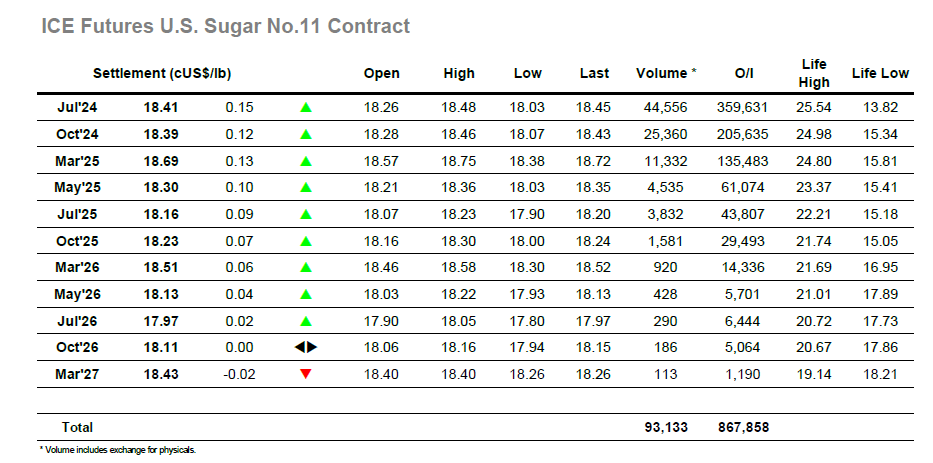

The market started a little lower this morning, and while there was a brief recovery back to 18.28 soon afterwards the trend remained lower. Volumes remain incredibly low, as they have been throughout the month, and with a 3-day weekend to follow it felt as though many had already stepped away, leaving even fewer active participants. Having spent the morning drifting back down through the opening range there was a modicum of selling drawn in, with specs looking to challenge the recent 17.97 to try and generate some fresh movement. The effort lacked substance and proved brief as the market held at 18.03, and soon after a covering spike highlighted the illiquidity as Jul’24 moved from 18.12 to 18.31 on fewer than 1,500 lots. Consolidation followed before a fresh push saw the price rise to 18.48, with the final stages playing out at the upper end of the range and settling at 18.41. This close further cements the market within the 18c/19c band, with no sign that it is yet ready to break as we enter the final few days of the month.

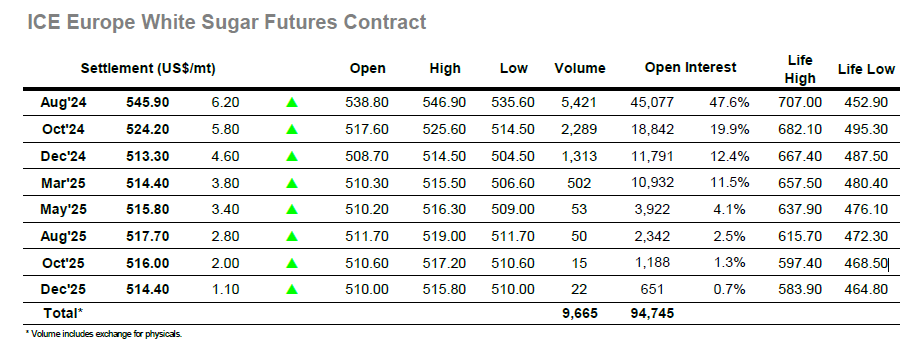

The session commenced slowly with Aug’24 nudging along near to overnight levels, though as the morning wore on so the lack of interest allowed the price to drift lower. By late morning lows had been registered at $535.60, and while there was no real change to the picture prices did start to pick up slightly against light consumer pricing. Having worked slowly away from the lows the market shot through to new highs on light volume, and this changed the dynamic for the remainder of the session. Remaining above $540 the market maintained an upward trajectory to reach $546.90, still within the broad recent range but adding a little gloss at the end of a poor week. Alongside the flat price movement we saw Aug’24 spreads remain robust, while the Aug/Jul’24 continues to yo-yo around its own band and returned to the $140 area late in the afternoon. Aug’24 settled at $545.90 to head into the 3-day holiday weekend on a positive note, though technical parameters remain unchanged.