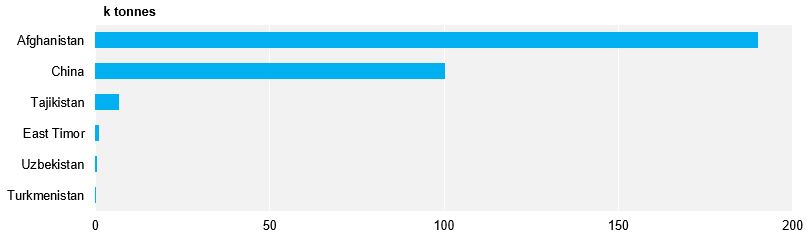

- Close to 300k tonnes of Pakistan whites has been exported since the start of 2019.

- The majority has headed to Afghanistan while the balance is part of a Pakistan-China trade deal.

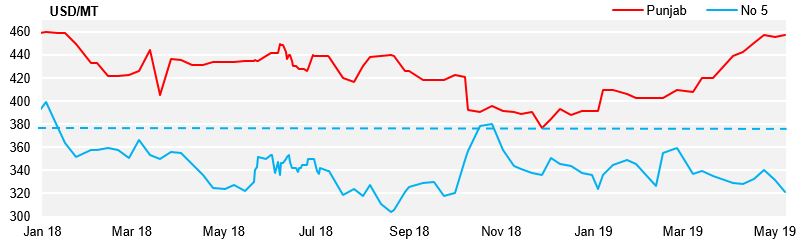

- Subsidised Pakistan exports are unlikely to be competitive on the world market at these low No.5 prices.

Exports confined to subsidized volumes

Pakistan 18/19 Exports

- Most exports have gone to Afghanistan. None to East Asia this year compared to 360kmt last year.

- With subsidy, export parity is at US$380/mt for Punjab mills, helping to connect to the 300k trade deal with China of which 100k has been exported.

- Punjab mills have export subsidy of US$38.5/mt for up to 572k tonnes.

- For Sindh mills without the subsidy, prices need to be at US$420/mt to incentivise exports, well away from world market levels.

- Domestic prices have been supported during Ramadan period which means there is no pressure for exports.

Pakistan Domestic Price vs No 5