Insight Focus

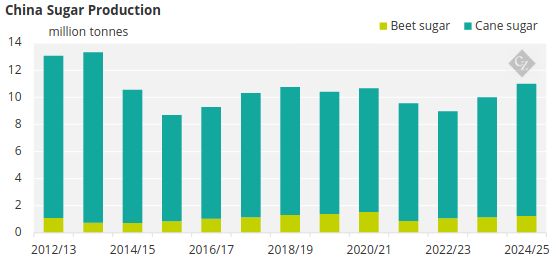

Chinese sugar production should increase in 2024/25. Perhaps by as much as 1m tonnes. China should also issue 3m tonnes of Out Of Quota import permits (AILs).

Another Crop Rebound in 2024/25?

We think that China currently doesn’t to worry about low sugar stocks, even though the 2022/23 crop was a failure and last year’s Out Of Quota (AIL) imports were low.

This is because China should produce 10m tonnes of sugar in 2023/24 season – 1m tonnes higher than last season. This improves the domestic stock level after it fell below 500k tonnes by the end of 2022/23 season.

And it may increase by another 500k tonnes to 1m tonnes in the 2024/25 season if the weather helps. With domestic sugar accounting for two-thirds of supply, the prospect of increased production is welcome.

Extra Quotas Make Up the Drop of 2023 AILs

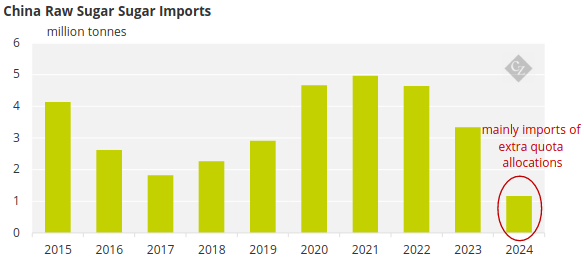

Chinese AIL raw sugar imports fell significantly last year due to the high price of world market raw sugar and negative import margins. But China allocated extra Quota to fill the gap. The majority of these Quota imports materialized in the first quarter of 2024.

Now, the rumour is that 2024 AILs will be issued soon, at a volume of 3m tonnes. Given the recent weakness in the world market raw sugar futures, Chinese refineries should have bought enough sugar to cover their both Quota and AIL demand. We should see this sugar arriving in second half of the year.

Stock Level Should Improve

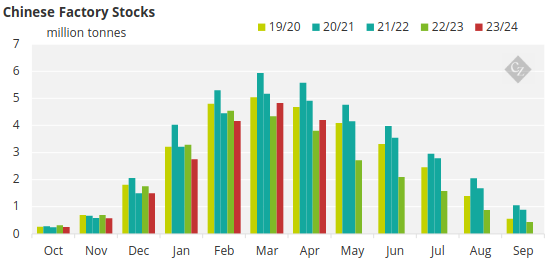

With strong performance from this season’s crop and the optimistic crop outlook for the next season, together with higher AIL imports due to improved import margins, we expect China’s sugar stock levels to improve. In addition, the Chinese government will likely hold a central sugar reserve of more than 4 million tonnes, which allows the government to cope with any sugar shortage.