Insight Focus

Amid the floods in the South, the feeling of uncertainty about public accounts is growing, with an impact on the dollar exchange rate and other indicators. The departure of Roberto Campos from the presidency of the Central Bank is also on the radar.

Dollar exchange rate and fiscal uncertainty are reason for concern

Rarely has the issue of public spending and the direction of the economy been so evident in Brazil. Amid the floods in Rio Grande do Sul, with losses exceeding BRL 1.3 billion in agribusiness alone, economists reveal a feeling of uncertainty in relation to public spending and the conduct of Brazilian economic policy.

Factors such as the worsening perception of fiscal risk, with the difficulty in reducing the public deficit, and the departure of Roberto Campos Neto from the Central Bank, in December, are on the market’s radar.

The impact on the dollar exchange rate is one of the most visible signs of this scenario. In April, the exchange rate depreciated 3.5%, closing at BRL 5.19. It may not seem like much, but in the view of economists it is something that signals a more complex issue. We spoke with Gabriel Barros, chief economist at Ryo Asset and former director of the Independent Fiscal Institution (IFI), about the topic. Read the interview below.

Gabriel Barros, chief economist at Ryo Asset. Source: publicity photo/Gabriel Barros.

How do you see the sentiment in Brazil regarding the economy and the exchange rate?

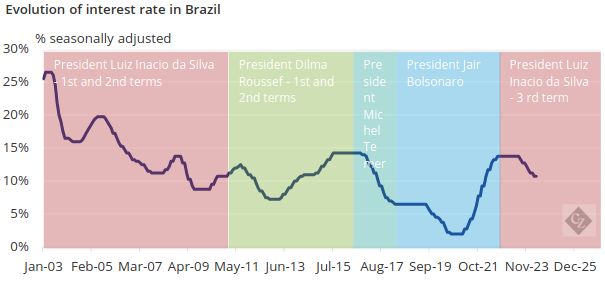

We must think about the reasons behind the increase in the dollar. It is not so significant, at this moment, how much the dollar has increased, but rather why. It’s something qualitative. The perception is that there has been a worsening of the fiscal situation, that is, the country’s ability to control its expenses and revenues, among other things. There is also a feeling that the change of command at the Central Bank, in December, should provoke changes in Brazilian fiscal and economic policy.

Source: Central Bank.

What is the market’s perception of the change of command at the Central Bank?

Roberto Campos Neto leaves the institution in December, as planned. In his place, a more heterodox economist should step in, aligned with the government’s vision. One of the economists most likely to replace Roberto Campos as president of the Central Bank is Gabriel Galípolo, who served as executive secretary in the Ministry of Finance of the current government and is now a member of the board of directors of the Central Bank. The expectation is that the political agenda may interfere with the conduct of the Central Bank, since Galípolo is close to the government, which has generated noise.

And would this already be causing concerns in relation to investments and the Brazilian economy?

Yes. In my view, the rise in the dollar is mainly due to this reason. It is important to say that even if another economist is appointed to the presidency of the Central Bank, the feeling is that it will probably be someone aligned with the government. The government’s vision is that the State should drive economic development. From a practical point of view, this could mean, for example, lowering the interest rate with the aim of facilitating consumption and taking out credit even if inflation has not decreased.

Source: Central Bank.

Is this what the market fears?

Exactly. This fear began to grow as the names being considered to preside over the Central Bank were circulated and, at the same time, an increase in public spending was observed. It is a set of factors, with some more preponderant.

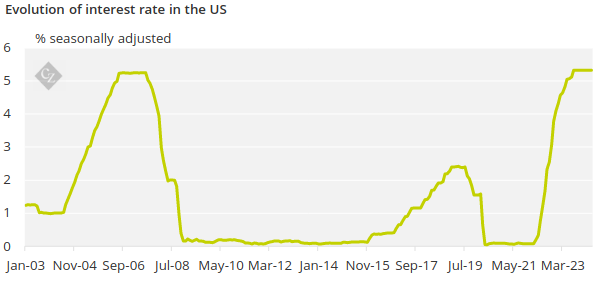

Does the external setting also interfere with this perception?

Yes. We cannot forget that the United States is unlikely to lower interest rates in the short term and Brazilian investors should look with increasing interest at the American market. The United States is considered trustworthy, and the dollar is seen as a safe investment. In favor of Brazil, we have the perception that the number of emerging countries that attract international investment has been reduced, with Russia on the sidelines and other countries showing political and economic noise, such as Turkey.

Source: FRED of St. Louis.

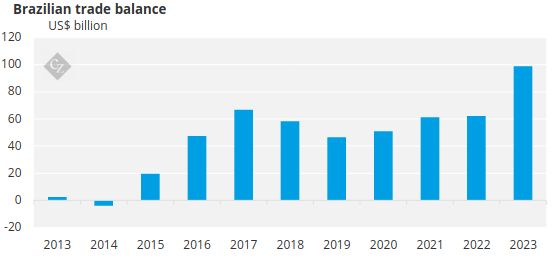

What is the market’s feeling about the future of the Brazilian economy?

If the vision I presented is confirmed, we can expect consequences for the exchange rate, with a higher dollar and a greater outflow of capital to other countries. If the interest rate falls without keeping up with the fall in inflation, there may also be an increase in prices. Now there is also the issue of flooding in Rio Grande do Sul, which requires emergency financial assistance. What helps us is that we are a large exporter of commodities, something beneficial for the trade balance.

Source: Central Bank.

What could be done to change the perception about the direction of the economy?

In my view, there should be a spending review and an effort to reduce the fiscal deficit, which is historically high in Brazil. Even compared to other emerging countries, our public spending is high. Our tax burden is also high, so a series of revisions would need to be made for the country to start growing sustainably.

Source: Central Bank.