 2019).

- This has been significant enough to slow growth at a national level, even with yields up 2.0% YoY on these bottom states.

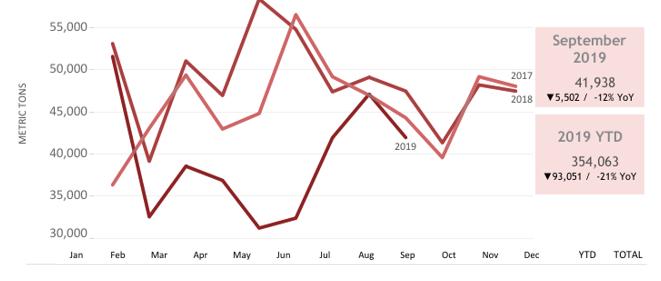

Monthly Milk Production – 24 Selected States (Source: USDA)

- California is characterised as a Non-Fat Dried Milk (NFDM)/Butter producing region, while in the Midwest cheese production dominates.

- There is a West-to-East butter flow that can be materially impacted by freight rates.

- A key watch-out at present, though, is related to the above bullet, whereby the Southeast has needed to import fresh milk for things like yoghurt production, as its own supply has fallen. This is pulling milk away from cheese vats in the Midwest.

Recent Production and Stocks Highlights

- Cheese production in September was up 1.1% year-to-date (YTD).

- This was driven by mozzarella and “Other American” (non-cheddar).

- Cheddar, on the other hand, is down 2.3% YTD. Note two key points:

- It takes less milk to make a tonne of mozzarella than it does a tonne of cheddar.

- While mozzarella is larger, the futures are cheddar contacts. This can drive interesting dynamics in the US cheese market as mozzarella is often priced basis cheddar. With less cheddar and cheddar futures rallying, we should see the basis for mozzarella sales widen.

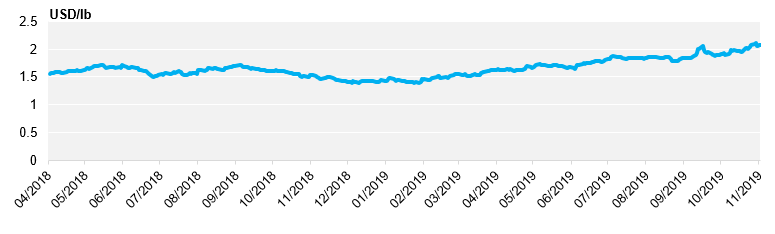

CME Cheddar Chart

- Butter production is down -0.6% YTD, but the decline is slowing with September being up 1.2% YoY. This marks the fourth YoY gain in a row, even while US prices continue to be materially higher than their competitors’.

- NFDM and Skimmed Milk Powder (SMP) production are down -1.1% YTD, with production of both being up YoY in September. This is notable as SMP is the more exportable product, with NFDM largely servicing domestic and Mexican needs). NFDM stocks continue to be in drawn down as well (5.8% month-on-month).

- Whole Milk Powder stocks are down 12.5% MoM off a small base. ~6k tonnes has been drawn down over the past two months, so while this is small on a global scale, this could be disruptive for marginal buyers.

American Imports and Exports

- The USA is a large importer of European cheese, with ~75k tonnes a year representing ~55% of total cheese imports.

- Imports of hard European-style cheese were up year on year ahead of new tariffs coming into effect on 18th October 2019.

- US butter imports also continue to grow, up 41.2% YTD, with Ireland being the dominant supplier. Given this, the imposition of tariffs on 107k tonnes of European dairy is a situation to watch closely.

- Tariffs impacting Ireland alone equate to approximately ~28k tonnes of butter and ~7k tonnes or cheese.

- In 2018, exports were equivalent to 15% of US milk production on a total milk solids basis; this continues to be in a broad uptrend.

- Key market exports for the US are Mexico (particularly NFDM), Southeast Asia, Canada, China and South Korea respectively. Combined, these account for almost two thirds of US dairy exports, by value.

- US cheese exports were the only commodity product still up YTD in September, but this is falling on a MoM basis as US cheese prices are materially above those of other exports.

- Other sources will be relatively appealing in the next round of Japanese tendering, a six-monthly tender process where all major suppliers compete.

Trade Disputes

- Trade disputes have impacted US exports in the past two years.

- Mexican retaliatory tariffs on cheese were in place from June 2018 until May 2019.

- Chinese tariffs on whey remain partially in place, with US exports down 94k tonnes YTD (21%). However, the tariff on feed-grade whey was lifted in September 2019, but this is yet to have impacted futures pricing.

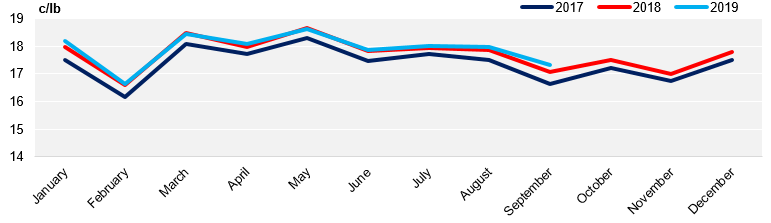

Chart of Chinese Imports of US Whey Powder for the Past Three Years (Source: US DEC)

Pricing

- The US runs a class system for milk. The fat and protein components which input to this, along with the CME dairy futures settlement, are based on the monthly weighted price of the National Products Sales Report (NDPSR) for that product.

- The NDPSR is a survey with extrapolation for un-surveyed participants, and can therefore be subject to revisions.

- There is also a dairy spot market for physical product held by the CME; this typically the “channel of last resort” and therefore represents the marginal transaction.

- Though volume in the cash market can be light, it is often market-moving for futures. Basis between the cash and futures market is also telling for domestic US supply and demand dynamics.

- For example, the NFDM basis is currently quite negative. This indicates that physical sales are not yet converting at the levels that futures traders are willing to transact at.

- With stocks drawing down and the US price relatively cheap on a world market basis, this may well be indicative of further production gains expected by cash traders or well-contracted buyers.

Cash NFDM vs. the rolling front NFDM Futures Contract