Insight Focus

PTA and MEG futures continue to rebound, lifted by recent destocking and tighter spot liquidity.

Container rates see further increased in June, lack of availability also impacting PET flows.

PET resin export prices firm slightly following feedstock costs, margins compress further.

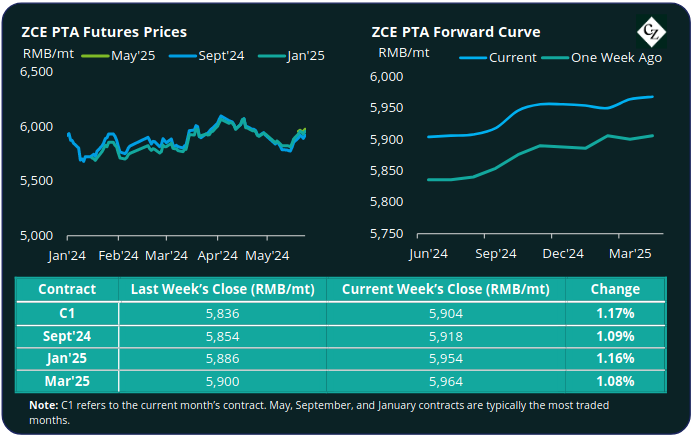

PTA Futures and Forward Curve

PTA futures strengthened through last week, continuing to rebound from the lows earlier in the month. PTA main month contracts ended the week up over 1%.

PTA price increases went against the flow of the crude market, with Brent ending the week with a loss of some 3%, hitting its lowest levels in 3-months.

These losses haven’t yet been felt in the PTA market, with lower inventory and tightening of PTA spot liquidity supporting prices, underpinned by extensive PX plant maintenance.

Both the PX-N and PTA-PX CFR spreads widened last week; the PTA-PX spread averaged USD 88/tonne, the highest weekly average since the end of March.

However, PTA production is expected to gradually recover following recent turnarounds, and less PTA maintenance is planned in June. Lower polyester operating rates, and PTA demand, may also contribute to weakening in PTA fundamentals in June.

The forward curve kept a slight contango through 2H’24 and into 2025; Sept’24 contract premium over the current month is just RMB 14/tonne, whilst Jan’25 has a RMB 50/tonne premium.

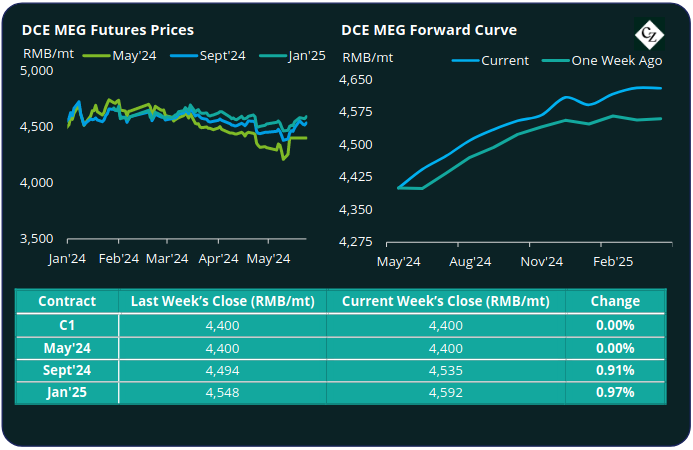

MEG Futures and Forward Curve

MEG Futures continued to strengthen following the previous week’s rally; main forward contract months increased by just under 1%.

Although destocking and delayed restarts of units, including by ZPC, has supported prices in recent weeks, East China main port inventories increased by around 7.3% to 825k tonnes last Friday, and port arrivals expected to accelerate into June.

Upcoming plant restarts and higher average domestic operating rates are likely to result in limited near-term upside in MEG prices. Lotte Chemical has also recently restarted its 700kta MEG plant in Louisiana, US that will feed into future Chinese imports.

Softer demand resulting from lower polyester production rates may also lead to weaker fundamental support in June.

The forward curve has steepened, with the Sept’24 contract holding a RMB 135/tonne premium over the current month, whilst Jan’25 has a RMB 192/tonne premium.

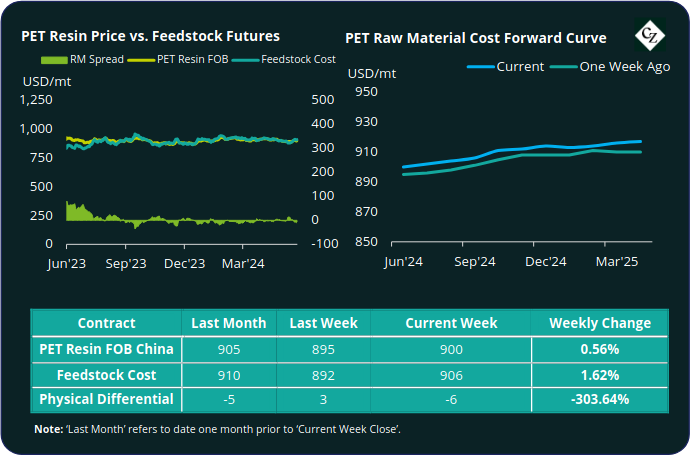

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices saw modest increases last week, with the average price up USD 10/tonne to USD 900/tonne by Friday.

The PET resin physical differential against raw material future costs collapsed, decreasing USD 13/tonne, to average minus USD 8/tonne last week. By Friday, the differential was USD 6/tonne.

The raw material cost forward curve kept a slight contango through to year end; Sept’24 contract premium over the current month was just USD 6/tonne, whilst Jan’25 holds USD 13/tonne premium.

Concluding Thoughts

The collapse of the physical differential between spot PET resin export prices and future raw material, particularly during peak season, indicates Chinese resin demand has weakened, likely brought on by the current global container crisis.

The freight crisis out of China is impacting all global routes, with most ocean rates seeing further uplifts in June. Buyers also face limited availability and delays.

Other Asian exporters also face similar issues, with shipping lines hiving off vessels and containers to support routes out of China. The current situation is expected to persist through the summer with peak season in Q3.

Larger buyers are already shifting back to breakbulk movements for key routes, seeing substantial freight savings.

Given the slowdown in port throughput, inventory through the chain is expected to rise, increasing domestic Chinese availability. Maintenance restarts and further capacity expansion may also lengthen near-term PET resin supply in China.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.